PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850945

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850945

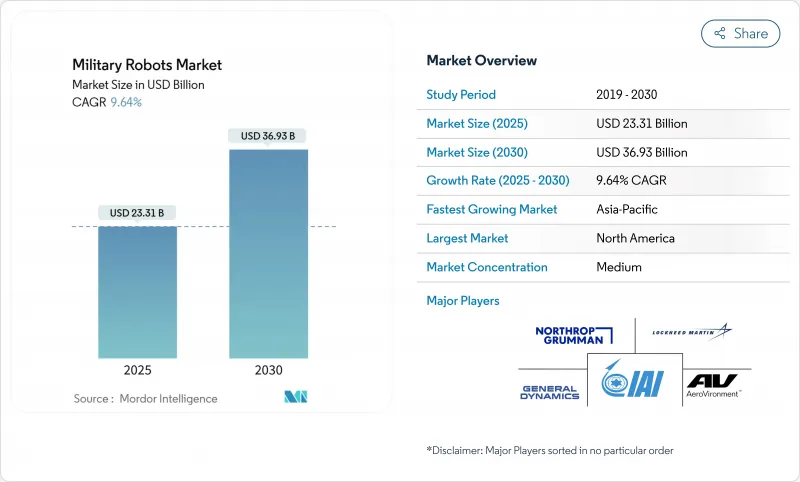

Military Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The military robots market size stands at USD 23.31 billion in 2025 and is forecast to reach USD 36.93 billion by 2030, expanding at a 9.64% CAGR.

Growth is powered by surging adoption of autonomous and semi-autonomous systems across air, land, and sea, reflecting lessons from the Ukraine conflict, shifting NATO and AUKUS doctrines, and rapid edge-AI innovation. Budget reallocations from traditional crewed platforms toward swarming drones and uncrewed ground vehicles (UGVs) are broadening demand. At the same time, advances in secure communications and ruggedized processors enable reliable operations in jammed environments. The Pentagon's Replicator program is accelerating mass production of expendable systems that overwhelm adversaries by volume rather than unit sophistication. China's civil-military fusion policies are triggering a regional response that lifts procurement across Asia-Pacific. At the same time, tightening European export rules on lethal autonomy and persistent battery-density limits in desert operations act as counterweights but have yet to derail the overall upward trajectory of the military robots market.

Global Military Robots Market Trends and Insights

Accelerated NATO and AUKUS Battlefield-Digitisation Programs

Sustained increases in allied defense budgets are earmarked for network-ready unmanned platforms, with every US Army division slated to field drones by 2026 and AUKUS partners harmonizing command architectures to enable plug-and-fight interoperability. Larger primes are standardizing open controllers so multiple robots can share data links, shortening integration cycles and favoring vendors that provide software-defined radios hardened against jamming. Europe's annual defense spending now grows 6.1%, reinforcing a procurement pivot from legacy crewed assets to agile, mission-specific robots that fit within digitised formations. Collectively, these dynamics add fresh order visibility that underpins the military robots market through the end of the decade.

Ukraine-War Demand for Attritable Land-Drone Swarms

The March 2025 fully robotic assault in Donetsk proved that low-cost UGV-and-FPV combinations can neutralise heavier armour, prompting NATO front-line armies to re-engineer manoeuvre brigades around massed expendable platforms. Capital flows to start-ups able to deliver thousands of simple robots at pace, and framework contracts increasingly specify cost ceilings that assume planned loss rates. As a result, the military robots market sees rising volumes even where unit margins compress, rewarding scale players that can automate final assembly and test.

Geneva-Convention Concerns Delaying Lethal-Autonomy Exports

The UN Resolution 78/241 and the ICRC's call for binding rules add compliance layers that slow European export licences, increase documentation costs, and lengthen development cycles for AI-enabled lethal payloads. While this spurs innovation in "human-on-the-loop" safeguards, it shifts some near-term orders to regions with fewer constraints, fragmenting certified demand and tempering growth momentum within the military robots market.

Other drivers and restraints analyzed in the detailed report include:

- The US DoD "Replicator" USD 1 billion Initiative

- Edge-AI Breakthroughs for Compliant Target Recognition

- EW-Jamming Vulnerabilities of Commercial Links

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Airborne robots generated 46.58% of the military robots market revenue in 2024. Yet, land platforms expand at a 13.49% CAGR as battle-tested UGVs prove indispensable for breaching, casualty evacuation, and sensor-relay missions. Large quadrotors such as the Ghost X still provide the reach and height essential for brigade ISR, but demand for attritable ground swarms that can absorb heavy losses is rising sharply. Ukraine's USD 250,000 drone-carrying USVs underscore cross-domain innovation that pulls naval operators into the military robots market.

Land-robot growth is further propelled by cheaper drivetrains, lighter composite armour, and AI stacks that enable obstacle negotiation without GPS. Air platforms respond by adding multi-payload bays and electronic-attack pods to stay relevant. Although a small slice, Marine robots receive targeted spending from GCC navies focused on oil-terminal defense. The interplay across domains broadens supplier opportunities and brings fresh entrants into the military robots market.

Human-operated robots held 56.50% of the military robots market share in 2024 because policy still requires human confirmation for lethal action. Fully autonomous modes, however, advance at 12.84% CAGR thanks to onboard neural-network accelerators that classify threats within milliseconds. Programs such as CJADC2 integrate time-sensitive networking so commanders can retask fleets from a single console without latency, representing evolutionary rather than revolutionary change.

Semi-autonomy remains the workhorse because it splits cognitive load: operators define mission goals while autonomy manages route-planning and obstacle avoidance. Overland AI's Ultra vehicle, one soldier can control alongside multiple sister units, illustrates how duty-cycled oversight eases workforce demands. As doctrinal trust grows, the military robots market will likely see autonomously initiated engagement options bounded by predefined rulesets.

The Military Robots Market Report is Segmented by Platform (Land, and More), Mode of Operation (Human Operated, and More), Application (Intelligence, Surveillance and Reconnaissance (ISR), and More), Payload (EO/IR Sensor Suites, and More), Weight Class (Nano/Micro, and More), Mobility (Tracked Platforms, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remains the largest spender, anchored by USD 1 billion in Replicator funding and mandated drone deployment across all US Army divisions by 2026. Canada's NORAD upgrade complements these efforts by fielding autonomous Arctic surveillance towers resilient to polar conditions. A mature supplier base spanning primes and start-ups sustains technology leadership, ensuring continued dominance of the military robots market in the region.

Asia-Pacific is the fastest-growing segment as China's civil-military fusion subsidies accelerate domestic scale-out and spur responses from India, South Korea, and Japan. Beijing's push for humanoid robots and mass-swarms shifts regional procurement toward cheap, numerous systems, while Seoul's Hanwha Aerospace rolls out armed UGVs optimised for DMZ patrols. Maritime disputes in the South China Sea trigger parallel investment in USVs and seabed-monitoring crawlers.

Europe's defense budgets grow 6.1% annually through 2035, driven by the lessons of the Ukraine war that validate attributable drones and ground swarms. France's DROIDE framework and Germany's new Bundeswehr robotics plan reflect the urgency of reinforcing NATO's eastern flank. Export-licence scrutiny over lethal autonomy tempers shipment speed yet channels R&D funds into "human-in-the-loop" safeguards, differentiating European contributions to the military robots market.

The Middle East focuses on spending on naval USVs to guard oil terminals. Israel's operational deployment of RobDozer and robotic M113 variants proves reliability in austere desert theatres. At the same time, the UAE's EDGE Group builds indigenous boats and ground-robot capacity that is aligned with Vision 2030's localisation goals. Saudi Arabia's joint ventures on autonomous patrol craft further expand a niche but lucrative slice of the military robots market.

South America invests selectively; Brazil's USD 23.7 billion 2025 defense budget allocates funds for networked artillery and surveillance drones to police vast borders and Amazonia. Economic constraints limit volume, yet region-specific needs for anti-narcotics monitoring and disaster relief open opportunities for rugged, cost-efficient robots tailored to jungle conditions.

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- General Dynamics Corporation

- AeroVironment, Inc.

- Teledyne Technologies Incorporated

- QinetiQ Group plc

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Thales Group

- BAE Systems plc

- Saab AB

- Textron Inc.

- Boston Dynamics, Inc.

- Rheinmetall AG

- Milrem AS

- Anduril Industries, Inc.

- Ghost Robotics Corporation

- HYUNDAI MOTOR GROUP

- Hanwha Corporation

- EDGE Group PJSC

- Shield AI

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated NATO and AUKUS battlefield-digitization programs

- 4.2.2 Ukraine-war-driven demand for attritable land-drone swarms

- 4.2.3 US DoD "Replicator" USD 1 Bn initiative for expendable autonomous systems

- 4.2.4 Edge-AI breakthroughs enabling compliant autonomous target recognition

- 4.2.5 Oil-infrastructure protection spurring naval USV adoption

- 4.2.6 China's civil-military fusion subsidies

- 4.3 Market Restraints

- 4.3.1 Geneva-Convention concerns delaying lethal-autonomy export clearances

- 4.3.2 EW-jamming vulnerabilities of COTS comm-links

- 4.3.3 Battery energy-density limits constraining desert-operations

- 4.3.4 US export-control curbs on rad-hardened AI chips

- 4.4 Value Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Platform

- 5.1.1 Land

- 5.1.2 Airborne

- 5.1.3 Marine

- 5.2 By Mode of Operation

- 5.2.1 Human Operated

- 5.2.2 Semi-Autonomous

- 5.2.3 Fully Autonomous

- 5.3 By Application

- 5.3.1 Intelligence, Surveillance, and Reconnaissance (ISR)

- 5.3.2 Combat Support/Strike

- 5.3.3 Logistics and EOD

- 5.3.4 Search and Rescue

- 5.3.5 Fire-fighting and CBRN response

- 5.4 By Payload

- 5.4.1 EO/IR Sensor Suites

- 5.4.2 Radar and Lidar Modules

- 5.4.3 Electronic-Warfare Pods

- 5.4.4 Lethal Weapon Stations

- 5.4.5 Non-lethal Systems (Tasers, Nets)

- 5.5 By Weight Class

- 5.5.1 Nano/Micro ( less than 10 kg)

- 5.5.2 Small (10-200 kg)

- 5.5.3 Medium (200-2,000 kg)

- 5.5.4 Heavy (more than 2,000 kg)

- 5.6 By Mobility

- 5.6.1 Tracked Platforms

- 5.6.2 Wheeled Platforms

- 5.6.3 Legged/Bionic Platforms

- 5.6.4 Hybrid (Tracked-Wheeled)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 France

- 5.7.3.3 Germany

- 5.7.3.4 Italy

- 5.7.3.5 Russia

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Israel

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Northrop Grumman Corporation

- 6.4.2 Lockheed Martin Corporation

- 6.4.3 General Dynamics Corporation

- 6.4.4 AeroVironment, Inc.

- 6.4.5 Teledyne Technologies Incorporated

- 6.4.6 QinetiQ Group plc

- 6.4.7 Elbit Systems Ltd.

- 6.4.8 Israel Aerospace Industries Ltd.

- 6.4.9 Thales Group

- 6.4.10 BAE Systems plc

- 6.4.11 Saab AB

- 6.4.12 Textron Inc.

- 6.4.13 Boston Dynamics, Inc.

- 6.4.14 Rheinmetall AG

- 6.4.15 Milrem AS

- 6.4.16 Anduril Industries, Inc.

- 6.4.17 Ghost Robotics Corporation

- 6.4.18 HYUNDAI MOTOR GROUP

- 6.4.19 Hanwha Corporation

- 6.4.20 EDGE Group PJSC

- 6.4.21 Shield AI

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment