PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911325

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911325

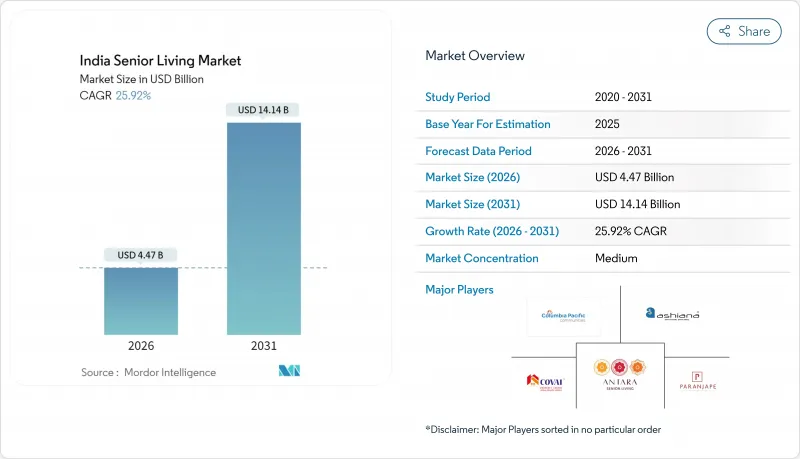

India Senior Living - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India senior living market was valued at USD 3.55 billion in 2025 and estimated to grow from USD 4.47 billion in 2026 to reach USD 14.14 billion by 2031, at a CAGR of 25.92% during the forecast period (2026-2031).

Demand accelerates as the share of citizens aged >=60 years rises and multi-generation households decline. Rising middle-class wealth is widening access to premium retirement communities with on-site health care and wellness programs. Developers are moving beyond southern strongholds into northern and western metros, encouraged by state incentives that cut transaction costs for older buyers. Competition is shifting from small local operators to integrated real-estate and health-care alliances that bundle preventive care, telemedicine, and social engagement services.

India Senior Living Market Trends and Insights

Rapidly Aging Population Creating Rising Demand for Senior-Focused Housing Solutions

India's demographic curve is steepening. Citizens aged >=60 years will more than double from 153 million in 2020 to 347 million in 2050, lifting the old-age share of the population from 11% to 21. The old-age dependency ratio is forecast to move from 16% in 2020 to 34% by 2050 as per national projections. Southern states feel the shift first; Kerala already records a 16.5% elderly share, creating immediate demand for purpose-built homes. Current penetration of senior living communities is at 1%, versus 11% in the United Kingdom, suggesting vast headroom. Meeting anticipated demand will require roughly 2.4 million new units designed for older residents by 2030.

Increasing Nuclear Family Structures Driving Need for Independent Senior Living Communities

Long-term urbanization pulls adult children away from parental homes, undercutting traditional joint-family care systems. The Longitudinal Ageing Study of India reports that 26.7% of urban elders now live alone. As companionship and daily assistance decline within family networks, interest in community-oriented retirement complexes climbs. Many seniors cite opportunities for peer engagement, safety, and on-site health monitoring as decisive factors. Peer-reviewed studies confirm a link between living alone and elevated geriatric depression, reinforcing the appeal of structured social settings. The greatest momentum is visible in Mumbai, Delhi NCR, and Bengaluru, where real-estate values and rental costs hinder multi-generation living.

Cultural Preference for Family-Based Elderly Care Slowing Adoption

Filial piety remains deeply ingrained. The Maintenance and Welfare of Parents and Senior Citizens Act 2007 obliges adult children to fund parental living expenses, reinforcing the expectation of at-home care. For many families, moving elders into organized communities feels akin to abandonment. The stigma is stronger in rural areas and mid-sized cities, where joint households still predominate. Academic research shows that older adults who perceive low family support experience higher anxiety when contemplating institutional options. While demographic reality is eroding these norms, the transition is gradual and varies by state.

Other drivers and restraints analyzed in the detailed report include:

- Growing Middle-Class Wealth Enabling Affordability of Premium Retirement Homes

- Health-Care Integration and Wellness-Focused Amenities Becoming Key Differentiators

- Limited Awareness and Social Acceptance of Institutional Senior Living

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Independent living accounted for 64.50% of the India senior living market share in 2025. Residents in this category purchase or rent units that resemble standard apartments yet benefit from emergency call systems, housekeeping, and recreational programs. Many projects cluster clubhouses, libraries, and walking tracks to support active lifestyles. Assisted living, though smaller, carries a 27.35% CAGR.

Developers are now creating continuum-of-care campuses where independent, assisted, and memory-care wings sit side by side. This arrangement allows residents to shift care levels without leaving familiar surroundings. It also lifts utilization ratios because apartments vacated by seniors moving to assisted facilities can be re-leased swiftly. Partnerships with tertiary hospitals provide visiting specialists, while tele-diagnostics reduce response time during medical events. Technology adoption, wearables that transmit blood-pressure and glucose levels, improves risk management and reduces liability insurance premiums.

The India Senior Living Market Report is Segmented by Property Type (Assisted Living, Independent Living, Memory Care, Nursing Care), by Business Model (Outright Sale (Freehold), Long-Lease / Rental, and More), by Age (55 To 64 Years, 65 To 74 Years, and More), and by Geography (Mumbai Metropolitan Region, Delhi NCR, Pune, Bengaluru, Hyderabad, Chennai, Kolkata). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Antara Senior Care

- Columbia Pacific Communities

- Ashiana Housing Ltd

- Paranjape Schemes (Construction) Ltd

- Covai Property Centre (I) Pvt Ltd

- Oasis Senior Living

- Primus Lifespaces Pvt Ltd

- The Golden Estate

- Vedaanta Retirement Communities

- Bahri Realty Management Services Pvt Ltd

- Ananya's Nana Nani Homes

- Athashri (Paranjape)

- Casagrand Communities

- Tata Housing - Riva

- Brigade Group - Parkside

- Mahindra Lifespaces - Happinest Senior

- Godrej Properties - Godrej Seasons Senior Living

- Vardaan Senior Living

- Athulya Senior Care

- Ananta Living

- Gracias Living

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly aging population creating rising demand for senior-focused housing solutions

- 4.2.2 Increasing nuclear family structures driving need for independent senior living communities

- 4.2.3 Growing middle-class wealth enabling affordability of premium retirement homes

- 4.2.4 Healthcare integration and wellness-focused amenities becoming key differentiators

- 4.2.5 Rising participation of private developers and healthcare operators in senior housing projects

- 4.3 Market Restraints

- 4.3.1 Cultural preference for family-based elderly care slowing adoption

- 4.3.2 Limited awareness and social acceptance of institutional senior living

- 4.3.3 High development and operating costs restricting affordability in certain segments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Policy & Regulatory Framework (state guidelines, licensing, incentives)

- 4.6 Insight on Upcoming and Ongoing Projects

- 4.7 Insights on Digital & Tech Enablers (telemedicine, smart amenities)

- 4.8 Insights on Business Model & Operator Evolution

- 4.9 Insights on Investment & Financing Trends

- 4.10 Insights Sustainability & Design Innovation

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Buyers/Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Assisted Living

- 5.1.2 Independent Living

- 5.1.3 Memory Care

- 5.1.4 Nursing Care

- 5.2 By Business Model

- 5.2.1 Outright Sale (Freehold)

- 5.2.2 Long-Lease / Rental

- 5.2.3 Hybrid (Sale + Lease)

- 5.3 By Age

- 5.3.1 55 to 64 years

- 5.3.2 65 to 74 years

- 5.3.3 75 to 85 years

- 5.3.4 Above 85 years

- 5.4 By Region

- 5.4.1 Mumbai Metropolitan Region

- 5.4.2 Delhi NCR

- 5.4.3 Pune

- 5.4.4 Bengaluru

- 5.4.5 Hyderabad

- 5.4.6 Chennai

- 5.4.7 Kolkata

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.3.1 Antara Senior Care

- 6.3.2 Columbia Pacific Communities

- 6.3.3 Ashiana Housing Ltd

- 6.3.4 Paranjape Schemes (Construction) Ltd

- 6.3.5 Covai Property Centre (I) Pvt Ltd

- 6.3.6 Oasis Senior Living

- 6.3.7 Primus Lifespaces Pvt Ltd

- 6.3.8 The Golden Estate

- 6.3.9 Vedaanta Retirement Communities

- 6.3.10 Bahri Realty Management Services Pvt Ltd

- 6.3.11 Ananya's Nana Nani Homes

- 6.3.12 Athashri (Paranjape)

- 6.3.13 Casagrand Communities

- 6.3.14 Tata Housing - Riva

- 6.3.15 Brigade Group - Parkside

- 6.3.16 Mahindra Lifespaces - Happinest Senior

- 6.3.17 Godrej Properties - Godrej Seasons Senior Living

- 6.3.18 Vardaan Senior Living

- 6.3.19 Athulya Senior Care

- 6.3.20 Ananta Living

- 6.3.21 Gracias Living

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment