PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687739

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687739

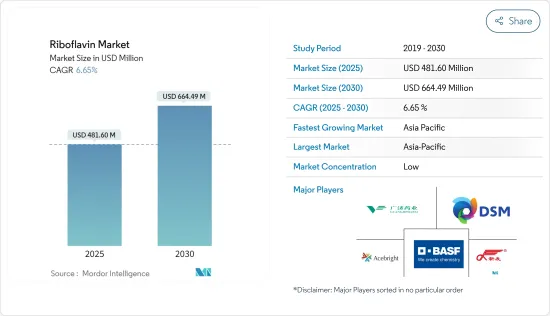

Riboflavin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Riboflavin Market size is estimated at USD 481.60 million in 2025, and is expected to reach USD 664.49 million by 2030, at a CAGR of 6.65% during the forecast period (2025-2030).

It is expected that the riboflavin market will continue to grow due to an increase in the global consumption of fortified foods and beverages. According to the Food Fortification Initiative, it is estimated that close to 31% of the industrially milled wheat flour in the world is fortified. There are primarily iron, zinc, folic acid, riboflavin, niacin, thiamin, vitamin B12, and vitamin B6 added to foods and beverages. Furthermore, riboflavin is expected to grow in popularity because of its broad application and multi-functionality. Riboflavin/vitamin B2 has diverse applications in many fields, including food processing, pharmaceuticals, and animal feeding, which is further fostering the demand in the market.

The riboflavin market is driven by the increased demand for riboflavin-infused supplements, owing to its multi-utility, which makes it extremely useful in all sectors of the market across the world. The growing use of natural colorants in the packed food industry and the dietary supplements industry is driving the demand for riboflavin in the global market. The prevalence of vitamin deficiency in typical Western diets is higher, especially in senior adults. Milk and milk products fortified with Vitamin B2 are critical in the North American fortified foods market and are likely to fuel the overall need.

Riboflavin Market Trends

Increasing Demand for Functional and Fortified Food

- In the past, food fortification has been used to prevent micronutrient malnutrition. But today, food fortification is used to improve health and wellness. By increasing baked food's better-for-you attributes, fortification provides avenues for manufacturers to add value to their product categories.

- For instance, according to the Food Fortification Initiative (FFI), a global organization that supports the fortification of industrially milled flour, maize flour, and rice, approximately 31% of the world's industrially milled wheat flour is fortified. The FFI works with country leaders to promote, plan, implement, and monitor the fortification process to improve the nutritional quality of these staple foods.

- Various government initiatives are being taken to increase the consumption of fortified food and beverages, especially in developing countries. Similarly, the Food and Agricultural Organization (FAO) and World Health Organization (WHO) have identified food fortification as one of the strategies to reduce the prevalence of malnutrition, particularly in underdeveloped and developed countries.

- The nutrients most often included are iron, zinc, and the following B vitamins, namely folic acid, niacin, riboflavin, thiamin, vitamin B12, and vitamin B6. Thus, with the increasing consumer demand for fortified food and beverages with bioactive and essential vitamins, followed by increasing consumer awareness regarding vitamin B2/riboflavin deficiency, the manufacturers are actively expanding their product offerings with the fortification of riboflavin to meet the ongoing consumer demand.

- In October 2022, Fonterra expanded its product portfolio with the launch of BioKodeLab, a supplement brand aimed at improving cognitive performance. According to the company, the product consists of vitamin A, riboflavin, lutein, and zeaxanthin to support macular health.

- .

Asia-Pacific to Drive the Global Market For Riboflavin

- Asia-Pacific holds the dominant position in the riboflavin market, driven by factors such as rapid urbanization, industrialization, ongoing product development, and technological advancements in the region. Moreover, increasing health awareness among people, the rise in per-capita income, and a wide range of applications have been further augmenting the market growth.

- For instance, according to World Bank, gross domestic product (GDP) per capita in Singapore, Australia, and Japan was USD 72,794, 59,594, and 39,285, respectively, in 2021. Some of the popular riboflavin sources in the region encompass meat, eggs, salmon, and dairy products.

- However, with the growing consumer preferences toward veganism/vegetarianism across the region, there has been rising pressure on the food ingredients manufacturers, like BASF SE, MTC Industries Inc., and DSM, to invest in research and development and introduce plant-based riboflavin ingredients for multiple industrial applications such as food and beverages, personal care products, nutraceuticals, pharmaceuticals, and animal feed.

- As cereals are inexpensive and consumed in large quantities in the country for producing multiple food products like porridge, breakfast cereals, raised bread, flatbread, biscuits, cereal-based beverages, and seedling juices, attempts are being made to enrich these cereal grains and flour with vitamins B1, B2, B3, and B9 using fortification and biofortification, as recommended by the Food & Drug Administration (FDA).

- Additionally, riboflavin deficiency is a problem in many parts of Asia and the Pacific, especially in South and Southeast Asia. In response, governments and health organizations have launched fortification programs to increase the nutritious density of commonly consumed foods like rice, flour, and oil by adding vitamins and minerals like riboflavin. Fortification initiatives are driving riboflavin demand in the region.

Riboflavin Industry Overview

The global riboflavin market is concentrated in nature due to many regional and domestic players. Importance is given to partnerships, expansions, product innovations, and mergers and acquisitions as leading companies adopt strategic approaches to boost their brand presence among consumers.

Consumers in the market are increasingly becoming health conscious and looking for health supplements. This factor strategically makes companies innovate and expand their existing product portfolios, thereby making the market more conducive to further development to gain more revenue.

Some major players in the market studied include BASF SE, Hubei Guangji Pharmaceutical Co. Ltd, Xinfa Pharmaceutical Co. Ltd, Koninklijke DSM NV, and Shanghai Acebright Pharmaceuticals Group Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Functional and Fortified Food

- 4.1.2 Multi-functionality and Wide Application of Riboflavin

- 4.2 Restraints

- 4.2.1 Low Stability of Riboflavin on Exposure to Light and Heat

- 4.3 Industry Attractiveness-Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Form

- 5.1.1 Powder

- 5.1.2 Liquid

- 5.2 Application

- 5.2.1 Food and Beverages

- 5.2.2 Dietary Suppplements

- 5.2.3 Pharmaceuticals

- 5.2.4 Animal Feed

- 5.2.5 Personal Care

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Koninklijke DSM NV

- 6.3.3 Shanghai Acebright Pharmaceuticals Group Co. Ltd

- 6.3.4 Xinfa Pharmaceutical Co. Ltd

- 6.3.5 Hubei Guangji Pharmaceutical Co. Ltd

- 6.3.6 N.B Group Co. Ltd

- 6.3.7 Shanghai Hegno Pharmaceutical Holding Co., Ltd

- 6.3.8 Legend Industries

- 6.3.9 Parchem Fine & Specialty Chemicals

- 6.3.10 Hebei Shengxue dacheng Pharmaceutical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS