PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910537

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910537

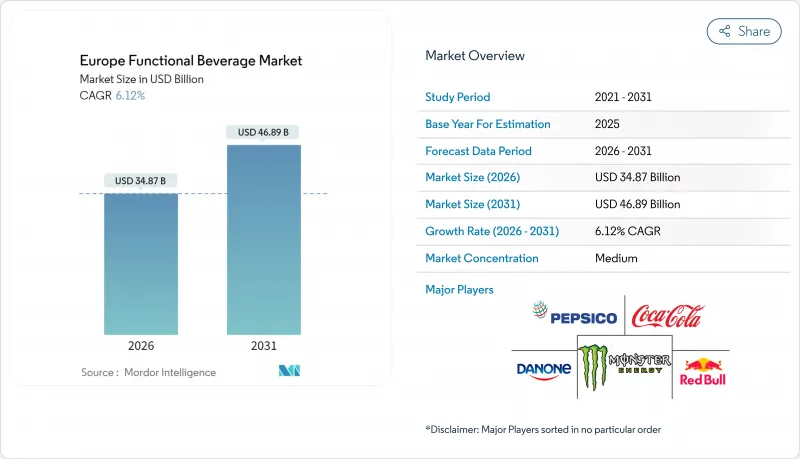

Europe Functional Beverage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European functional beverage market is expected to grow from USD 32.86 billion in 2025 to USD 34.87 billion in 2026 and is forecast to reach USD 46.89 billion by 2031 at 6.12% CAGR over 2026-2031.

This growth is fueled by rising consumer awareness about health and wellness, favorable regulations supporting the use of innovative ingredients, and the increasing popularity of online retail platforms. Among product types, energy drinks currently dominate the market, while sports hydration beverages are experiencing notable growth due to their appeal among fitness enthusiasts. In terms of functionality, immunity-boosting beverages remain the most sought-after, but there is a growing demand for products that support digestive health. When it comes to packaging, PET bottles are the most commonly used, although there is mounting pressure to shift toward more environmentally friendly options. Online distribution channels are gaining traction, offering convenience and personalized shopping experiences, which help build customer loyalty. The European functional beverage market is moderately concentrated, with major players such as PepsiCo, Coca-Cola, Red Bull, Danone, and Monster Beverage Corp. leading the competition.

Europe Functional Beverage Market Trends and Insights

Increasing consumer focus on health and wellness

European consumers are increasingly focusing on maintaining their health and wellness, which is driving the growth of the functional beverages market. According to the World Population Review, Italy is projected to be the healthiest country in Europe in 2025, with a health index score of 95.1 in 2024, followed by the Netherlands at 92.8. This growing health awareness is pushing consumers to look for beverages that provide specific benefits, such as boosting immunity, improving digestion, and enhancing mental focus. In response, beverage companies are developing new formulations and adjusting their marketing strategies to highlight long-term health benefits rather than just short-term effects. Younger generations are not only prioritizing health but also showing a strong preference for sustainable and eco-friendly products. This dual focus on health and sustainability is expected to support the continued growth of the functional beverage market in Europe, making it a promising sector for innovation and investment.

Growing awareness of gut health and microbiome

Awareness of gut health and the importance of the microbiome is becoming a major factor driving the European functional beverage market. According to Precision Biotics UK, as of September 2023, over half of Europeans (58%) reported experiencing gut health issues, with 45% of these cases being chronic and lasting more than 3 months. This rising concern has led to increased demand for beverages that support digestive health, such as probiotic and prebiotic drinks, including fermented beverages, yogurt-based drinks, and fiber-enriched options. To meet this demand, brands are focusing on creating scientifically backed products, offering clear and transparent labeling, and using marketing strategies that highlight the benefits of these beverages. By addressing the needs of consumers across different age groups, gut-health-focused drinks are becoming one of the fastest-growing segments in the functional beverage market.

Stringent regulatory and labeling requirements

Strict regulatory and labeling requirements pose challenges for the European functional beverage market, potentially slowing down innovation and product launches. For instance, completing Novel Foods dossiers can take over a year, delaying the introduction of new and innovative ingredients. The European Food Safety Authority (EFSA) has strict rules regarding the use of terms like "probiotic," requiring brands to describe benefits indirectly. This makes it harder for companies to educate consumers effectively. Regulations also vary across countries; for example, Germany allows the use of probiotic terminology on supplements, while France continues to restrict its use on food products. Furthermore, the updated European Food Safety Authority (EFSA) guidance for 2025 introduces stricter requirements for allergenicity and compositional data, adding more complexity to the approval process. These regulations are designed to ensure that claims are backed by science and to protect public health.

Other drivers and restraints analyzed in the detailed report include:

- Demand for clean label and natural ingredients

- Sustainability and ethical sourcing focus

- Taste and consumer palatability challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy drinks led the European functional beverage market in 2025, holding 48.90% of the market share. Their popularity comes from being widely available in various retail outlets like convenience stores, supermarkets. These drinks appeal to a wide range of consumers, including busy professionals, students, and young adults looking for quick energy boosts. Strong branding, new flavors, and targeted advertising have further solidified their dominance. The combination of easy access, convenience, and functional benefits has made energy drinks a key part of the European functional beverage market.

Sports drinks are the fastest-growing segment in the European functional beverage market, expected to grow at a CAGR of 8.12% through 2031. This growth is driven by a wide range of consumers, including casual athletes, esports players, and workers looking for hydration and performance support. New formulations, such as low-sugar options and blends with added vitamins and minerals, are attracting health-conscious buyers. Marketing efforts focusing on recovery, endurance, and mental alertness are also connecting with younger, active consumers. As more people become aware of hydration and performance needs, sports drinks are expected to play a bigger role in market growth.

Immune-support beverages were the leading segment in the European functional beverage market in 2025, contributing 47.92% of the total revenue. Their strong performance is due to consumers continuing to prioritize their health and immunity, especially to prevent common illnesses like colds and flu. These beverages are packed with ingredients such as vitamin C, zinc, and botanicals, which are widely recognized for their immune-boosting properties. Their availability in convenient formats, both in physical stores and online platforms, along with effective marketing campaigns, has made them a staple in the daily routines of many European consumers.

Digestive health beverages are the fastest-growing segment, expected to grow at a 8.55% CAGR through 2031. This rapid growth is fueled by increasing awareness of the importance of gut health and its connection to overall well-being. These beverages include products like probiotics, prebiotics, fermented drinks, and fiber-enriched options, which help improve digestion and support a healthy gut microbiome. Companies are also working to ensure that the health benefits of these products are clearly communicated to consumers while adhering to European regulatory standards. As more people seek long-term solutions for digestive health, this segment is emerging as a key driver of growth in the functional beverage market.

The Europe Functional Beverage Market is Segmented by Product Type (Energy Drinks, Sports Drinks, and More), Functionality (Digestive Health, Immune Support, and More), Packaging Type (PET/Glass Bottles, Cans, and More), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography (United Kingdom, Germany, France, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PepsiCo Inc.

- Red Bull GmbH

- The Coca-Cola Company

- Danone SA

- Monster Beverage Corp.

- Keurig Dr Pepper Inc.

- Nestle SA

- Suntory Holdings Limited

- Punchy Drinks Limited

- Celsius Holdings Inc.

- Yakult Honsha Co. Ltd.

- The Healthy Protein Co. Ltd

- Purity Soft Drinks Ltd

- Ocean Spray Cranberries Inc.

- Eko-Vit Sp. z o.o.

- DC Holdings Ltd.

- Glanbia plc

- Unilever plc

- Vitamin Well AB's

- Replenish+ Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing consumer focus on health and wellness

- 4.2.2 Demand for clean label and natural ingredients

- 4.2.3 Growing awareness of gut health and microbiome

- 4.2.4 Innovation in ingredients and formulations

- 4.2.5 Sustainability and ethical sourcing focus

- 4.2.6 Personalization and targeted functional benefits

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory and labeling requirements

- 4.3.2 Packaging and sustainability shallenges

- 4.3.3 Taste and consumer palatability challenges

- 4.3.4 High production and ingredient costs

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Energy Drinks

- 5.1.2 Sports Drinks

- 5.1.3 Fortified Juice

- 5.1.4 Dairy and Dairy-Alternative Drinks

- 5.1.5 Functional/Fortified Water

- 5.1.6 Other Product Types

- 5.2 By Functionality

- 5.2.1 Digestive Health

- 5.2.2 Immune Support

- 5.2.3 Bone and Joint Health

- 5.2.4 Other Functionalities

- 5.3 By Packaging Type

- 5.3.1 PET/Glass Bottles

- 5.3.2 Cans

- 5.3.3 Tetra Paks

- 5.3.4 Others

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Specialty Stores

- 5.4.4 Online Retail Stores

- 5.4.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Poland

- 5.5.9 Switzerland

- 5.5.10 Russia

- 5.5.11 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 PepsiCo Inc.

- 6.4.2 Red Bull GmbH

- 6.4.3 The Coca-Cola Company

- 6.4.4 Danone SA

- 6.4.5 Monster Beverage Corp.

- 6.4.6 Keurig Dr Pepper Inc.

- 6.4.7 Nestle SA

- 6.4.8 Suntory Holdings Limited

- 6.4.9 Punchy Drinks Limited

- 6.4.10 Celsius Holdings Inc.

- 6.4.11 Yakult Honsha Co. Ltd.

- 6.4.12 The Healthy Protein Co. Ltd

- 6.4.13 Purity Soft Drinks Ltd

- 6.4.14 Ocean Spray Cranberries Inc.

- 6.4.15 Eko-Vit Sp. z o.o.

- 6.4.16 DC Holdings Ltd.

- 6.4.17 Glanbia plc

- 6.4.18 Unilever plc

- 6.4.19 Vitamin Well AB's

- 6.4.20 Replenish+ Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK