PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644313

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644313

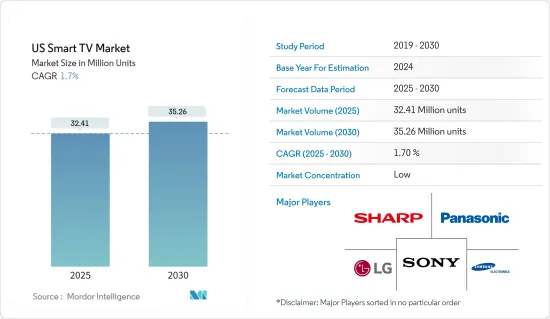

US Smart TV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Smart TV Market size is estimated at 32.41 million units in 2025, and is expected to reach 35.26 million units by 2030, at a CAGR of 1.7% during the forecast period (2025-2030).

The increasing adoption of OTT services leading to the preference of smart TVs as a typical streaming entertainment product and the Us-China trade dispute prompting smart TV vendors dependent on Chinese manufacturing to expand shipments for building safety stocks are the two major factors driving the growth of smart TV in the United States.

Key Highlights

- Streaming media such as Apple TV, Amazon Fire TV, and Google Chromecast are changing the consumers' viewing experience. Several manufacturers are teaming up with OTT (over-the-top) content and device providers to provide built-in features with no further requirement of a set-top box. For instance, TCL Corporation has teamed up with Roku Inc. and introduced a 4K HDR Roku TV.

- Furthermore, viewership of online material has expanded dramatically in recent years as high-speed broadband access has increased. Furthermore, the expanding electronics sector has started merging different technical advancements, including voice command and computational intelligence, with growing demand for intelligent gadgets, including smart TVs.

- Additionally, the increasing product development by major market players is expected to contribute to segment growth over the study period. For instance, in March 2022 - LG Display first introduced a 77-inch 8K OLED TV panel with MLA technology at the Society for Information Display's (SID) Display Week 2022, which was held in San Jose, California, on the 10th (local time) for three days. LG Display's 77-inch 8K OLED TV was the first in the world to use EX technology and MLA.

- Further, an ever-expanding universe of video streaming services, each with its exclusive TV shows and movies, is attracting a growing audience. According to the Consumer Technology Association, spending on video streaming services reached USD 47 billion in 2022, a 7% increase over 2021.

- For instance, 2021 saw 8K TV makers get into gear. Alongside the usual trio of 8K resolution screens from Samsung 8K TV, such as QN900A, QN800A, and QN700A, LG also brought several 8K-capable models that feature their Mini LED technology. Other brands are also launching, such as TCL's 6-Series 8K QLED, proving the cheapest 8K TV in the United States.

- Moreover, the increasing penetration of ultra-high-speed internet and highly efficient network infrastructure are expected to favorably impact the Smart TV Resolutions. For instance, the US federal government plans to build a centralized 5G wireless network nationwide by 2021. Recently, the White House released its National Strategy to Secure 5G in the US, mainly focusing on upgrading and securing 5G infrastructure at home and abroad.

- The COVID-19 pandemic has drastically impacted the lifestyles and routines of all consumers. Shelter-in-place orders and work-at-home mandates have driven in-home video consumption to unprecedented levels. The growing number of smartphone users in emerging economies has acted as a significant catalyst for smart TV as users look to continue their streaming content consumption on more giant screens when at home.

US Smart TV Market Trends

Boosting Demand for 55 Inches and above Screen Size

- The United States has seen a shift from small- and medium-sized TV screens to big screens. This is mainly driven by the increasing per capita income, followed by the growing change for premium and luxurious products. According to the US Department of Commerce, per capita, personal income in the United States was USD 63,444 last year, an increase from the previous year.

- Moreover, the demand for online streaming apps has shifted the consumers' focus toward the trend of an immersive experience in audio and video quality, which has been a significant driver for smart TVs with larger screens.

- Furthermore, TVs have served as a retreat for people during the pandemic, as the market witnessed a double-digit increase in soundbars, streaming players, and mounts. At Video & Audio Center stores in Los Angeles, a retail store carrying the sale of larger displays, a 98-inch Samsung 8K TV exceeded expectations. When the retailer began selling the USD 60,000 8K display at its Santa Monica store in June, it sold three quickly. Since then, the chain has expanded sales of the display to its other four LA-area stores.

- According to Samsung Electronics America, screens larger than 75 inches have become one of the market's fastest-growing segments. As consumers started spending more time at home, working from home, and even teaching their kids, they increased their focus on investing more in home improvement projects to make their homes more comfortable and enjoyable.

- The industry players are also offering streaming services to remain competitive. For instance, Disney gives consumers the option to bundle Disney+ with Hulu and ESPN+ for USD 12.99 per month (a USD 5 per month discount). CBS offers a bundle of Showtime and CBS All Access starting at USD 14.99 per month (a USD 2 per month discount). All the above factors are increasing the demand and adoption of Smart TVs in the region.

- Though the demand for smart TVs with 55 inches above-sized screens was present before, the outbreak of the COVID-19 pandemic transformed the scenario into a need for smart TVs with much bigger screens. During the spring, as state and local regulations across the United States recommended people stay at home, consumers purchased televisions at levels usually seen during the holiday season.

OLED Segment to Witness Significant Growth

- The television industry has ramped up its use of OLED displays recently. With OLED becoming the future of the display market and being used almost everywhere in the best possible ways, television manufacturers are increasingly using OLED displays for televisions. The increasing adoption in the television industry will further augment the OLED panel's growth in the regional smart tv market.

- According to the Consumer Technology Association, US OLED TV factory revenue increased by 11% to USD 3.3 billion in 2022 from USD 2.98 billion in 2021, further driving the market growth.

- The adoption of innovative technologies, such as Quantum dot LEDs (QLEDs) across Ultra-high-definition (UHD) Smart TVs, is expected to fuel the segment demand over the forecast period. Televisions in this range have high penetration rates compared to the others. For instance, in June 2021, LG Electronics introduced the first global 83-inch OLED television in the United States. The 83C1 is also the most giant 4K OLED TV industry.

- Furthermore, price reductions in OLED TVs may create profitable expansion prospects. According to the US Department of Energy, labor costs for organic light-emitting diode (OLED) panel fabrication in the United States is expected to fall to USD 5 per square meter of OLED panel produced by 2025.

- Improvements in OLED innovation in the following years, as well as lower raw material costs, are likely to lower the expense of OLED TVs, propelling the industry in the foreseeable future. Additionally, the emergence of new industry participants and the mass manufacturing of OLED TVs will help reduce OLED TV prices, driving the demand for OLED displays. In addition, in December 2021, Samsung placed its bets on hybrid TVs featuring quantum dot/OLED technology, commonly called QD-OLED. Although Samsung Electronics purchases panels from LG Display, the company revealed plans for its in-house display division to manufacture the quantum dot/OLED (QD-OLED) TV panels.

US Smart TV Industry Overview

The United States smart TV market consists of several players. This industry is viewed as a lucrative investment opportunity due to enormous consumer interest. The companies are investing in future technologies to gain substantial expertise and achieve sustainable competitive advantage.

- January 2022 - Sharp Home Electronics Company of America collaborated with Roku TV, a TV-specific streaming platform that provides a premium home entertainment experience that includes a simple, customizable home screen, access to thousands of streaming channels, and over 200 live TV channels. This collaboration builds on Sharp's long history of home entertainment innovation.

- August 2021 - Hitachi introduced the Q series of large-screen Quantum Dot (QLED) Android TVTM OS devices. The frameless 4K HDR TVs, available in 65"/55"/50"/43" screen sizes, bring the user closer to the on-screen action while delivering higher levels of color accuracy and detail thanks to QLED technology. They enhance the audio-visual performance with features such as Dolby Vision HDR and integrated speakers to provide a more immersive home entertainment experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Disposable Income across Emerging Economies

- 5.1.2 Rising Trend of Video-on-demand Service

- 5.2 Market Challenges

- 5.2.1 Lack of High-speed Internet Penetration in Developing Economies

6 MARKET SEGMENTATION

- 6.1 By Screen Size (Diagonal)

- 6.1.1 30-45 Inches

- 6.1.2 45-55 Inches

- 6.1.3 55 Inches and above

- 6.2 By Resolution Type

- 6.2.1 4K UHD TV

- 6.2.2 Full HD TV

- 6.2.3 HDTV

- 6.3 By Panel Type

- 6.3.1 LCD

- 6.3.2 LED

- 6.3.3 OLED

- 6.3.4 QLED

- 6.4 By Pricing Range

- 6.4.1 Under USD 1,000

- 6.4.2 USD 1,000 to USD 2,000

- 6.4.3 USD 2,000 to USD 3,000

- 6.4.4 USD 3,000 and Above

- 6.5 By Operating Segment

- 6.5.1 Android

- 6.5.2 Tizen

- 6.5.3 WebOS

- 6.5.4 Roku

- 6.5.5 Other Operating Systems

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 LG Electronics Inc.

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 Sony Corporation

- 7.1.4 Panasonic Corporation

- 7.1.5 Sharp Corporation

- 7.1.6 VIZIO Inc.

- 7.1.7 Hisense Group Co. Ltd

- 7.1.8 Koninklijke Philips NV

- 7.1.9 Insignia Systems Inc.

- 7.1.10 Haier Group Corporation

- 7.1.11 Hitachi Ltd

- 7.1.12 Westinghouse Electric Corporation

- 7.1.13 TCL Technology

8 VENDOR MARKET RANKING ANALYSIS

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET