PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906883

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906883

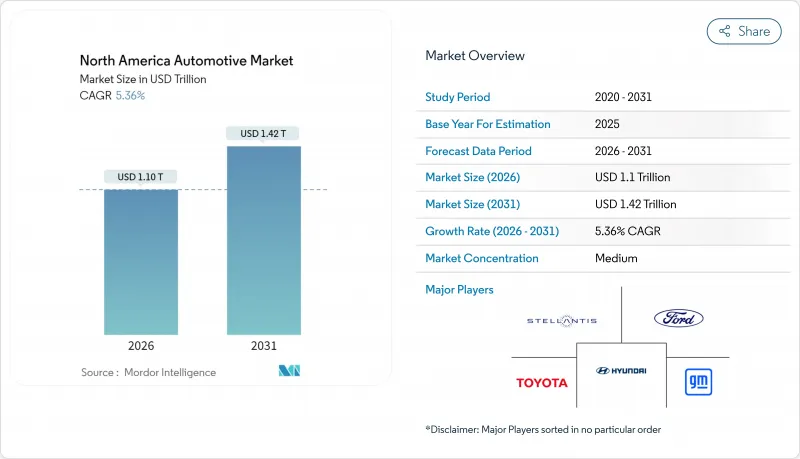

North America Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America automotive market was valued at USD 1040 billion in 2025 and estimated to grow from USD 1095.7 billion in 2026 to reach USD 1422.2 billion by 2031, at a CAGR of 5.36% during the forecast period (2026-2031).

Robust federal and provincial zero-emission vehicle mandates and fiscal incentives in the Inflation Reduction Act underpin the projected expansion. Automakers are localizing battery and vehicle production at unprecedented speed, balancing short-term profitability from light-truck and SUV sales with long-term electrification commitments. Commercial vehicle electrification is accelerating as fleet operators prioritize total cost-of-ownership gains, while direct-to-consumer sales models pressure entrenched dealer networks. Intensifying tariff policies and critical-mineral bottlenecks remain near-term headwinds.

North America Automotive Market Trends and Insights

Federal and State ZEV Mandates

California's Advanced Clean Cars II regulation requires 35% zero-emission sales by 2026 and 100% by 2035; eleven additional states and Washington, D.C. have adopted identical timelines. Canada's federal ZEV rule mirrors the 2035 deadline with interim 20% and 60% milestones for 2026 and 2030, respectively. Proposed U.S. EPA limits push 30% zero-emission medium- and heavy-truck sales by 2030, rising to 100% by 2040. Credit banking lets early movers monetize compliance, whereas laggards face increasing penalties. The mandate architecture, therefore, rewards proactive electrification investments and accelerates supplier realignment across North America automotive market participants.

Battery "Auto-Alley" Localization

Cumulative North American battery supply-chain commitments topped USD 250 billion by end-2023, with cell plants positioned a median 284 miles from final assembly sites. Cell fabrication absorbs roughly half of the outlays, with upstream mineral processing and downstream EV assembly splitting the remainder. Canada rose first in the lithium-ion supply-chain ranking, buoyed by Honda's CAD 15 billion integrated complex slated for 2028. Parallel Mexican projects, such as BMW's USD 800 million San Luis Potosi expansion, secure cost-competitive capacity while preserving USMCA trade eligibility. Localized clusters mitigate logistics expense and tariff risk across the North America automotive market.

Vehicle Affordability Squeeze

Record transaction prices have pushed average monthly payments to historic highs, sidelining a swath of mainstream buyers. Rising incentives strain margins yet fail to restore affordability. Leasing costs have climbed sharply since 2023, nudging consumers toward used-vehicle substitutes. The pinch is most acute for battery-electric models whose upfront premiums outweigh lifetime savings for many households. Although falling interest-rate expectations offer relief, price sensitivity will cap near-term volume upside in the North America automotive market.

Other drivers and restraints analyzed in the detailed report include:

- NEVI-Funded EV-Charging Build-Out

- Software-Defined-Vehicle Revenue Model

- Peak-Hour "Charging-Queue" Anxiety

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium-and heavy-commercial vehicles, though smaller in absolute volume, expand at 8.22% CAGR through 2031, materially outpacing passenger cars' dominion in the North American automotive market. A regulatory push-California's Advanced Clean Trucks rule and U.S. EPA proposals-targets 100% zero-emission truck sales by 2040. Fleet buyers embrace electrification, where charging can be centralized and duty cycles predictable.

Passenger cars still anchor 68.63% 2025 revenue but contend with affordability pressures and rising compliance outlays. Plant retooling for multi-powertrain flexibility enables manufacturers to modulate output amid shifting demand. Total cost-of-ownership parity for zero-emission trucks by 2035 will further tilt investment toward commercial applications, reinforcing structural growth in this segment of the North America automotive market.

Internal-combustion powertrains command an 82.11% share in 2025; however, battery-electric vehicles will capture incremental gains at 9.58% CAGR, supported by up to USD 7,500 clean-vehicle tax credits. Hybrid models act as a bridge technology, with Ford reporting double-digit hybrid sales gains in 2024.

Plug-in hybrids provide range assurance for long-distance drivers while meeting partial electrification quotas. Fuel-cell offerings remain niche, limited by hydrogen infrastructure gaps. Propulsion diversification allows OEMs to de-risk capital allocation while scaling batteries and software platforms central to the evolving North America automotive market size.

The North America Automotive Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion Type (ICE, and More), Sales Channel (OEM-Franchised Dealer, and More), Level of Automation (Level 0-1, Level 2, Level 3, and Level 4-5), and Country (United States, Canada, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD) and Volume in Units.

List of Companies Covered in this Report:

- General Motors Company

- Toyota Motor Corporation

- Ford Motor Company

- Stellantis N.V.

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- BMW AG

- Tesla, Inc.

- Volkswagen AG

- Mercedes-Benz Group AG

- Kia Corporation

- Subaru Corporation

- Mazda Motor Corporation

- Rivian Automotive, Inc.

- Lucid Group, Inc.

- BYD Company Ltd.

- Volvo Car Corporation

- Mitsubishi Motors Corporation

- Daimler Truck Holding AG

- PACCAR Inc.

- Navistar International Corp.

- Harley-Davidson, Inc.

- Yamaha Motor Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Federal and State ZEV Mandates

- 4.2.2 Falling Auto-Loan Rates and Pent-Up Demand

- 4.2.3 NEVI-Funded EV-Charging Build-Out

- 4.2.4 Light-Truck/SUV Mix Shift Lifts Margins.

- 4.2.5 Battery "Auto-Alley" Localization

- 4.2.6 Software-Defined-Vehicle Revenue Model

- 4.3 Market Restraints

- 4.3.1 Vehicle Affordability Squeeze

- 4.3.2 Chip and Battery-Grade Mineral Bottlenecks

- 4.3.3 Tariff Brinkmanship Under USMCA Review

- 4.3.4 Peak-Hour "Charging-Queue" Anxiety

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium & Heavy Commercial Vehicles

- 5.1.4 Two-Wheelers

- 5.2 By Propulsion Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Hybrid Electric Vehicles (HEV)

- 5.2.3 Plug-in Hybrid Vehicles (PHEV)

- 5.2.4 Battery Electric Vehicles (BEV)

- 5.2.5 Fuel-Cell Electric Vehicles (FCEV)

- 5.2.6 Natural-Gas Vehicles (NGV)

- 5.3 By Sales Channel

- 5.3.1 OEM-Franchised Dealer Sales

- 5.3.2 Direct-to-Consumer (Online)

- 5.3.3 Fleet and Rental Sales

- 5.4 By Level of Automation (Value)

- 5.4.1 Level 0 - 1 (Basic / No ADAS)

- 5.4.2 Level 2 (Partial Automation)

- 5.4.3 Level 3 (Conditional Automation)

- 5.4.4 Level 4 - 5 (High / Full Automation)

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 General Motors Company

- 6.4.2 Toyota Motor Corporation

- 6.4.3 Ford Motor Company

- 6.4.4 Stellantis N.V.

- 6.4.5 Hyundai Motor Company

- 6.4.6 Honda Motor Co., Ltd.

- 6.4.7 Nissan Motor Co., Ltd.

- 6.4.8 BMW AG

- 6.4.9 Tesla, Inc.

- 6.4.10 Volkswagen AG

- 6.4.11 Mercedes-Benz Group AG

- 6.4.12 Kia Corporation

- 6.4.13 Subaru Corporation

- 6.4.14 Mazda Motor Corporation

- 6.4.15 Rivian Automotive, Inc.

- 6.4.16 Lucid Group, Inc.

- 6.4.17 BYD Company Ltd.

- 6.4.18 Volvo Car Corporation

- 6.4.19 Mitsubishi Motors Corporation

- 6.4.20 Daimler Truck Holding AG

- 6.4.21 PACCAR Inc.

- 6.4.22 Navistar International Corp.

- 6.4.23 Harley-Davidson, Inc.

- 6.4.24 Yamaha Motor Co., Ltd.

7 Market Opportunities and Future Outlook