PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692105

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692105

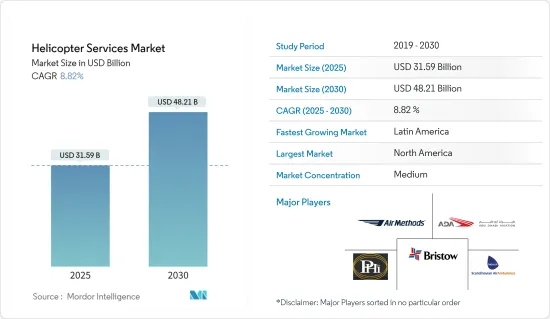

Helicopter Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Helicopter Services Market size is estimated at USD 31.59 billion in 2025, and is expected to reach USD 48.21 billion by 2030, at a CAGR of 8.82% during the forecast period (2025-2030).

Helicopters are widely used in several sectors because they can hover, land, take off vertically, and enter and exit confined spaces. Depending upon the application and cost of operation, operators select a particular helicopter model. Airbus, Bell, and Robinson helicopters are currently dominating the market in terms of new deliveries. In addition, the demand from various end users for lightweight helicopters is expected to drive the market positively during the forecast period.

The introduction of large drones with advanced flight capabilities, coupled with the inability of helicopter companies to eliminate current technology limitations, resulted in drone services continuing to be a substitute for helicopter services in several applications. This factor might challenge the market's growth during the forecast period.

However, factors such as severe road congestion and the need for quicker aerial transportation for helicopter services in emergency medical services, especially in developing countries, create new opportunities for the helicopter services market.

Helicopter Services Market Trends

Air Ambulance Segment is Projected to Show the Highest Growth During the Forecast Period

Air ambulance offers numerous advantages over conventional road ambulance services, as the former helps mitigate the issue of limited access to remote areas and prolonged travel durations. Air ambulances are equipped with different medical equipment and have an onboard medical crew that provides initial emergency medical care to patients. The market for air ambulance services is on the rise owing to several benefits, such as increased survival rates, swift and comfortable transportation, and a vast coverage range in a shorter time. These advantages make helicopters a compelling choice for emergency medical transportation.

For instance, globally, from 2019 to 2023, 268 helicopters were in operation, performing various emergency and medical services. Helicopters for air ambulance services have been made lightweight by original equipment manufacturers (OEMs). Multiple countries are procuring new air ambulance helicopters to cater to this demand. For instance, in November 2023, the Norwegian Air Ambulance awarded a contract to Airbus to deliver three H135s and two five-bladed H145s to carry out helicopter emergency medical service missions in Denmark. Similarly, in December 2023, Gama Aviation launched its Helicopter Emergency Medical Services (HEMS) for the Wales Air Ambulance Charity. Under a USD 70 million contract, a fleet of four Airbus H145 helicopters will likely be operated and maintained, with their base of operations being the charity's existing sites. Thus, such technological advancements made by the original equipment manufacturers (OEMs) will lead to the rotor-craft segment showing impressive growth during the forecast period.

North America to Exhibit the Largest Market Share During the Forecast Period

North America held the highest shares in the helicopter services market. This dominance is owing to the presence of the largest helicopter fleet and the rising use of helicopters for air ambulance services. The US has a total fleet of around 7,014 helicopters, with air ambulances recorded at more than 1000 units. With the increase in inclination toward cleaner, more sustainable energy demands, the increasing offshore wind farm projects across the country have driven the demand for helicopter services. As a result, new contracts and partnerships have increased market value.

For instance, Orsted and Eversource announced in April 2022 that HeliService International Inc. had been awarded the contract for helicopter crew change operations for the two companies' joint venture of offshore wind projects in the Northeast United States. The company will use Leonardo AW169 helicopters to support its everyday operations. The country's increasing revenue from the oil and gas sector has been witnessing an increasing demand, which has thus directly impacted the need for helicopter services in the offshore segment of the helicopter services industry.

Furthermore, the growing influx of private equity investors into maintaining and operating the air ambulance market, despite improving the chances for better services, poses a risk of the increased cost of operations that could be levied on the customers. Similarly, the growing demand for helicopters for various applications such as emergency medical services, search and rescue, leisure charters, and others from Canadian operators drives the market growth across the region.

Helicopter Services Industry Overview

The helicopter services market is semi-consolidated and is characterized by several operators providing various helicopter services. Some of the major players in the market are Babcock Scandinavian Air Ambulance (Babcock International Group), Abu Dhabi Aviation, Air Methods Corporation, Bristow Group Inc., and PHI Group, Inc. Over the years, the aviation regulatory bodies introduced tough and rigid rules and regulations for helicopter operators. However, various governments are now introducing supportive laws encouraging helicopter and fixed-wing aircraft operations to develop the general aviation sector. This leads to increased influx of local players and expanding existing players into new markets. Furthermore, the key players focus on business expansion through strategic partnerships, mergers, and acquisitions. Such strategies are expected to help the players' growth during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Air Ambulance

- 5.1.2 Business and Corporate Travel

- 5.1.3 Search and Rescue

- 5.1.4 Leisure Charter

- 5.1.5 Transport

- 5.1.6 Media and Entertainment

- 5.1.7 Surveying

- 5.1.8 Offshore

- 5.1.9 Other Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Indonesia

- 5.2.3.6 Malaysia

- 5.2.3.7 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Turkey

- 5.2.5.5 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Acadian Air Med Services (Acadian Companies)

- 6.2.2 Air Methods Corporation

- 6.2.3 Heli-union

- 6.2.4 Abu Dhabi Aviation

- 6.2.5 Emsos Medical Pvt. Ltd.

- 6.2.6 Bristow Group Inc

- 6.2.7 LUXEMBOURG AIR RESCUE ASBL

- 6.2.8 PHI Group, Inc.

- 6.2.9 Babcock Scandinavian Air Ambulance (Babcock International Group)

- 6.2.10 CHC Group LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS