PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689852

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689852

United Kingdom Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

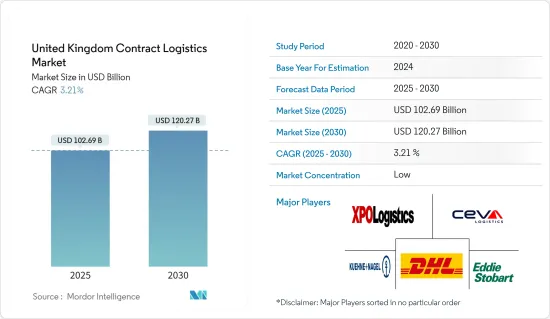

The United Kingdom Contract Logistics Market size is estimated at USD 102.69 billion in 2025, and is expected to reach USD 120.27 billion by 2030, at a CAGR of 3.21% during the forecast period (2025-2030).

Key Highlights

- Despite facing significant operational and financial disruption since March 2020, the logistics industry continued to supply the nation with goods, including food supplies and PPE. To deal with the COVID-19 pandemic, logistics businesses managed risks by scaling back operations, taking work back in-house, and reducing their reliance on third-party services. At the same time, many also focused on their core fleet of vehicles to save costs.

- The United Kingdom has the most advanced logistics industry in Europe. Owing to the variety and higher prevalence of e-commerce, this may not change-the contract logistics market benefits from expanding e-commerce due to increased demand for contract logistics services. As a result of the e-commerce boom, logistics companies are expanding their services.

- With the expansion of international trade and the interconnectedness of economies, companies in the UK are increasingly engaging in global business activities. This has led to a surge in the demand for efficient and streamlined logistics services to facilitate the movement of goods across borders.

- The Need for expanded transportation networks, the complexity of global supply chains, advancements in technology, and the rise of e-commerce have all influenced the growth and evolution of contract logistics in the UK.

- Contract logistics services are in high demand as a result of the retail e-commerce boom. Over the last decade, e-commerce has become the most popular retail trend in the United Kingdom. Even though e-commerce platforms have been around for a long time, they have only recently gained mainstream notice. In order to keep up with the rest of the globe, the expansion of internet shopping in the United Kingdom has been phenomenal.

UK Contract Logistics Market Trends

Growing demand for contract logistics in the manufacturing segment

- The manufacturing sector in the UK is highly diverse, encompassing industries such as automotive, aerospace, pharmaceuticals, electronics, and more. Each industry has its unique logistics requirements, and contract logistics providers specialize in catering to these specific needs. This specialization allows manufacturers to benefit from industry-specific expertise and best practices.

- One of the key benefits of contract logistics in the manufacturing sector is increased flexibility. Manufacturers can scale their logistics operations based on demand fluctuations, ensuring efficient utilization of resources and cost optimization.

- Contract logistics providers offer customizable solutions tailored to the specific needs of manufacturers, allowing them to adapt quickly to changing market conditions.

- By outsourcing logistics activities to experts, manufacturers can benefit from streamlined processes, optimized routing, and improved inventory management. This leads to reduced lead times, lower costs, and enhanced overall operational efficiency.

- Contract logistics also plays a vital role in ensuring supply chain visibility and traceability. With the help of advanced technologies such as track and trace systems, manufacturers can monitor the movement of goods throughout the supply chain. This visibility helps in identifying bottlenecks, optimizing inventory levels, and ensuring timely delivery to customers.

Growth in e-commerce supporting the market advancement

Significant growth in the e-commerce industry and increasing consumer propensity to shop online are among the key factors creating a positive outlook for the UK market. Logistics plays a vital role in the smooth functioning of warehousing, transportation, shipping, and online delivery. The widespread adoption of this solution is also due to the increase in reverse logistics operations, such as simple return and refund policies offered by various e-commerce platforms with flexible tracking capabilities will drive market growth.

In addition, the widespread use of logistics by several industrial sectors is another growth driver due to growing awareness of the benefits of logistics, such as reduced investment, faster delivery times, and a greater focus on consumers rather than administrative tasks. The introduction of technology-driven logistics services and the Internet of Things (IoT)-)-enabled connected devices, enabling the tracking of objects and remote control of elements of the transportation process, is driving the market growth.

Moreover, growing interest in sustainable development has increased the demand for green logistics to support the growth of the market. Furthermore, the prevalence of radio frequency identification (RFID), Bluetooth, and other emerging technologies, such as drone delivery and unmanned vehicles, are having a positive impact on the market growth. Extensive research and development (R&D) activities and other factors, such as increasing demand for safe refrigerated transportation across the country, are expected to boost market growth. The building is equipped with new technology and the latest storage software, further expanding the logistical capacity to manage all services. The e-commerce industry is driving a new era in customer service with extensive automation. The logistics industry is constantly adapting to new technologies and innovations.

Soon, drone deliveries might become more common in the United Kingdom. At the same time, hyperlocal services would help businesses deliver their goods, thus fast-tracking last-mile delivery for a quick turnaround time on e-commerce orders from major retailers.

UK Contract Logistics Industry Overview

The market is relatively fragmented, with a large number of local and international players, including DHL Supply Chain, Wincanton, Clipper Logistics, and UPS as its key players. The market is experiencing expansions, mergers, and acquisitions as players focus on increasing their grasp over the nation as well as the international market.

The UK contract logistics market provides an example of near-perfect competition, as many buyers and sellers are operating in the market. Even though major players have a strong footprint across the region and account for a significant market share, the market is still fragmented to some extent, with many players providing contract logistics services at different levels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Increased Globalization boosting the market

- 4.2.1.2 Technological advancements bolstering the market

- 4.2.2 Market Restraints

- 4.2.2.1 Infrastructure limitation affecting the market

- 4.2.2.2 Shortage of Labour force affecting the market

- 4.2.3 Market Opportunities

- 4.2.3.1 International trade boosting the market

- 4.2.3.2 Specialized services boosting the market

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technological Trends in the Market

- 4.5 Industry Policies and Regulations

- 4.6 Industry Value Chain Analysis

- 4.7 Insights into the E-commerce Industry in the Country (both Domestic and Cross-border)

- 4.8 Insights into Contract Logistics in the Context of After-sales/Reverse Logistics

- 4.9 Brief on Different Services Provided by Contract Logistics Players

- 4.10 Spotlight on Freight Transportation Costs/Freight Rates

- 4.11 Insights into the Effect of Brexit in the UK Logistics Industry

- 4.12 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Insourced

- 5.1.2 Outsourced

- 5.2 By End-User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Consumer Goods and Retail

- 5.2.3 Pharmaceuticals and Healthcare

- 5.2.4 Hi-tech

- 5.2.5 Other End-Users (Energy, Construction, Aerospace, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL Supply Chain

- 6.2.2 UPS

- 6.2.3 Wincanton

- 6.2.4 XP Supply Chain

- 6.2.5 Eddie Sobert

- 6.2.6 CEVA Logistics

- 6.2.7 Clipper Logistics

- 6.2.8 FedEx

- 6.2.9 Rhenus Logistics

- 6.2.10 EV Cargo*

- 6.3 Other Companies (Key Information/Overview)

7 FUTURE OF THE MARKET

8 APPENDIX