PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852072

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852072

Cigar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

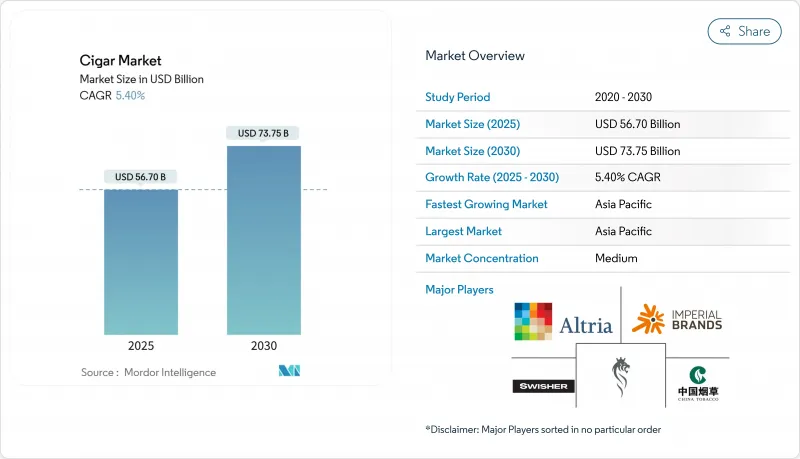

The global cigar market size currently stands at USD 56.70 billion in 2025 and is anticipated to expand to USD 73.75 billion by 2030, demonstrating a compound annual growth rate (CAGR) of 5.40%.

Manufacturers in the market benefit from the premium pricing of hand-rolled and limited-edition cigars, which enables them to effectively manage the impact of increased taxation and rising raw material expenses. The Asia-Pacific region exhibits remarkable market expansion, driven by its substantial population of high-net-worth individuals, the ongoing recovery in international tourism, and the growing cultural acceptance of cigars as prestigious luxury items. To maintain their market position, manufacturers are investing in developing tobacco varieties from specific geographical regions and implementing advanced storage technologies, which ensures product quality and supports their premium pricing strategies in the market.

Global Cigar Market Trends and Insights

Rising Popularity of Premium and Hand-Rolled Cigars

Premium handmade cigars represent a small but highly valuable segment of the total cigar market, with U.S. imports showing steady growth in the current year. This segment demonstrates remarkable resilience during economic uncertainty, as consumers maintain their luxury tobacco purchases while reducing expenditure in other categories. Nicaragua maintains its position as the primary exporter of handmade cigars, while the Dominican Republic has experienced substantial growth in exports, indicating a significant shift in supply chain dynamics beyond traditional Cuban production. The market continues to evolve as mass-market consumers increasingly transition to artisanal products, influenced by social media engagement and changing consumption preferences focused on premium experiences. The pricing landscape has notably shifted upward, with entry-level premium cigars commanding higher price points, as tobacconists implement price adjustments in response to increased manufacturing costs.

Product Innovation in Cigar Blends and Packaging

The Dominican Republic's tobacco manufacturing sector has demonstrated remarkable progress, reaching USD 1.14 billion in exports during 2023 . This achievement stems from substantial investments in advanced climate-controlled facilities and robust quality assurance systems that align with rigorous international standards. Taking inspiration from the wine industry, manufacturers carefully select and promote specific growing regions and vintage tobacco leaves, creating distinctive products that resonate with premium market segments. Through meticulous attention to curing and fermentation processes, producers develop refined flavor profiles that meet consumer preferences. The industry has also embraced innovative packaging solutions, implementing sophisticated moisture control mechanisms and secure tamper-evident seals. These advancements ensure consistent product quality across extensive distribution networks, particularly benefiting the growing e-commerce sales channels.

Stringent Tobacco Regulations and Advertising Restrictions Globally

The European Union's proposed tobacco taxation directive plans to increase cigar excise duties from EUR 12 to EUR 143 per thousand units, representing a potential 1,100% increase that may significantly impact medium-sized producers . The European Commission's tax harmonization initiative, set to take effect in 2028, aims to standardize rates across member states and incorporate new products, including heated tobacco, into existing regulatory frameworks . In the United States, FDA regulatory oversight imposes compliance requirements on premium handmade cigars, despite their small market share, requiring manufacturers to complete extensive approval processes for new products. Current advertising restrictions constrain brand development opportunities, particularly affecting boutique producers who depend on direct marketing channels. These regulatory requirements concentrate market influence among larger manufacturers with sufficient resources to manage compliance costs, potentially limiting innovation from smaller companies.

Other drivers and restraints analyzed in the detailed report include:

- Rising Consumer Preference for Luxury and Status Symbol Products

- Growth of Boutique and Artisan Cigar Brands

- High Taxation on Tobacco Products in Many Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The traditional cigar segment maintains its market leadership with a substantial 60.22% share in 2024, demonstrating the enduring appeal of full-size cigars among consumers who value traditional smoking experiences. This dominance reflects deep-rooted brand loyalty within premium segments, where customers appreciate the craftsmanship and ritual associated with traditional cigars. Meanwhile, the cigarillo segment is experiencing robust growth, projected at a 6.32% CAGR through 2030. This growth is primarily attributed to changing consumer preferences, as cigarillos offer a more time-efficient smoking experience that accommodates modern lifestyle constraints and workplace smoking policies. The market received additional momentum when Swisher entered the cannabis segment in Michigan during October 2024, introducing blunts with hemp wrappers that circumvent FDA tobacco regulations.

The manufacturing landscape significantly influences market dynamics, with cigarillo producers benefiting from cost-effective automated production methods compared to the labor-intensive process of handmade traditional cigars. Premium cigar manufacturers have recognized this opportunity and are strategically expanding their product portfolios to include cigarillo variants, enabling them to capture a broader consumer base while preserving their premium brand positioning. The regulatory environment also shapes market development, as traditional cigar producers face higher compliance costs due to comprehensive FDA oversight, while cigarillo manufacturers operate under more streamlined approval processes. These market conditions indicate an ongoing convergence between segments, as consumers increasingly gravitate toward products that balance premium quality with convenience and shorter consumption times.

Non-flavored cigars dominate the market with a substantial 66.43% share in 2024. This significant market presence stems from enduring traditional consumer preferences and the distinct regulatory advantages these products enjoy in regions implementing strict flavor restrictions. The flavored cigar segment demonstrates robust growth potential, with projections indicating a 6.63% CAGR through 2030, as manufacturers successfully develop innovative products that comply with regulations while meeting the evolving preferences of younger adult consumers.

Market analysis of the Philippines tobacco industry reveals compelling insights, with 58.49% of tobacco products incorporating flavor descriptors, and menthol emerging as the most prevalent category. In response to this clear consumer demand for enhanced products, manufacturers are making strategic investments in sophisticated natural flavoring technologies and advanced tobacco blending techniques. These innovations enable them to create distinctive taste profiles that resonate with consumers while maintaining compliance with regulatory frameworks.

The Cigar Market Report is Segmented by Product Type (Cigarillos, and Cigar), Flavor (Flavored, and Non-Flavored), Price Point (Mass, and Premium), Distribution Channel (Offline Retail Stores, and Online Retail Stores) and Geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific currently dominates the global premium tobacco market, commanding a substantial 54.63% market share in 2024. The region's market leadership is underpinned by its large consumer base, established distribution networks, and the cultural significance of premium tobacco products. Japan serves as a notable example of the region's evolving market dynamics, where a significant 52.6% decline in cigarette sales from 2011-2023 has created new opportunities for premium cigars to position themselves as luxury alternatives.

North America demonstrates the fastest market development, characterized by its mature premium cigar culture and sophisticated distribution infrastructure. The region's growth is supported by a well-established network of specialty retailers, knowledgeable consumers, and a strong presence of boutique brand manufacturers. The market benefits from consistent demand patterns and a regulatory environment that has historically accommodated premium tobacco products.

Other regions present diverse market opportunities and challenges. Latin American production regions maintain their significance, with the Dominican Republic achieving USD 1.14 billion in export value and Nicaragua producing 210.9 million units, leveraging their favorable growing conditions and manufacturing expertise. European markets face potential restructuring due to proposed taxation directives, which may lead to market consolidation among larger manufacturers. The Middle East and Africa regions show promise as emerging markets, with increasing demand driven by rising tourism and growing affluent consumer segments.

- Scandinavian Tobacco Group A/S

- Imperial Brands PLC

- China National Tobacco Corp.

- Altria Group Inc.

- Swisher International Inc.

- Oettinger Davidoff AG

- Philip Morris International Inc.

- Japan Tobacco Inc.

- British American Tobacco PLC

- Habanos S.A.

- JC Newman Cigar Co.

- Manifatture Sigaro Toscano S.p.A.

- Plasencia Cigars

- Rocky Patel Premium Cigars

- Gurkha Cigars

- Drew Estate

- Villiger Sons Ltd.

- Tabacalera de Garcia

- General Cigar Company

- Oliva Cigar Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Popularity of Premium and Hand-Rolled Cigar

- 4.2.2 Product Innovation in Blends and Packaging

- 4.2.3 Rising Consumer Preference for Luxury and Status Symbol Products

- 4.2.4 Growth of Boutique and Artisan Brands

- 4.2.5 Increasing Adoption of Humidor Technology for Better Preservation

- 4.2.6 Expansion of Online Retail Channels for Cigar

- 4.3 Market Restraints

- 4.3.1 Stringent Tobacco Regulations and Advertising Restrictions Globally

- 4.3.2 High Taxation on Tobacco Products in Many Regions

- 4.3.3 Increasing Age Restrictions and Enforcement on Tobacco Sales

- 4.3.4 Risks of Counterfeit and Smuggled Products Affecting Brand Trust

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Cigarillos

- 5.1.2 Cigar

- 5.2 By Flavor

- 5.2.1 Flavored

- 5.2.2 Non-Flavored

- 5.3 By Price Point

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Offline Retail Stores

- 5.4.2 Online Retail Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Scandinavian Tobacco Group A/S

- 6.4.2 Imperial Brands PLC

- 6.4.3 China National Tobacco Corp.

- 6.4.4 Altria Group Inc.

- 6.4.5 Swisher International Inc.

- 6.4.6 Oettinger Davidoff AG

- 6.4.7 Philip Morris International Inc.

- 6.4.8 Japan Tobacco Inc.

- 6.4.9 British American Tobacco PLC

- 6.4.10 Habanos S.A.

- 6.4.11 JC Newman Cigar Co.

- 6.4.12 Manifatture Sigaro Toscano S.p.A.

- 6.4.13 Plasencia Cigars

- 6.4.14 Rocky Patel Premium Cigars

- 6.4.15 Gurkha Cigars

- 6.4.16 Drew Estate

- 6.4.17 Villiger Sons Ltd.

- 6.4.18 Tabacalera de Garcia

- 6.4.19 General Cigar Company

- 6.4.20 Oliva Cigar Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK