PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689868

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689868

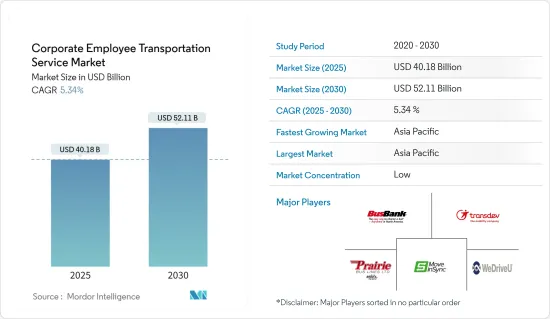

Corporate Employee Transportation Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Corporate Employee Transportation Service Market size is estimated at USD 40.18 billion in 2025, and is expected to reach USD 52.11 billion by 2030, at a CAGR of 5.34% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the market by forcing many companies to work from home, resulting in less employee transportation. However, as economies have recovered from the lockdown, a return to office is expected to provide transportation service operators with numerous opportunities in the coming years. Moreover, governments in various states are also initiatives to improve employee commute systems. For instance,

Key Highlights

- April 2022: Baltimore Mayor announced the launch of the city's innovative transportation program, "Let's Ride to Work." The Mayor's Office of Employment Development (MOED) and Lyft, Inc. collaborated on the agenda. Its main goal is to help newly hired Baltimore City residents by providing free rides to and from work for the first four weeks. This initiative is funded by the American Rescue Plan Act and is part of Baltimore City's COVID-19 employment recovery strategy.

Over the long term, employee transportation services are becoming more popular as people have become more aware of the significance of improved transportation safety measures. In addition, with the low prices offered by transportation providers, employees are choosing them to save time and effort when traveling. Therefore, players are coming up with new product developments and launches for employee transportation services. For instance,

Key Highlights

- November 2022: CharterUP, the fully integrated charter bus marketplace for corporations, consumers, and operators, announced the national launch of Corporate Shuttles, a new platform for booking and managing day-to-day employee transportation. Hilton, Hyatt, Sysco, H-E-B, Texas Instruments, and other companies are currently using CharterUP to address their daily corporate shuttle needs.

Rising incidents of transportation insecurity, assaults, rude behavior, and high fees in ride-hailing and ride-sharing vehicles have prompted employers to consider their employees' safety. This factor is also in charge of driving market growth.

Asia-Pacific is expected to dominate the market due to a growing corporate office presence. It is because many North American and European MNCs are establishing offices, factories, warehouses, and plants in countries such as India, China, and the Philippines, owing to rising demand for goods and low labor costs. For instance,

Key Highlights

- April 2022: Siam Rajathanee Public Co., Ltd (SO), a personnel recruitment service provider and a rental and service business, partnered with SWAT Mobility Pte Ltd (SWAT Mobility), Southeast Asia's leading transportation technology provider. The companies collaborated to launch the "SWAT Mobility" application to improve employees' commute experience to meet the demands of businesses in both the public and private sectors.

Employee Transportation Services Market Trends

Increasing Internet Usage and Technological Advancements to Drive Demand in the Market

With the increased internet use among the global population, markets such as transportation services, vehicle rentals, and so on have primarily benefited their business operations in recent years. The booking ease, pre-estimated fee, comfortable journey, on-time arrival, and quick payment options are just a few factors driving markets such as shared mobility and employee transportation services worldwide.

The transportation industry is tremendously leading among internet-based business sectors, accounting for most of the digital economy. With the online platform's growth and increased competition among market operators, quick action and resolution of issues have become the most critical factor for companies to sustain their businesses in the current competitive environment.

Due to the inherent operations nature, there is a high reliance and dependency on the internet. More internet users are required than necessary for companies with a multi-city presence. As a result, companies frequently accept differential pricing arrangements within and/or across locations and need help to exercise greater bargaining power with vendors.

Other reasons for using these services include technological advancements in transportation, such as live tracking, cashless payments, cancellations, real-time vehicle monitoring, etc. Furthermore, the global IT emergence and other technology sectors toward the end of the last century necessitate the need for flexible working and operations. This operation created opportunities for many associated businesses and jobs. Employee transportation is one of them, becoming a requirement due to statutory regulations regarding employee safety.

With increased internet usage and technological advancements, the market is expected to grow consistently for operators, prompting them to maintain a good vehicle fleet for their business operations during the forecast period.

Asia-Pacific Region Expected to Dominate the Market

The Asia-Pacific region is expected to grow significantly during the forecast period due to increasing corporate companies and rising demand for mass transit solutions by companies to attract a diverse employee range. Furthermore, the low labor cost in countries such as India, Japan, and China, attracts big firms to open their offices in these countries, expecting to drive demand for corporate transportation services in the region over the forecast period. For instance,

- In 2021, Japan's total labor force was estimated to be 68.6 million. The labor force dropped from approximately 68.7 million the previous year.

Furthermore, several key players in the market are implementing various growth strategies, such as partnerships and collaborations, capturing a growing market share in the region. For instance,

- In June 2022, Share Mobility, a company providing transportation solutions for businesses, raised USD 12 million to assist businesses in providing transportation to their employees.

The market in focus is expected to grow significantly during the forecast period due to an increase in employee numbers across the country.

Employee Transportation Services Industry Overview

The market for corporate employee transportation services is fragmented, with few players utilizing technological assistance for fleet and employee commute management. Apart from using the most recent assistive technology, many major players are broadening the scope of their offerings. For instance,

- In October 2021, Shuttl, a bus aggregator for office commute, was acquired by online bus ticketing startup Chalo in an all-cash deal. The amount was not disclosed. The acquisition enabled Chalo to accelerate its plans for international expansion, as Shuttlalready is already present in Bangkok and have entered large Indian metro cities that Chalodid does not have a presence in.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 Ownership

- 5.1.1 Company-owned Transportation Service

- 5.1.2 Outsourced Transportation Service

- 5.1.3 Rentals

- 5.1.4 Pick and Drop Transportation Service

- 5.2 Passenger Vehicle Type

- 5.2.1 Cars

- 5.2.2 Vans

- 5.2.3 Bus

- 5.3 Service Type

- 5.3.1 Mobility as a Service (MaaS)

- 5.3.2 Software as a Service (SaaS)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of the South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of the Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Busbank (Global Charter Services Ltd.)

- 6.2.2 Transdev

- 6.2.3 Prairie Bus Line Limited

- 6.2.4 Move-In-Sync

- 6.2.5 First Class Tours

- 6.2.6 Janani Tours

- 6.2.7 Shuttl

- 6.2.8 Eco rent a car

- 6.2.9 Sun Telematics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS