Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644399

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644399

China Coal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

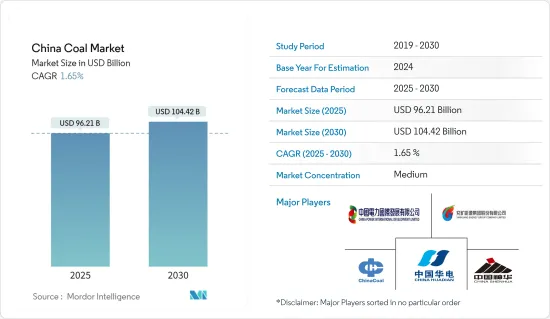

The China Coal Market size is estimated at USD 96.21 billion in 2025, and is expected to reach USD 104.42 billion by 2030, at a CAGR of 1.65% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors like increasing electricity demand and investments in the coal industry are expected to drive the market.

- On the other hand, increasing environmental concern over the use of coal and adopting renewable energy sources is a major restraint hindering the market's growth.

- Nevertheless, the increasing ways to mine coal and extract value from coal using technologies like carbon capture and storage technologies are expected to create enormous opportunities for the China coal market.

China Coal Market Trends

The Power Generation Segment Expected to Dominate the Market

- The power generation segment will likely dominate the market during the forecast period owing to the increasing demand for electricity across the country.

- In 2022, China accounted for more than 54.7% of the global share in total coal consumption, and about 55.46% of primary energy consumption in the country was attributed to coal.

- China produced 8848.7 TWh of electric power in 2022, up 3.6% compared to 2021, driven by rapid economic recovery from the pandemic. China was one of the few countries to see an increase in its energy demand in 2022 and the most significant rise globally. Coal accounted for 61% of the source of energy in electricity generation in the country.

- Additionally, China's rapid economic growth over the past few decades led to a surge in demand for energy. As a result, the Chinese government prioritized ensuring a stable and abundant energy supply, which meant continuing to rely on coal.

- For instance, in the first quarter of 2022, provincial governments in China approved plans to build new coal power plants totaling 8.63 GW, according to the Chinese Department of Energy. One approved project is a new 15 GW coal-fired thermal power plant in Shanghai, China, which was approved in September 2022.

- Therefore, from the above points, power generation will likely dominate the Chinese coal market during the forecast period.

Increasing Adoption of Renewable Energy to Restrain the Market

- The Chinese government actively pushed renewable energy production through policies and incentives such as subsidies, tax breaks, and regulations. This government assistance aided growth in the renewable energy sector and is likely to continue in the future years.

- China struggled with severe air pollution for many years, leading to public health problems and economic losses. Renewable energy sources like wind and solar are considered a cleaner alternative to fossil fuels and can help reduce air pollution.

- Furthermore, China relies heavily on imported fossil fuels to cover its energy demands. It exposes the country to price swings and supply disruptions. China can minimize its reliance on foreign energy sources and boost its energy security by investing in renewable energy.

- Additionally, the cost of renewable energy has dropped dramatically in recent years, making it more competitive with fossil fuels. Renewable energy is already cheaper than coal-fired power facilities in some circumstances. Because of its low cost, renewable energy is an appealing choice for China, which is looking to lower its energy expenses.

- In 2022, China's total installed renewable energy capacity was 1,171.55 GW, an increase of 14.19% compared to 2021. A similar trend is expected to be followed during the forecasted period.

- For instance, in March 2022, it was announced by the Chinese government announced that they intended to construct a solar and wind power generation capacity of 450 GW in desert regions such as the Gobi desert. Currently, around 100 GW of solar power capacity is already under construction.

- Therefore, due to the factors mentioned above, the growth of renewable energy can hinder China's coal market growth.

China Coal Industry Overview

The Chinese coal market is semi-consolidated. The key players in the market (in no particular order) include China Coal Energy Group Co. Ltd, China Shenhua Energy Company Limited, Yanzhou Coal Mining Company Limited, China Power International Development Limited, and Huadian Power International Corporation Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71556

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Electricity Demand

- 4.5.1.2 Rsing Investments in the Coal Industry

- 4.5.2 Restraints

- 4.5.2.1 Increasing Installation of Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Power Generation (Thermal Coal)

- 5.1.2 Coking Feedstock (Coking Coal)

- 5.1.3 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 China Coal Energy Group Co. Ltd.

- 6.3.2 China Shenhua Energy Company Limited

- 6.3.3 Huadian Power International Corporation Limited

- 6.3.4 Yanzhou Coal Mining Company Limited

- 6.3.5 China Power International Development Limited

- 6.3.6 Huaneng Power International Inc.

- 6.3.7 China Resources Power Holdings Company Limited

- 6.3.8 Datang International Power Generation Company Limited

- 6.3.9 Shandong Energy Group Co. Ltd.

- 6.3.10 Zijin Mining Group Co. Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Ways to Mine Coal and Extract Value From Coal Using Different Technologies

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.