PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687778

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687778

GCC Warehousing And Distribution Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

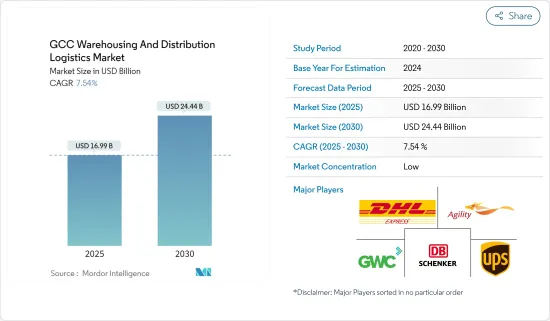

The GCC Warehousing And Distribution Logistics Market size is estimated at USD 16.99 billion in 2025, and is expected to reach USD 24.44 billion by 2030, at a CAGR of 7.54% during the forecast period (2025-2030).

Key Highlights

- There has been an increase in warehousing demand in GCC countries due to huge investments by the companies for their inventory storage and logistics market-driven by e-commerce. Technology advancement is also supporting market growth.

- The GCC's warehousing and distribution logistics market is estimated to witness substantial growth during the forecast period due to the increasing warehousing infrastructure and government and private investments to develop the region into a robust logistics hub with pro-business regulatory policies.

- The UAE is one of the fastest-growing countries in the GCC region, owing to the rising importance of Dubai in world trade and its strong economic outlook for the forecast period. Bahrain offers some of the lowest setups and operating costs for a logistics business, with cost savings of 30-40% compared to the rest of the GCC. This has encouraged several companies to invest in the country to set up businesses and access the GCC and the Arab world.

- According to industry sources, despite the COVID-19 pandemic-induced economic challenges, the Saudi warehousing sector maintained its winning streak in 2021 as e-commerce and megaprojects boosted demand for larger areas. The need for warehousing is predicted to grow in the next few years due to the growing population and planned big projects in line with Saudi Vision 2030.

- Riyadh, Jeddah-King Abdullah Economic City (KAEC), and Dammam-Al Khobar are the main hubs for the Kingdom's logistics and warehousing business, with a combined supply of 72 million square meters.

- The interest in time-tested warehouse automation systems that pick, pack, sort, and transport products across the facility is rising. To maximize the benefit of automation, end users are increasingly researching ways to incorporate this automation into warehouse software platforms like warehouse management and warehouse control systems (WCS).

GCC Warehousing and Distribution Logistics Market Trends

Increasing demand for warehousing demand in Kuwait driving the market

- The demand for warehousing in Kuwait is driven by several factors, including the growth of the retail sector, the growing need for cold storage, and the country's advantageous position as a logistics hub for goods transportation between Asia, Europe, and Africa.

- The warehousing market in Kuwait is expected to expand over the next few years as the economy of the country continues to grow and the logistics industry continues to develop. The growth of e-commerce is one of the main drivers of the warehousing business in Kuwait. As more and more Kuwaiti consumers shop online, the need for warehousing facilities to store and manage their products is growing. This is why specialized e-commerce fulfillment centers are available in the country.

- The warehousing management methods used in Kuwait's industry are anticipated to undergo a significant change. Companies intend to employ biodegradable materials, lessen packaging, and use energy-efficient technology. Agility, a Kuwait-based logistics company, has invested USD 18 million in green supply chain solutions through Agility Ventures, its corporate venture arm. Hyliion and TVP Solar are the two businesses that have benefited from this action.

- The logistics & warehousing market has a number of key challenges and opportunities that affect the functioning of the market. Infrastructure constraints, such as transport networks, ports, and warehousing, can lead to bottlenecks and inefficiencies. Complicated regulatory and customs processes can create obstacles and increase administrative burdens.

- A lack of skilled employees in the industry can affect the quality of service and operational effectiveness. Intensive competition from domestic & foreign players needs to differentiate and innovate. The economy is heavily reliant on the oil & gas sector, making it vulnerable to oil price fluctuations. Geo-political events in the region can disrupt supply chains and increase security risks.

E-commerce growth driving the market

The GCC e-commerce market is expanding with increasing competition, driven primarily by the UAE. Saudi Arabia is expected to remain the largest and fastest-growing e-commerce market in the region, with the consumer electronics and fashion categories witnessing the highest demand. The GCC region has a high spending potential in line with its high per capita income. Additionally, internet penetration and social media penetration are also among the best globally, meaning that the GCC is ready for strong growth in the e-commerce market.

According to industry reports, customers in Saudi Arabia are turning more frequently to their digital devices and are spending more time and money online. About 91% of Saudi customers currently shop online, according to the study. As the opportunity to buy an ever-wider choice of goods and services becomes increasingly fundamental to their everyday life, it is perhaps even more striking that a startling 14% of them say they shop online at least once each day.

E-commerce in Saudi Arabia has exploded as the country works toward Vision 2030, a comprehensive plan aimed at transforming the country into a knowledge-based economy. Online sales have surged by about 60% on an annual basis across all categories, with e-commerce holding the highest position for media products, clothes, and footwear.

GCC Warehousing and Distribution Logistics Industry Overview

The GCC warehousing and distribution logistics market is moderately fragmented and highly competitive, with major international and domestic players. The major players include DHL Group, Agility Logistics, GWC (Gulf Warehousing Company), DB Schenker Logistics, UPS, and many others. With a few players holding a significant share, the market has a detectable level of consolidation. With increasing competition from global service providers, logistics service providers need to focus on improving operational efficiency and optimizing the performance of assets to stay ahead of the competition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Market Definition

- 1.3 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Government Regulations in GCC Countries

- 4.3 Technological Developments in Warehousing

- 4.4 Insights into Warehousing Rents

- 4.5 Insights into General Warehousing

- 4.6 Insights into Dangerous Goods Warehousing

- 4.7 Insights into Refrigerated Warehousing

- 4.8 Insights into Effects of E-commerce Growth

- 4.9 Insights into Free Zones and Industrial Parks

- 4.10 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strategic Location

- 5.1.2 Economic diversification

- 5.2 Market Restraints

- 5.2.1 Infrastructure challenges

- 5.2.2 Skilled workforce

- 5.3 Market Opportunities

- 5.3.1 E-commerce Boom

- 5.3.2 Trade and logistics hub

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Country

- 6.1.1 Saudi Arabia

- 6.1.2 United Arab Emirates

- 6.1.3 Qatar

- 6.1.4 Kuwait

- 6.1.5 Oman

- 6.1.6 Bahrain

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DHL Group

- 7.2.2 Agility Logistics

- 7.2.3 GWC (Gulf Warehousing Company)

- 7.2.4 DB Schenker Logistics

- 7.2.5 UPS

- 7.2.6 Aramex Logistics

- 7.2.7 Ceva Logistics

- 7.2.8 Al-Futtaime Logistics

- 7.2.9 Global Shipping and Logistics

- 7.2.10 Integrated National Logistics

- 7.2.11 FedEx

- 7.2.12 Barq Express

- 7.2.13 TNS

- 7.2.14 GAC

- 7.2.15 LSC Logistics and Warehousing Co.

- 7.2.16 Kuehne + Nagel*

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators

- 9.2 External Trade Statistics - Exports And Imports, By Product

- 9.3 Insights into Key Export Destinations And Import Origin Countries