PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851074

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851074

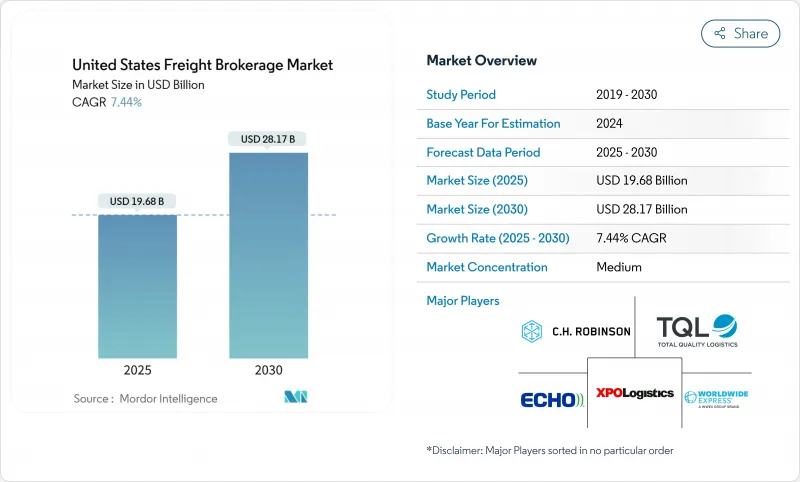

United States Freight Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States freight brokerage market is valued at USD 19.68 billion in 2025 and is set to reach USD 28.17 billion by 2030, registering a 7.44% CAGR through the forecast period.

Growth momentum is supported by the rapid uptake of digital freight platforms, sustained e-commerce demand, and continued federal investment in infrastructure. Tech-enabled brokers are scaling automation to compress transaction time, while traditional intermediaries look to mergers for scale advantages. Driver shortages and heightened spot-market reliance continue to favor intermediaries that maintain deep carrier networks and real-time pricing engines. At the same time, asset-based carriers are bolting on brokerage desks to protect margins, forcing pure-play brokers to differentiate through specialized compliance, temperature-controlled capacity, or managed-transport contracts. The convergence of predictive analytics, electronic logging data, and venture funding is expected to widen the performance gap between digitally mature and lagging firms, thereby reshaping competitive hierarchies across the United States freight brokerage market.

United States Freight Brokerage Market Trends and Insights

Tight Domestic Truckload Capacity and Driver Shortage

Persistent driver turnover keeps capacity tight and lifts spot tender rejection rates, pushing more loads toward brokers with agile matching engines. Mid-sized shippers increasingly depend on intermediaries to secure trucks when contract carriers reject tenders. Digital load boards capture rising volume because automated postings reduce the time needed to cover urgent freight. Driver scarcity is most acute for long-haul refrigerated lanes, intensifying broker leverage in that sub-market. Carriers are demanding higher rates to offset retention bonuses, and savvy brokers bundle back-haul opportunities to keep trucks moving. Tight capacity, therefore, sustains brokerage relevance even as asset-based fleets expand direct sales.

Heightened E-Commerce Parcel Volumes

Rapid-fire online ordering pivots shipment profiles toward smaller, more frequent loads that favor Less-than-Truckload capacity. General rate increases of 4.9%-7.9% across major LTL carriers in 2025 signal constrained pallet space and bolster broker margins when they secure capacity in advance. Density-based freight re-classification slated for July 2025 will lift costs on lightweight e-commerce parcels, reinforcing the need for brokerage expertise in class assignment. Digital LTL portals offering dynamic quoting stand to gain market share as shippers seek rapid cost visibility. Brokers capable of pre-consolidating parcel freight into LTL moves can capture incremental value by reducing per-unit shipping costs. The United States freight brokerage market thus benefits from the structural e-commerce shift toward middle- and final-mile optimization.

Volatile Diesel Prices

Average U.S. diesel swung between USD 3.43 and USD 4.58 per gallon in 2024, outpacing fuel-surcharge recalibration and compressing broker spot margins. Large brokers deploy hedging models that ingest Energy Information Administration data to anticipate surcharges, but smaller players often misprice loads, eroding net revenue. Refrigerated lanes are hit hard because reefer units consume extra fuel. Some brokers now publish "all-in" offers with real-time fuel clauses to shield margins while maintaining price transparency. Fluctuation uncertainty discourages shippers from locking year-long rates, nudging them to transactional spot brokerage.

Other drivers and restraints analyzed in the detailed report include:

- Shipper Demand for Managed Transportation

- ELD Mandate Compliance Requirements

- Port Congestion and Chassis Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The United States freight brokerage market size for service lines continues to skew toward FTL, which generated 63.75% of revenue in 2024, yet the LTL corridor is on track for a 9.0% CAGR through 2030. Digital platforms that quote pallet-level rates within seconds are winning volume from manual call-and-fax workflows. The density-based re-classification in July 2025 will reward brokers able to re-engineer packaging dimensions so that shippers avoid higher classes for light bulky products.

FTL still commands the bulk of long-haul industrial freight, but driver scarcity and equipment constraints are nudging shippers to multistop LTL consolidations. Parcel-to-LTL consolidation hubs reduce last-mile congestion and cut per-unit cost, giving brokers new margins on value-added cross-dock services. Specialized brokers also exploit "partial truckload" offerings to bridge the gap between LTL and FTL. Consequently, multi-service capability is now a benchmark for winning diversified RFPs across the United States freight brokerage market.

Dry vans produced 44.65% of revenue in 2024, but refrigerated units are advancing at 10.1% CAGR, lifting the equipment segment's United States freight brokerage market size over the forecast horizon. Food-grade and pharmaceutical shippers require temperature verification and electronic seals, favoring brokers with telematics-equipped carrier pools.

Rising specialty produce exports out of the West Coast elevate back-haul demand for reefers into the Midwest and East. Brokers bundle harmonized temperature monitoring and detention mitigation into premium pricing. Flatbed and step-deck equipment remains cyclical, spiking during spring construction, while tanker brokerage stays niche due to hazmat compliance burdens. Equipment flexibility, therefore, became central to winning multi-modal contracts in 2025.

The US Freight Brokerage Market Report is Segmented by Service (FTL and More), by Equipment / Trailer Type (Dry Van and More), by Haul Length (Long-Haul and More), by Business Model (Traditional Freight Brokerage and More), by End User (Manufacturing and More), by Customer Size (Large Enterprise and More), and by Geography (Northeast and More). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- C.H. Robinson Worldwide Inc.

- Total Quality Logistics (TQL)

- XPO Logistics Inc.

- Echo Global Logistics

- Worldwide Express

- Coyote Logistics (UPS)

- Landstar System Inc.

- Schneider FreightPlus

- GlobalTranz (WWEX)

- J.B. Hunt 3600

- Hub Group

- Uber Freight

- BNSF Logistics

- SunteckTTS

- Arrive Logistics

- Nolan Transportation Group

- Mode Global

- Convoy Inc.

- Red Technologies

- ArcBest Corporation

- Allen Lund Company

- Redwood Logistics

- BlueGrace Logistics

- Trinity Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tight Domestic Truckload Capacity & Driver Shortage Boosting Spot Brokerage Activity

- 4.2.2 Heightened E-Commerce Parcel Volumes Driving LTL Brokerage Penetration

- 4.2.3 Shipper Demand for Managed Transportation & 4PL Solutions

- 4.2.4 Electronic Logging Device (ELD) Mandate Increasing Reliance on Brokers for Compliance-Ready Carriers

- 4.2.5 Venture-Capital Funding Accelerating Digital Freight-Matching Platforms

- 4.2.6 Infrastructure Investment & Jobs Act (IIJA) Re-energising Construction-Related Freight Flows

- 4.3 Market Restraints

- 4.3.1 Volatile Diesel Prices Compressing Spot Margin for Brokers

- 4.3.2 Port Congestion & Chassis Shortages Disrupting Drayage Reliability

- 4.3.3 Asset-Based Carriers Expanding Direct-to-Shipper Brokerage (Margin Squeeze)

- 4.3.4 Increasing Federal Scrutiny on Broker Bond Requirements & Fraud Cases

- 4.4 Value / Supply-Chain Analysis

- 4.5 Key Government Regulations & Initiatives (HOS, AB5, Speed-Limiter NPRM)

- 4.6 Technology Snapshot (Digital Freight Brokerage, IoT, AI, Visibility APIs)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 US Logistics Industry Overview

- 4.9 Insights on Spot vs. Contract Truck Rates

- 4.10 Impact of Geopolitical Events on the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service

- 5.1.1 Full-Truckload (FTL)

- 5.1.2 Less-than-Truckload (LTL)

- 5.1.3 Others

- 5.2 By Equipment / Trailer Type

- 5.2.1 Dry Van

- 5.2.2 Refrigerated Van

- 5.2.3 Flatbed / Step-Deck

- 5.2.4 Tanker (Bulk Liquid & Chemical)

- 5.2.5 Others

- 5.3 By Haul Length

- 5.3.1 Long-Haul (More than 500 miles)

- 5.3.2 Regional (100-500 miles)

- 5.3.3 Local (Less than 100 miles)

- 5.4 By Business Model

- 5.4.1 Traditional Freight Brokerage

- 5.4.2 Asset-Based Freight Brokerage

- 5.4.3 Agent Model Freight Brokerage

- 5.4.4 Digital Freight Brokerage

- 5.5 By End-User Industry

- 5.5.1 Manufacturing & Automotive

- 5.5.2 Construction & Infrastructure Projects

- 5.5.3 Oil, Gas, Mining & Chemicals

- 5.5.4 Agriculture & Food / Beverage

- 5.5.5 Retail, FMCG & Wholesale Distribution

- 5.5.6 Healthcare & Pharmaceuticals

- 5.5.7 E-commerce & 3PL Fulfilment

- 5.5.8 Other End-User Industry

- 5.6 By Customer Size

- 5.6.1 Large Enterprise Shippers (More than $100 M Freight Spend)

- 5.6.2 Mid-Market Shippers ($10-100 M)

- 5.6.3 Small Businesses (Less than $10 M)

- 5.7 By Geography

- 5.7.1 Northeast

- 5.7.2 Midwest

- 5.7.3 Southeast

- 5.7.4 Southwest

- 5.7.5 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 6.4.1 C.H. Robinson Worldwide Inc.

- 6.4.2 Total Quality Logistics (TQL)

- 6.4.3 XPO Logistics Inc.

- 6.4.4 Echo Global Logistics

- 6.4.5 Worldwide Express

- 6.4.6 Coyote Logistics (UPS)

- 6.4.7 Landstar System Inc.

- 6.4.8 Schneider FreightPlus

- 6.4.9 GlobalTranz (WWEX)

- 6.4.10 J.B. Hunt 3600

- 6.4.11 Hub Group

- 6.4.12 Uber Freight

- 6.4.13 BNSF Logistics

- 6.4.14 SunteckTTS

- 6.4.15 Arrive Logistics

- 6.4.16 Nolan Transportation Group

- 6.4.17 Mode Global

- 6.4.18 Convoy Inc.

- 6.4.19 Red Technologies

- 6.4.20 ArcBest Corporation

- 6.4.21 Allen Lund Company

- 6.4.22 Redwood Logistics

- 6.4.23 BlueGrace Logistics

- 6.4.24 Trinity Logistics

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment