PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642176

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642176

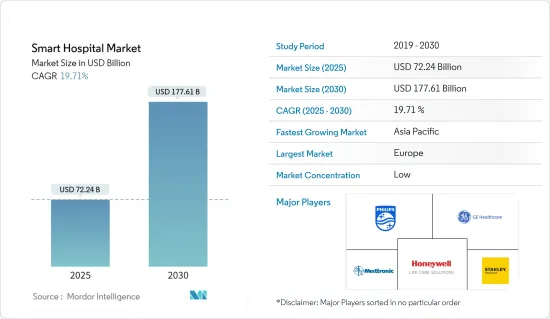

Smart Hospital - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Smart Hospital Market size is estimated at USD 72.24 billion in 2025, and is expected to reach USD 177.61 billion by 2030, at a CAGR of 19.71% during the forecast period (2025-2030).

The rising trend of the Internet of Things (IoT) continues to transform healthcare delivery services at an unprecedented pace. Connected medical devices are increasing patient safety and efficiency. When such technologies apply to the complete healthcare organization ecosystem, it becomes a "Smart Hospital."

Key Highlights

- Due to the high investments involved, hospitals worldwide have been reluctant to adopt these technologies and practices. However, with the diminishing cost of technology and in the light of fast-developing use cases that show the importance of digital connectivity solutions, hospitals today are being forced to embrace them. These technological changes will also benefit hospitals by digitizing personnel management, asset tracking, and scheduling for better operational efficiency.

- Owing to the rise in the aging population and long-term chronic disease conditions in many regions, there is an increasing demand for remote patient monitoring solutions. This is a significant factor impacting the market's growth. There is constant pressure on hospital administrators to lower costs while continuing to improve the standard of patient care. Hospitals are turning to wireless technologies to operate more efficiently, support patient care, and improve their experiences.

- For instance, to better understand and enhance the workflow of nursing staff, hospitals are equipping nurse ID badges with an RFID tag that works with the hospital's Wi-Fi network. These tags track the movement of the nurses throughout their shifts. The data is captured and analyzed, providing insights to the hospitals on how to upgrade their procedures.

- The wireless RFID technology also allows hospitals to track the real-time location of critical equipment and the condition of the equipment. By adopting this wireless technology, the Shands hospital in Florida experienced a 98.8% reduction in the hours spent searching for missing items.

- The COVID-19 pandemic had pushed hospitals beyond their capacity. Yet, the response to the crisis also encouraged innovation. Progressing digital transition was sped up by the requirement to maintain social distance and make the most meaningful use of overworked workers.

Smart Hospital Market Trends

Software Segment is Expected to Show Significant Growth

- One of the most challenging tasks for the hospital's staff includes reducing the wait time for any patient. Implementing various software would help optimize workflows, improve patient care, and reduce staff burnout. Therefore, vendors are focusing on developing software and solutions to enhance hospitals' efficiency.

- AI, 3-D rendering, and cloud-based technology are digital solutions to the medical device industry's most pressing issues. They can be implemented during the forecast period. Many medical device organizations will take up such digital solutions in the near future. These technologies will not replace workers by any measure but will help medical workers operate in conjunction with the workforce.

- The market studied is witnessing strategic investments, acquisitions, and product innovation. For instance, in July 2022, the University Hospital Essen in Northwestern Germany announced a collaboration with NVIDIA to implement AI in clinical care. The collaboration aimed to bolster efficiency and add new data dimensions for the medical decision-making process.

- According to the National Institutes of Health, while clinicians spend 35% of their time on documentation, only 19% of it is spent on patient care. Therefore, smart platforms are expected to help doctors serve patients much better.

- For instance, Hamilton Health Sciences (HHS) witnessed a 61 % reduction in code blues (calls signaling the risk of a cardiac arrest) with the help of ThoughtWire's EarlyWarning. The EarlyWarning application also addresses some of the biggest challenges for health systems, which include the rising cost of healthcare, clinician burnout, the inability to operationalize data quickly, disconnected data silos, etc. Such applications are expected to boost the market.

Europe Occupies the Largest Market Share

- European countries, such as Germany, the United Kingdom, Sweden, and the Netherlands, have advanced infrastructure to deploy next-generation health informatics applications and build smart hospitals. These countries use AI for smart medical services, and IoT to connect devices to transfer patient data and reduce health risks.

- With wide-scale involvement for businesses, consumers, and workers, the rapid implementation of Industry 4.0 in the United Kingdom is a revolutionary step for the country, thereby leading to the development of smart hospitals.

- While several regulatory constraints were posed due to the Brexit scenario, Europe has managed to be one of the top smart device manufacturers. Also, the steady flow of investments into the healthcare sector, primarily due to starting projects previously in the pipeline, is expected to create opportunities for the market studied.

- Many companies in the region are witnessing the introduction of technologies, such as Internet of Medical Things (IoMT), which is expected to propel the well-established healthcare industry. For instance, in October 2021, Royal Philips announced that with the release of its new device drivers that enable integration and interoperability, Philips Capsule Medical Device Information Platform (MDIP) exceeded the milestone of integrating more than 1,000 unique medical device models.

Smart Hospital Industry Overview

The Smart Hospital market is moderately fragmented because of the major players. These players include Koninklijke Philips NV, GE Healthcare, Medtronic PLC, Honeywell Life Care Solutions, and Stanley Healthcare. To sustain intense competition, some prime growth strategies that the companies adopt are product launches, high expenses on research and development, partnerships and acquisitions, etc.

In July 2022, GE Healthcare inaugurated the company's first 5G innovation lab. The lab aimed at developing healthcare solutions by employing 5G and other smart solutions, such as artificial intelligence, augmented and virtual reality, and advanced visualization to streamline image transfers and teleradiology. It also enabled the company to foster collaborations with various academia, industry researchers, and startups to co-create future-ready solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment Of The Impact Of COVID-19 On The Market

- 4.5 Market Drivers

- 4.5.1 Modernization of Healthcare Infrastructure is Boosting the Demand for Smart Hospitals

- 4.5.2 Increasing Penetration of Connected Devices and Instruments in Hospitals

- 4.6 Market Restraints

- 4.6.1 High Cost of Connected Systems

- 4.7 Technology Development

- 4.8 Emerging Use-cases

- 4.9 Key Regulatory Frameworks

5 TECHNOLOGY SNAPSHOT

- 5.1 Smart Hospital Landscape

- 5.1.1 Remote Care System

- 5.1.2 Networked Medical Devices

- 5.1.2.1 Mobile Devices

- 5.1.2.2 Wearable External Devices

- 5.1.2.3 Implantable Devices

- 5.1.2.4 Stationary Devices

- 5.1.2.5 Assistive Robots

- 5.1.3 Identification Systems

- 5.1.3.1 Biometric Scanners

- 5.1.3.2 RFID Systems

- 5.1.3.3 Other Identification Systems

- 5.1.4 Interconnected Clinical Information Systems

- 5.1.4.1 Hospital Information Systems

- 5.1.4.2 Laboratory Information Systems

- 5.1.4.3 Other Interconnected Clinical Information Systems

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Application

- 6.2.1 Electronic Health Record

- 6.2.2 Remote Patient Monitoring

- 6.2.3 Pharmacy Automation

- 6.2.4 Medical Asset Tracking

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Koninklijke Philips NV

- 7.1.2 GE Healthcare ( General Electric)

- 7.1.3 Medtronic PLC

- 7.1.4 Honeywell Life Care Solutions ( Honeywell International Inc.)

- 7.1.5 Stanley Healthcare

- 7.1.6 SAP SE

- 7.1.7 Microsoft Corporation

- 7.1.8 Allscripts Healthcare Solutions Inc.

- 7.1.9 Cerner Corporation

- 7.1.10 McKesson Corporation

- 7.1.11 Schneider Electric Healthcare

- 7.1.12 ThoughtWire Corp.

8 INVESTMENT ANALYSIS

9 FUTURE OPPORTUNITIES