PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910925

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910925

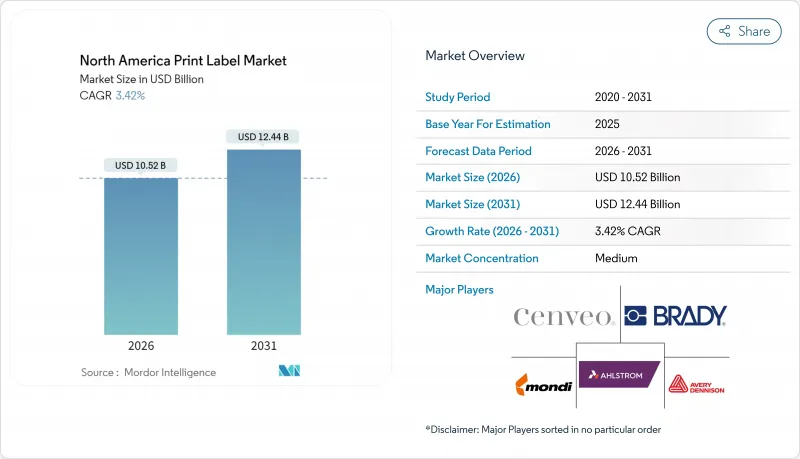

North America Print Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

North America print label market size in 2026 is estimated at USD 10.52 billion, growing from 2025 value of USD 10.17 billion with 2031 projections showing USD 12.44 billion, growing at 3.42% CAGR over 2026-2031.

This steady expansion reflects a maturing landscape in which digital transformation, e-commerce logistics, and sustainability mandates collectively redefine converter economics and end-user demand. Accelerating adoption of variable-data workflows supports real-time supply-chain visibility, while FDA-driven UDI requirements in healthcare sustain premium growth niches. Mexico's role as a regional production hub complements the United States' domestic dominance, as manufacturers relocate to optimize cost structures and shorten lead times. Flexography remains dominant, yet inkjet's rapid gains signal a decisive pivot toward digital-first operations that alleviate labor constraints and cut setup waste. Sustainability continues to reshape material selection, with linerless and bio-based substrates gaining traction as corporate packaging goals tighten against regulatory benchmarks.

North America Print Label Market Trends and Insights

Growing Demand for Digital Print Technologies

Digital adoption in the North America print label market accelerates as offset economics weaken under rising raw-material prices and labor shortages. Ricoh data show the digital crossover point shifting from 2,000 A4 prints in 2010 to roughly 10,000 prints in 2025. Canon's LabelStream LS2000, slated for H2 2025, exemplifies the trend with high-density aqueous inks that support FSC-compliant substrates and reduce VOC emissions. HP Canada notes digital now accounts for more than 10% of pressure-sensitive label volumes, driven by brand demand for customization at scale. Converters transition toward just-in-time models that slash inventory costs and enable premium, short-run orders with higher margins. The resulting shift restructures capital allocation, favoring modular, upgradeable inkjet platforms over analog presses with high setup waste and plate costs.

Surge in Variable Data Printing for E-commerce Logistics

Explosive e-commerce growth boosts variable-data requirements as fulfillment networks demand serialized QR and data-matrix codes for real-time tracking. Amazon's packaging-efficiency programs drive labels that adapt dynamically to inventory location, shipping route, and customer preference parameters. API-ready printing systems integrate directly with ERP and warehouse software, accelerating order-to-ship cycles and reducing error rates. Brands now embed promotional content or loyalty incentives inside shipping labels, turning the last mile into a marketing touchpoint. For converters, variable-data capability differentiates service offerings and insulates margins against commodity price competition.

Inadequate Durability in Extreme Cold-Chain Applications

Standard adhesives delaminate below -40 °F, jeopardizing traceability for vaccines and frozen food. Specialty cryogenic labels using silicone-based adhesive and PET facestocks maintain adhesion down to -196 °C but cost 2-3 times more than commodity products. Zebra's Z-Xtreme 5000T illustrates available solutions, yet converters cite price sensitivity among customers shipping low-margin perishable goods. The technical challenge limits addressable volume in cold-chain growth segments pending broader adoption of affordable, high-performance adhesives.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability-Driven Switch to Linerless and Shrink-Sleeve Formats

- Healthcare UDI-Labeling Mandates

- Supply Volatility of Specialty Label-Stock Papers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexography captured 37.92% of the North America print label market share in 2025, reflecting its entrenched role in large-volume food and beverage lines. Inkjet platforms, however, are accelerating at a 6.69% CAGR, signaling a decisive move toward digitization as converters seek quick changeovers, reduced plate waste, and variable-data capability. The North America print label market size attached to inkjet presses is expected to more than double by 2031 as the total cost of ownership declines.

Hybrid workflows are emerging where flexo units lay white or spot varnish while inkjet heads manage four-color builds, optimizing run-length economics across SKUs. Kodak's PROSPER 7000 Turbo and Fujifilm's Jet Press FP790 exemplify high-speed, water-based systems that reach 50 m/min at 1,200 dpi, closing the productivity gap versus legacy analog machines. Electrophotography remains relevant for small-batch cosmetics and nutraceutical applications requiring opaque whites and brand-centric metallics, though ink cost per square foot limits broader adoption.

Pressure-sensitive solutions held 36.35% of the North America print label market size in 2025, owing to application versatility, but linerless alternatives are registering the fastest 6.98% CAGR. E-commerce fulfillment centers value linerless for 40% more labels per roll and 50% lower transport cost, while retailers adopt the format to meet zero-waste back-of-store initiatives. Shrink and stretch sleeves advance on recyclability innovations such as CCL's EcoFloat polyolefin sleeve, which delaminates in standard recycling processes. In-mold labels maintain a niche presence in durable consumer goods where scuff resistance is paramount.

Multi-part tracking labels supporting RFID or NFC overlays serve regulated pharma and industrial sectors. Wet-glue labels persist in premium beer and spirits categories for heritage branding aesthetics but lose share as aluminum can adoption surges. As the linerless scale improves, pressure-sensitive volumes could plateau mid-forecast, pressuring converters to diversify application portfolios or integrate print-and-apply automation that accommodates both formats.

The North America Print Label Market Report is Segmented by Printing Technology (Offset Lithography, Gravure, Flexography, Screen, and More), Label Type (Wet-Glue Labels, Pressure-Sensitive Labels, Linerless Labels, and More), Substrate Material (Paper, Plastic, and More), End-User Industry (Food, Beverage, Healthcare, Cosmetics, Household, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Avery Dennison Corporation

- CCL Industries Inc.

- Multi-Color Corporation

- Brady Corporation

- Smurfit WestRock

- Mondi Group

- Ahlstrom-Munksjo Oyj

- Cenveo Worldwide Limited

- Resource Label Group

- Blue Label Packaging

- OMNI Systems Inc.

- Inovar Packaging Group

- Fort Dearborn Company

- R.R. Donnelley & Sons Co.

- Fortis Solutions Group

- Traco Packaging

- UPM-Raflatac

- Brook + Whittle

- Lux Global Label

- Consolidated Label Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for digital print technologies

- 4.2.2 Surge in variable data printing for e-commerce logistics

- 4.2.3 Sustainability-driven switch to linerless and shrink-sleeve formats

- 4.2.4 Healthcare UDI-labeling mandates

- 4.2.5 AI-enabled print workflow automation reducing turnaround time

- 4.2.6 Brand protection and anti-counterfeit features integration

- 4.3 Market Restraints

- 4.3.1 Inadequate durability in extreme cold-chain applications

- 4.3.2 Supply volatility of specialty label-stock papers

- 4.3.3 Capital-intensive transition from analog to digital presses

- 4.3.4 Stringent VOC and ink-migration regulations tightening in 2026

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Printing Technology

- 5.1.1 Offset Lithography

- 5.1.2 Gravure

- 5.1.3 Flexography

- 5.1.4 Screen

- 5.1.5 Letterpress

- 5.1.6 Electrophotography

- 5.1.7 Inkjet

- 5.2 By Label Type

- 5.2.1 Wet-glue Labels

- 5.2.2 Pressure-sensitive Labels

- 5.2.3 Linerless Labels

- 5.2.4 Multi-part Tracking Labels

- 5.2.5 In-mold Labels

- 5.2.6 Shrink and Stretch Sleeves

- 5.3 By Substrate Material

- 5.3.1 Paper

- 5.3.2 Plastic

- 5.3.3 Metallic

- 5.3.4 Sustainable bio-based

- 5.4 By End-user Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Healthcare

- 5.4.4 Cosmetics

- 5.4.5 Household

- 5.4.6 Industrial

- 5.4.7 Logistics and E-commerce

- 5.4.8 Other End-user Industries

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Avery Dennison Corporation

- 6.4.2 CCL Industries Inc.

- 6.4.3 Multi-Color Corporation

- 6.4.4 Brady Corporation

- 6.4.5 Smurfit WestRock

- 6.4.6 Mondi Group

- 6.4.7 Ahlstrom-Munksjo Oyj

- 6.4.8 Cenveo Worldwide Limited

- 6.4.9 Resource Label Group

- 6.4.10 Blue Label Packaging

- 6.4.11 OMNI Systems Inc.

- 6.4.12 Inovar Packaging Group

- 6.4.13 Fort Dearborn Company

- 6.4.14 R.R. Donnelley & Sons Co.

- 6.4.15 Fortis Solutions Group

- 6.4.16 Traco Packaging

- 6.4.17 UPM-Raflatac

- 6.4.18 Brook + Whittle

- 6.4.19 Lux Global Label

- 6.4.20 Consolidated Label Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment