PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910707

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910707

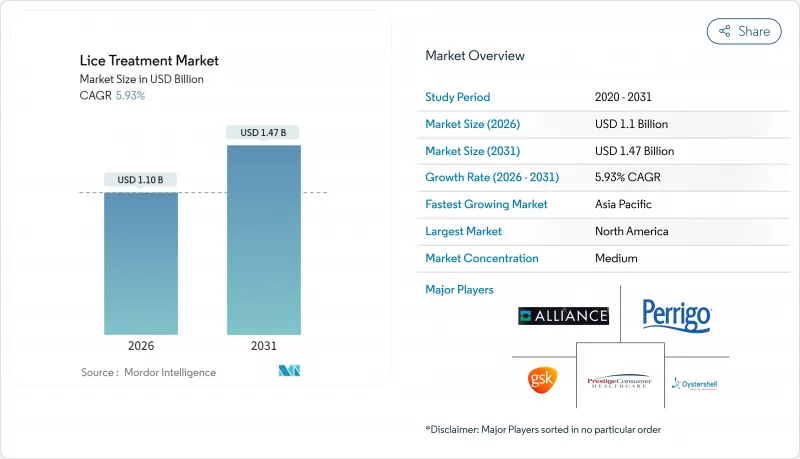

Lice Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The lice treatment market is expected to grow from USD 1.04 billion in 2025 to USD 1.10 billion in 2026 and is forecast to reach USD 1.47 billion by 2031 at 5.93% CAGR over 2026-2031.

Demand rises as pyrethroid-resistant "super lice" undercut legacy products, prompting a pivot toward novel actives, systemic dosage forms and digitally enabled buying models. Prescription therapies featuring ivermectin and spinosad are gaining momentum, while oral tablets post the highest growth among dosage forms . Online pharmacies accelerate access and discretion, reinforcing e-commerce penetration. Regionally, North America retains leadership on spending strength, yet Asia-Pacific delivers the fastest growth on expanding healthcare access and hygiene investment. Competitive intensity is shaped by fragmented players racing to commercialize next-generation formulations and professional clinic services.

Global Lice Treatment Market Trends and Insights

Increasing Prevalence of Head-Lice Infestation

Persistent infestation rates among school-age children sustain recurring demand across every major geography. The economic cost exceeds USD 1 billion per year in direct U.S. treatment spending, while productivity losses add USD 4-8 billion annually. Close-contact behaviors and high classroom densities reinforce transmission. Continued outbreaks despite decades of OTC options spotlight resistance-driven efficacy gaps, pushing families and employers toward more potent and sometimes costlier solutions. Public health departments intensify screening programs, keeping the lice treatment market in constant visibility and stimulating product innovation.

Easy Availability of OTC Products in Retail & E-Commerce

The FDA monograph under 21 CFR 358.610 standardizes active ingredients, ensuring consistent OTC supply in store aisles and on digital shelves. Multichannel presence lowers purchase friction and normalizes self-treatment, which keeps the lice treatment market accessible even in the absence of clinical consultation. Discreet online ordering lessens stigma, while bundled virtual advice improves correct application. Retail chains upscale inventory breadth, and e-pharmacies leverage algorithmic recommendations to convert search traffic into sales, broadening reach across suburban and rural areas.

Low Awareness & Low Disposable Income in Developing Nations

Public health budgets prioritizing communicable diseases leave lice management under-funded, stalling educational outreach. Rural consumers often purchase small-volume pesticides or rely on ineffective folk cures due to cost constraints, limiting lice treatment market penetration. Sparse pharmacy density and weak supply chains prolong stock-outs, curbing treatment adherence rates. NGOs implement pilot school screening programs, yet scale-up remains uneven, sustaining an unaddressed burden.

Other drivers and restraints analyzed in the detailed report include:

- Rising Hygiene & Healthcare Spending in Emerging Markets

- Growing Penetration of E-Commerce Distribution

- Declining Efficacy of Legacy Pyrethrin and Permethrin Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OTC formulations retained 69.67% lice treatment market share in 2025, anchored by shelf visibility and consumer habit. Permethrin and pyrethrin products continue to move volume, yet resistance has eroded cure rates under real-world conditions. Healthcare providers now escalate quickly to ivermectin, spinosad or malathion when first-line therapy fails, propelling prescription sales.

Prescription drugs post a 6.36% CAGR to 2031, reshaping the lice treatment market as insurance coverage widens and single-dose convenience resonates with time-pressed families. FDA reclassification of ivermectin lotion to OTC sparks category blurring, enabling aggressive DTC marketing campaigns that could siphon share from entrenched pyrethroids .

Shampoos led with 42.07% of the lice treatment market size in 2025 due to ease of pediatric use and existing retail planogram placement. Lotions and sprays remain alternatives for fragrance-sensitive users, while foams and gels populate the "others" bucket now targeted by natural-ingredient startups.

Oral tablets expand at 6.42% CAGR as caregivers seek systemic options that bypass combing fatigue and ensure uniform drug exposure. Comparative studies reveal faster symptom relief, fostering prescriber confidence. This systemic shift signals a profound change in the lice treatment market trajectory, opening space for extended-release formats that could achieve single-tablet eradication.

The Lice Treatment Market Report Segments the Industry Into by Product Type (OTC Medication, Prescription Medication), by Distribution Channel (Hospitals and Clinics, Retail Pharmacies, Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, South America). Get Five Years of Historical Data Alongside Five-Year Market Forecasts.

Geography Analysis

North America generated 37.84% of global revenue in 2025, underpinned by high per-capita spend, insurance coverage and widespread professional clinic adoption. FDA clarity on active ingredient monographs provides regulatory certainty, stimulating brand lifecycle extensions. Ongoing resistance trends raise patient revisit rates, fueling incremental sales across both prescription and service categories.

Europe mirrors North American resistance dynamics yet demonstrates a stronger consumer tilt toward plant-based formulations. Pharmacies leverage pharmacist-led consultations to encourage proper combing techniques, sustaining repeat visits. Regulatory restraints on neuro-toxic ingredients encourage investment in physical-mode treatments, broadening the lice treatment market portfolio and aligning with the region's natural-product ethos.

Asia-Pacific records the fastest CAGR at 6.88% through 2031, propelled by escalating hygiene awareness and e-commerce adoption. Urban middle-class households shift to branded solutions, while rural uptake benefits from smartphone ordering and rapidly improving last-mile logistics. Domestic manufacturers introduce sachet pack sizes priced for daily-wage budgets, widening inclusivity in the lice treatment market across population tiers.

- Prestige Consumer Healthcare

- Perrigo Company

- Bayer - Oystershell Consumer Health

- Alliance Pharmaceuticals Ltd (Vamousse)

- Johnson & Johnson

- GlaxoSmithKline

- Arbor / Azurity Pharmaceuticals

- Parapro Pharmaceuticals

- Fleming Medical

- Lice Clinics of America (Larada Sciences)

- TyraTech Inc.

- Teva Pharmaceutical Industries

- Sanofi

- Dr. Reddy's Laboratories

- Shionogi & Co., Ltd.

- Sandoz (Novartis division)

- Taro Pharmaceutical Industries

- Reckitt Benckiser Group

- Procter & Gamble

- Thor International (Licener)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing prevalence of head-lice infestation

- 4.2.2 Easy availability of OTC products in retail & e-commerce

- 4.2.3 Rising hygiene & healthcare spending in emerging markets

- 4.2.4 Growing penetration of e-commerce distribution

- 4.2.5 Surge in pyrethroid-resistant super-lice driving novel therapies

- 4.2.6 Expansion of professional salon/clinic lice-removal services

- 4.3 Market Restraints

- 4.3.1 Low awareness & low disposable income in developing nations

- 4.3.2 Declining efficacy of legacy pyrethrin and permethrin products

- 4.3.3 Regulatory curbs on neuro-toxic pesticides

- 4.3.4 Popularity of DIY home-remedy alternatives

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Treatment Type

- 5.1.1 OTC Medication

- 5.1.1.1 Permethrin-based

- 5.1.1.2 Pyrethrin-based

- 5.1.1.3 Others

- 5.1.2 Prescription Medication

- 5.1.2.1 Ivermectin

- 5.1.2.2 Spinosad

- 5.1.2.3 Malathion

- 5.1.2.4 Others

- 5.1.1 OTC Medication

- 5.2 By Dosage Form

- 5.2.1 Shampoo

- 5.2.2 Lotion

- 5.2.3 Spray

- 5.2.4 Oral Tablet

- 5.2.5 Others

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Pharmacies

- 5.3.3 Online Pharmacies

- 5.4 By Route of Administration

- 5.4.1 Oral

- 5.4.2 Topical

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Prestige Consumer Healthcare Inc.

- 6.3.2 Perrigo Company plc

- 6.3.3 Bayer - Oystershell Consumer Health

- 6.3.4 Alliance Pharmaceuticals Ltd (Vamousse)

- 6.3.5 Johnson & Johnson Services, Inc.

- 6.3.6 GlaxoSmithKline plc

- 6.3.7 Arbor / Azurity Pharmaceuticals

- 6.3.8 Parapro Pharmaceuticals

- 6.3.9 Fleming Medical Ltd

- 6.3.10 Lice Clinics of America (Larada Sciences)

- 6.3.11 TyraTech Inc.

- 6.3.12 Teva Pharmaceutical Industries Ltd

- 6.3.13 Sanofi SA

- 6.3.14 Dr. Reddy's Laboratories

- 6.3.15 Shionogi & Co., Ltd.

- 6.3.16 Sandoz (Novartis division)

- 6.3.17 Taro Pharmaceutical Industries

- 6.3.18 Reckitt Benckiser Group plc

- 6.3.19 Procter & Gamble Co.

- 6.3.20 Thor International (Licener)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment