Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687732

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687732

Commercial Aircraft Cabin Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 182 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

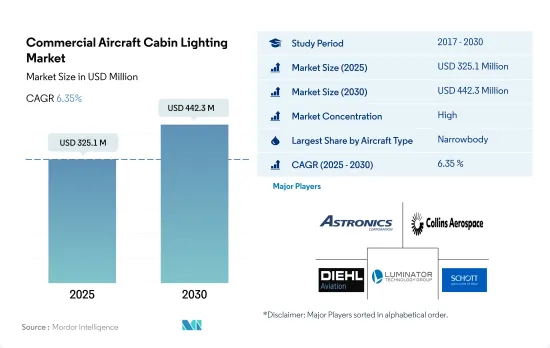

The Commercial Aircraft Cabin Lighting Market size is estimated at 325.1 million USD in 2025, and is expected to reach 442.3 million USD by 2030, growing at a CAGR of 6.35% during the forecast period (2025-2030).

As the number of air travelers continues to grow, airlines will continue to invest in cabin lighting to improve the passenger experience.

- The global commercial aircraft cabin interior market is expected to grow at a significant rate in the coming years, driven by the increasing demand for luxury travel among affluent customers. Luxury travel is associated with higher customer satisfaction, loyalty, and willingness to pay.

- The narrowbody aircraft segment dominated the number of deliveries, with 83% of the overall deliveries during 2017-2022. The procurement of new aircraft was affected due to delays by airline companies in adding new aircraft to their fleets. Additionally, the airlines in the region are moving toward advanced LED lighting as it helps the airlines eliminate various drawbacks of the existing interior cabin lights in terms of efficiency, reliability, durability, and weight. The widespread adoption of LED ambient lighting technology has enabled cabin modernization activities to maintain a consistent service quality on board.

- With the increasing number of air passengers, airlines are expected to invest in aircraft cabin lighting to enhance the passenger experience. They are equipping their newer aircraft with LED lights instead of incandescent lights, as they can illuminate the entire cabin and give the same effect as mood lighting.

- The fleet expansion plans of airlines to cater to the growing passenger traffic are expected to boost the demand for cabin lighting. For instance, in 2022, Latin American airline LATAM placed an order for 17 Airbus A321neo medium-range jets. The A321neo is the longest fuselage aircraft in the Airbus A320 family and can accommodate 180-220 passengers in a typical two-class interior. Around 13,358 aircraft are expected to be delivered between 2023 and 2030.

Asia-Pacific is anticipated to be the most lucrative market during the forecast period

- Customer experience is always a top priority for airlines. Airlines ensure a positive travel experience for their passengers. Thus, they focus on providing new, innovative products (such as mood lighting) that play an important role in defining the complete passenger experience during their travel. The increasing air passenger traffic is generating the demand for cabin lighting and driving new aircraft procurements and orders.

- Significant aircraft orders placed by numerous airlines are also driving demand for aircraft cabin lighting. United Airlines announced an order for 270 narrowbody aircraft, with deliveries beginning in 2023, all of which are equipped with LED mood lighting. In July 2022, Delta Air Lines placed orders for 100 Boeing 737s, which would feature LED lighting. In September 2021, Lufthansa announced that Human Centric Lighting, a specially programmed, flexible lighting system, was installed on its new Airbus A320neo fleet to enhance the travel experience for passengers.

- Similarly, in April 2022, Etihad Airways announced its plans to install LED mood lighting in its 15 new A350-1000 aircraft to improve the guest experience and reduce jetlag. Likewise, in April 2022, Qatar Airways announced that it installed touch points with programmable LED mood lighting in its fleet of 48 new B777X aircraft to optimize the cabin environment according to flight phases.

- Around 13,812 aircraft are expected to be delivered between 2023 and 2030. The fleet expansion plans of various global airlines are expected to aid the procurement of passenger aircraft and, thus, drive the growth of the commercial aircraft cabin lighting market, increasing by 442 million by 2030 compared to 216 million in 2022.

Global Commercial Aircraft Cabin Lighting Market Trends

The aviation industry's growth is fueled by the recovery of air travel and the high volume of aircraft orders placed by various airlines

- Boeing was impacted by the ongoing political tensions between China and the United States, and it plans to remarket certain 737MAX jets earmarked for Chinese customers. Boeing is facing a challenging situation as Chinese airlines are no longer ordering its jets. The Boeing delivery center in Zhoushan, China, is ready and expected to resume delivery of 737MAX aircraft. The Zhoushan plant can accommodate 100 aircraft annually.

- Airbus accumulated 1,044 net new orders (1,080 gross orders), compared to 259 net new orders (442 gross orders) in the first half of 2022. In 2022, Airbus booked 820 net new orders (1,078 gross orders), surpassing both gross orders and net new orders in 2021. In 2022, Airbus won the orders crown for the fourth consecutive year by a fairly slim margin of 46 aircraft compared to Boeing. In 2021, Airbus booked a total of 771 gross orders and received 264 cancellations, for a total of 507 net new orders. In June 2023, Airbus booked orders for a whopping 902 aircraft for 12 different customers and reported two A321neo cancellations, for a total of 900 net new orders.

- Boeing accumulated 415 net new orders (527 gross orders), compared to 186 net new orders (286 gross orders) in the first six months of the previous year. In 2022, Boeing booked 774 net new orders (935 gross orders), up from 479 net new orders (909 gross orders) in 2021. As of June 2023, Boeing booked orders from nine customers for a total of 304 jets (gross orders). However, the company also reported 16 777X cancellations, resulting in 288 net new orders.

An increase in international passenger traffic post the COVID-19 pandemic is driving market demand

- As cross-border travel was progressively restored in 2022 post the COVID-19 pandemic, the carriers in Asia-Pacific raced to increase their flights to meet runaway demand, stimulated by people's desire to travel and cash in on savings accumulated in the two years of isolation. As a result, in 2022, the air passenger traffic in the region recovered more rapidly from the pandemic than in the other regions. For instance, in 2022, air passenger traffic in the whole of Asia-Pacific was recorded at 1.9 billion, a growth of 6% compared to 2021 and 151% compared to 2020. Airline companies in the region are implementing fleet expansion plans to cater to the growing air passenger traffic in the major countries. China, India, Japan, and Indonesia accounted for 70% of the total air passenger traffic in the region, generating higher demand for new aircraft compared to other Asia-Pacific countries.

- Airlines in Asia-Pacific also witnessed a good recovery in international air passenger markets as travel demand continued to fuel growth despite increasingly challenging global economic conditions. For instance, in August 2022, the region recorded 13.1 million international air passenger traffic, an 836% increase compared to August 2021, when it was recorded at 1.4 million. The healthy growth in international passenger traffic in the first eight months of the year showed strong travel demand from business and leisure consumers. The rapid increase in air passenger traffic in the region is expected to drive the air transport industry in the future.

Commercial Aircraft Cabin Lighting Industry Overview

The Commercial Aircraft Cabin Lighting Market is fairly consolidated, with the top five companies occupying 83.55%. The major players in this market are Astronics Corporation, Collins Aerospace, Diehl Aerospace GmbH, Luminator Technology Group and SCHOTT Technical Glass Solutions GmbH (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 64736

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.1.1 Asia-Pacific

- 4.1.2 Europe

- 4.1.3 Middle East

- 4.1.4 North America

- 4.2 New Aircraft Deliveries

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 GDP Per Capita (current Price)

- 4.3.1 Asia-Pacific

- 4.3.2 Europe

- 4.3.3 Middle East

- 4.3.4 North America

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.1.1 By Country

- 5.2.1.1.1 China

- 5.2.1.1.2 India

- 5.2.1.1.3 Indonesia

- 5.2.1.1.4 Japan

- 5.2.1.1.5 Singapore

- 5.2.1.1.6 South Korea

- 5.2.1.1.7 Rest of Asia-Pacific

- 5.2.2 Europe

- 5.2.2.1 By Country

- 5.2.2.1.1 France

- 5.2.2.1.2 Germany

- 5.2.2.1.3 Spain

- 5.2.2.1.4 Turkey

- 5.2.2.1.5 United Kingdom

- 5.2.2.1.6 Rest of Europe

- 5.2.3 Middle East

- 5.2.3.1 By Country

- 5.2.3.1.1 Saudi Arabia

- 5.2.3.1.2 United Arab Emirates

- 5.2.3.1.3 Rest of Middle East

- 5.2.4 North America

- 5.2.4.1 By Country

- 5.2.4.1.1 Canada

- 5.2.4.1.2 United States

- 5.2.4.1.3 Rest of North America

- 5.2.5 Rest of World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Astronics Corporation

- 6.4.2 Collins Aerospace

- 6.4.3 Diehl Aerospace GmbH

- 6.4.4 Luminator Technology Group

- 6.4.5 Safran

- 6.4.6 SCHOTT Technical Glass Solutions GmbH

- 6.4.7 STG Aerospace

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.