PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689972

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689972

India Feminine Hygiene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

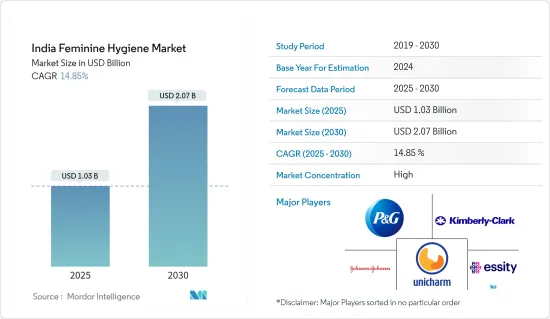

The India Feminine Hygiene Market size is estimated at USD 1.03 billion in 2025, and is expected to reach USD 2.07 billion by 2030, at a CAGR of 14.85% during the forecast period (2025-2030).

Over the medium term, the increasing awareness about intimate hygiene and increasing preference for menstrual products, like sanitary pads, tampons, and panty liners, are driving the demand for feminine hygiene products in the country. The Government of India has launched several awareness programs across the country about women's menstrual hygiene. However, menstruation continues to be a taboo, especially in rural areas, impeding the growth of the market studied. The country is witnessing an increasing number of promotions and educational sessions due to the rising prominence of social media and the various initiatives taken by the government and NGOs to increase awareness about the benefits of using menstrual hygiene products. For instance, in 2022, the Ministry of Health and Family Welfare introduced a scheme for the promotion of menstrual hygiene among adolescent girls in the age group of 10-19 years in rural areas.

Various innovations and easy availability of feminine hygiene products have been driving the market. For example, the tampons market has a lot of untapped potential. Most of the customers use the product due to its convenience and to avoid stains. Sanitary napkins are available in many variants suitable for day and night usage. The thickness and size of these napkins vary. Ultra-thin sanitary napkins are well-received by women in urban areas. The exception of GST on sanitary pads napkins and foreign feminine hygiene products imported to India is positively boosting the growth of the market. The importers have to pay a basic custom duty of 10%. Earlier, their product was charged 10% customs duty plus 12% GST, bringing the total tax incidence on their product to 22%. Thus, due to this development, an increasing number of international brands are expanding their presence in the country to tap into one of highly potential consumer products segments of the country and gain competitive advantage in the market.

Feminine Hygiene Market Trends

Technological Evolutions and Increasing Penetration of Brands in the Market

The feminine hygiene products market is highly influenced by factors such as softness, absorbency, performance, brand loyalty, good price, and value. Unlike the earlier traditional pads that lasted only a few hours, consumers now demand menstrual products with increased absorption technology. Thus, the manufacturers are offering menstrual products with optimized absorbent cores to enhance performance in fluid distribution material. The market is still dominated by sanitary napkins. However, the growing interest in intimate care products, urinary cups, and tampons is driving product launches in the country. The country has witnessed the entry of organic and eco-friendly brands in the market, catering to more eco-conscious consumers.

The demand for feminine hygiene products is significantly growing in urban areas, encouraging the players to offer personalized and eco-friendly options. Due to their cost-effectiveness, there is increasing demand for eco-friendly products in the female hygiene segment. Apart from cost-effectiveness, minimal waste generation is another major factor driving the increased adoption of products like menstrual cups and reusable cloth pads. For example, in December 2021, Pee Safe launched its retail store offering feminine hygiene products. The company opened its store in Pune and Mumbai as part of its plan of opening 50+ stores across India.

Emergence of More Start-ups, Self-help Groups, and Funding

In India, consumers choose sanitary pads as menstrual hygiene has gained prominence in society for several reasons. This trend has boosted the sanitary pads market in the Indian feminine hygiene industry. The increased focus on feminine hygiene in the country resulted in a rising number of domestic start-ups, NGOs, and self-help groups trying to tap into the market by overcoming the industry's major challenges, including a lack of awareness and affordability. Many menstrual start-ups have emerged in the past few years and are actively using technology to reach over 300 million women who lack access to menstrual hygiene products and awareness. These start-ups are providing affordable sanitary napkins to underprivileged women in rural areas. Data from the Economic Survey study reveal that between 2016-17 and 2020-21, the proportion of start-ups and Indian patent applications increased by more than five times. In January 2022, the Rajasthan government started "I am Udaan," a women-friendly project. This plan, which will cost INR 200 crore, will provide free sanitary napkins to every girl and woman in the state, regardless of where they live. Such factors are driving the market studied.

Feminine Hygiene Industry Overview

The Indian feminine hygiene market is highly competitive, with intense competition among the market players to increase their share in the market. In terms of share, the market is dominated by players such as Procter & Gamble, Kimberly-Clark Corporation, Unicharm Corporation, Johnson & Johnson Private Limited, and Essity AB. The manufacturers are investing a heavy amount of advertising and promotional activities to increase their consumer base by capturing their attention and gaining a competitive advantage in the country. Private-label feminine hygiene product manufacturers have been giving tough competition to the existing players in terms of product offerings, packaging, and pricing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Sanitary Napkins/Pads

- 5.1.2 Tampons

- 5.1.3 Menstrual Cups

- 5.1.4 Other Types

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Pharmacies/Drug Stores

- 5.2.3 Online Retail Stores

- 5.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Key Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Procter & Gamble Company

- 6.3.2 Essity AB

- 6.3.3 Johnson & Johnson Private Limited

- 6.3.4 Kimberly Clark Corporation

- 6.3.5 Tzmo SA

- 6.3.6 Redcliffe Hygiene Pvt. Ltd

- 6.3.7 Edgewell Personal Care

- 6.3.8 Unilever PLC

- 6.3.9 Unicharm Corporation

- 6.3.10 Wet and Dry Personal Care Pvt. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER