Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687424

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687424

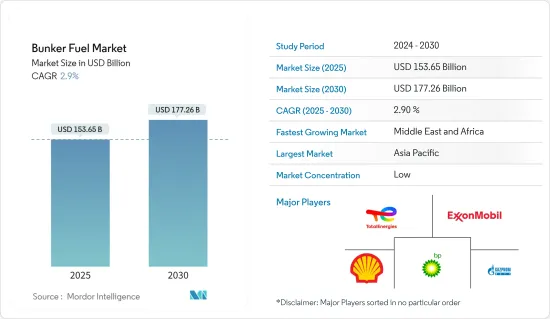

Bunker Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 180 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Bunker Fuel Market size is estimated at USD 153.65 billion in 2025, and is expected to reach USD 177.26 billion by 2030, at a CAGR of 2.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing LNG trade is expected to boost the demand for bunker fuel. LNG is majorly traded for the power sector in industrial, commercial, and residential segments. Countries with high coal dependencies, such as China and India, are gradually moving toward cleaner energy by increasing the import volume of natural gas from the Middle East and a few other nations, like Russia, Australia, and Nigeria.

- On the other hand, environmental concerns and the strict regulations related to emissions from the maritime industry are anticipated to limit the usage of heavy bunker fuels, especially high sulfur fuel oil, during the forecast period.

- Nevertheless, with the improved economic performance of developing countries across regions such as Asia-Pacific and Middle East and Africa, the demand for marine transportation and the number of ships in operation are expected to increase, offering significant growth opportunities for players in the bunker fuels market over the coming years.

- Asia-Pacific is expected to dominate the market during the forecast period, with the majority of the demand being generated from countries like China and India.

Bunker Fuel Market Trends

LNG Likely to Witness Significant Market Growth as a Bunker Fuel

- The global LNG bunkering market has evolved over the past decade, driven by the increase in global LNG usage amid growing demand for clean energy due to its ability to reduce greenhouse gas emissions.

- The conversion of the current operating vessels into LNG-based vessels is highly expensive. Hence, it is not economically viable. However, the operational cost of LNG-based vessels is expected to be the lowest among all the fuel alternatives once the new emission regulations become applicable. Further, a gradual shift to LNG for propulsion is more advantageous than the traditional methods of fueling ships with heavy fuel oil, marine gas oil, marine diesel oil, etc. LNG-based propulsion reduces the carbon footprint significantly and increases a ship's operational efficiency.

- With demand for LNG as a fuel expected to rise to 30 million tonnes by 2030, Europe, Asia, and North America are adding LNG bunkering vessels to keep pace with the swelling gas-powered fleet. These larger capacity LNG bunker vessels (LNGBVs) on order at shipyards are designed to load at major LNG terminals and refuel gas-powered ocean-going tonnage.

- As of February 2024, there were 48 LNG active bunkering vessels, 11 more than in 2022. Out of the total fleet, nearly half operate in Europe, while the rest operate in Asia and North America. By the end of 2024, the number of LNG bunkering vessel fleets is likely to reach 55 units, with a total added capacity of 67,900 cm in 2024 alone.

- Shipowners, particularly those operating in the European or American Sea, now prefer LNG-based vessels over conventional vessels. Furthermore, LNG-fueled ships have not penetrated the market for bulk carriers to a significant extent, as these ships are designed to carry heavy loads, and LNG technology is relatively new to apply for this type of vessel. The bulk carriers amount to the largest share of the in-operation ships.

- Moreover, the use of LNG as a fuel is both a proven and commercially available solution. LNG offers enormous advantages, especially for ships in the light of ever-tightening emission regulations. Conventional oil-based fuels are expected to remain the primary fuel option for most ships in the mid-term, while LNG is likely to become a popular choice in the long-term scenario.

- In April 2024, Wartsila Gas Solutions, part of the technology group Wartsila, announced that it would supply the cargo handling system for a new 12,500 m3 LNG bunkering vessel being built for Spanish shipowner Scale Gas, a subsidiary of Enagas, the owner and operator of Spain's gas grid. The vessel is co-financed by the Support for Sustainable and Digital Transport Programme, part of the Recovery, Transformation and Resilience Plan from the Spanish Ministry of Transport, Mobility and Urban Agenda.

- LNG demand is likely to increase significantly in the forecast period as the order book for LNG vessels continues to increase due to it being relatively cheaper than conventional fuels and offering a 23% reduction in greenhouse gas emissions over oil-based marine fuel, which will aid in meeting global decarbonization goals. These factors project LNG to be the most popular marine fuel in the future.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is expected to dominate the bunker fuels market due to the immense maritime trade potential of countries like India, China, Singapore, and Japan.

- As of 2023, China ranked first in terms of exported goods and second for imported goods by value. In 2023, China imported goods worth around USD 2.5 trillion and exported USD 3.3 trillion. China's major exports are mechanical and electric machinery and equipment and automotive products, including vehicle parts, chemicals and plastics, iron and steel articles, and furniture.

- Australia is among the biggest exporters of LNG globally. Rising LNG exports have supported the growth in international trade in Australia. The export volume is likely to rise in the coming years as the demand for LNG is increasing significantly worldwide.

- To increase the share of the marine sector in international and domestic trade, the Indian government announced an investment of USD 22 billion by 2035 to modernize its existing ports and build new ports. The port infrastructure development is expected to increase the demand from the maritime industry and marine fuel suppliers in Asia-Pacific during the forecast period.

- In February 2024, Pavilion Energy, charterer of LNG bunker vessels, announced that LNG bunker vessel Brassavola had completed its first ship-to-ship (STS) LNG bunkering operation. In its maiden STS LNG bunkering operation, Brassavola delivered LNG to Rio Tinto chartered dual-fueled bulk carrier Mount Api.

- Therefore, in line with the aforementioned factors, Asia-Pacific is expected to dominate the bunker fuels market during the forecast period.

Bunker Fuel Industry Overview

The global bunker fuels market is fragmented. Some of the major players in the market (in no particular order) include Gazpromneft Marine Bunker LLC, ExxonMobil Corporation, Shell PLC, TotalEnergies SE, and BP PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 62667

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increased LNG Trade Worldwide

- 4.5.1.2 Increasing Dependencies over Natural Gas for Power Generation

- 4.5.2 Restraints

- 4.5.2.1 Environmental Concerns and the Strict Regulations Related to Emissions from the Maritime Industry

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 High Sulfur Fuel Oil (HSFO)

- 5.1.2 Very Low Sulfur Fuel Oil (VLSFO)

- 5.1.3 Marine Gas Oil (MGO)

- 5.1.4 Liquefied Natural Gas (LNG)

- 5.1.5 Other Fuel Types

- 5.2 Vessel Type

- 5.2.1 Containers

- 5.2.2 Tankers

- 5.2.3 General Cargo

- 5.2.4 Bulk Carriers

- 5.2.5 Other Vessel Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 NORDIC

- 5.3.2.6 Turkey

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fuel Suppliers

- 6.3.1.1 ExxonMobil Corporation

- 6.3.1.2 Shell PLC

- 6.3.1.3 Gazpromneft Marine Bunker LLC

- 6.3.1.4 BP PLC

- 6.3.1.5 PJSC Lukoil Oil Company

- 6.3.1.6 TotalEnergies SE

- 6.3.1.7 Chevron Corporation

- 6.3.1.8 Clipper Oil

- 6.3.1.9 Gulf Agency Company Ltd

- 6.3.1.10 Bomin Bunker Holding GmbH & Co. KG

- 6.3.2 Ship Owners

- 6.3.2.1 AP Moeller Maersk AS

- 6.3.2.2 Mediterranean Shipping Company SA

- 6.3.2.3 China COSCO Shipping Corporation Limited

- 6.3.2.4 CMA CGM Group

- 6.3.2.5 Hapag-Lloyd AG

- 6.3.2.6 Ocean Network Express

- 6.3.2.7 Evergreen Marine Corp Taiwan Ltd

- 6.3.2.8 Yang Ming Marine Transport Corporation

- 6.3.2.9 HMM Co. Ltd

- 6.3.2.10 Pacific International Lines Pte Ltd

- 6.3.3 List of Other Prominent Companies

- 6.3.4 Market Ranking Analysis

- 6.3.1 Fuel Suppliers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Risisng Demand for Marine Transportation and Increasing Number of Ships in Operation

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.