PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437609

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437609

Asia-Pacific Cruise Missile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

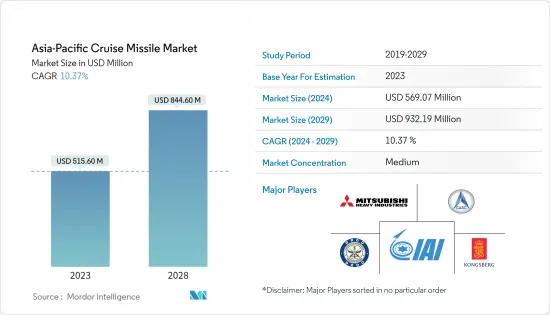

The Asia-Pacific Cruise Missile Market size is estimated at USD 569.07 million in 2024, and is expected to reach USD 932.19 million by 2029, growing at a CAGR of 10.37% during the forecast period (2024-2029).

Asia-Pacific has been one of the global hotspots for military conflicts. The increasing number of territorial issues in the region has propelled the countries to procure advanced cruise missiles to strengthen their defenses against potential adversaries. The growth in defense budgets of several nations in the region has also facilitated the development and procurement of newer cruise missile systems, thereby driving the growth of the market.

The use of missiles in modern warfare tactics have grown over time, putting pressure on the military and defense sectors of governments to maintain a significant stock of cruise missiles. Modern cruise missiles now have the added capability of autonomous navigation, operating on a non-ballistic trajectory at an exceptionally low altitude, and achieving hypersonic and supersonic velocities due to advancements in technology. These technological improvements are projected to be advantageous and will result in a notable expansion of the cruise missile market throughout the forecast period.

Asia-Pacific Cruise Missile Market Trends

Long-Range Missiles are Projected to Dominate the Market During the Forecast Period

The manufacturing and procurement costs of long-range missiles are higher compared to others, as they need to travel long distances and deliver more lethal warheads. The demand for long-range missiles is increasing in Asia-Pacific where the countries need to protect their extensive land-based borders from neighboring adversaries. In Asia-Pacific, countries like China, India, Japan, and South Korea have been developing long-range missiles for their militaries. Furthermore, rising cross border conflicts, growing political tensions among China-India and China-Taiwan leads to strengthening of defense capabilties from various Asian countries. According to the SIPRI report 2022, China and India are the second and fourth largest defense spender in the world with a defense budget of USD 292 billion and USD 81.4 billion respectively.

Growing investment in procurement of advanced long-range missiles and adoption of next-generation weapon systems to enhance defense capabilities drive the market growth. For instance, in August 2023, Australia announced to buying of Tomahawk cruise missiles for long-range defense capability. The procurement plan includes a USD 1.1 billion purchase from the United States of more than 200 Tomahawk cruise missiles for the Royal Australian Navy's Hobart-class destroyers. The missiles have a strike range of 1,500km. Such developments are expected to help the growth of the segment during the forecast period.

China to Dominate the Market During the Forecast Period

China is one of the largest defense spenders in the world. The country has grown its missile strength over the years. China has one of the largest inventories of both cruise and ballistic missiles in the world, placing it among the top 5 countries possessing the greatest number of missiles globally. The disputes of the country over the South China Sea and with several other nations globally have propelled the country to build and deploy a sophisticated, lethal, and advanced cruise missile arsenal. The People's Liberation Army (PLA) is a major user of cruise missiles. China manufactures and exports a wide range of cruise missiles in all categories. Several of China's designs are modeled on the Western Exocet, Harpoon, and Tomahawk families of missiles. In addition to domestically built cruise missiles, China also operates the imported Russian supersonic 3M80E Moskit / SS-N-22 Sunburn and the 3M54/3M14 Klub/Kalibr / SS-N-27 Sizzler missiles.

China is currently arming its long-range bombers with supersonic cruise missiles. The H-6N, the latest version of China's H-6 strategic bomber, is now equipped to carry the CJ-100 missile, which would increase the bomber's strike range to 6,000 km (3,728 miles). The country is also focusing on the development of air-launched cruise missiles. China is also working on the development of the CJ-20, an air-launched variant of the Changjian-10 (CJ-10) land-attack cruise missile (LACM). The CJ-20 can carry both conventional and nuclear warheads and is still under development. Thus, the development of various variants of the cruise missiles and their induction into the missile arsenal of the country is expected to increase the market for the cruise missiles in China during the forecast period.

Asia-Pacific Cruise Missile Industry Overview

The Asia Pacific cruise missile market is semi-consolidated in nature due to presence of few players holding significant shares in the market. Some of the prominent players in the market are the Defence Research and Development Organisation (DRDO), Israel Aerospace Industries Ltd., Mitsubishi Heavy Industries, China Aerospace Science and Industry Corporation, and Kongsberg Gruppen ASA, among others.

Countries in the region, like China, India, and South Korea, among others, have emphasized developing their own missiles indigenously, fueled by the interoperability issues of missile systems of certain countries with the missile defense systems of other countries. Countries in the region are collaborating with other nations to develop advanced cruise missile systems. For instance, DRDO of India and the NPOM of Russia developed BrahMos. It is one of the fastest supersonic cruise missile in the world. The system has been designed with two variants for Land-Attack and Anti-Ship roles. BRAHMOS weapon systems has been inducted and is operational with the Indian Navy (IN) as well as the Indian Army (IA).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Launch Platform

- 5.1.1 Air

- 5.1.2 Sea

- 5.1.3 Land

- 5.2 Range

- 5.2.1 Short-range Missiles

- 5.2.2 Medium-range Missiles

- 5.2.3 Long-range Missiles

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 South Korea

- 5.3.4 Japan

- 5.3.5 Australia

- 5.3.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Defence Research and Development Organisation

- 6.1.2 China Aerospace Science and Industry Corporation

- 6.1.3 Mitsubishi Heavy Industries, Ltd.

- 6.1.4 JSC Tactical Missiles Corporation

- 6.1.5 Rafael Advanced Defense Systems Ltd.

- 6.1.6 Israel Aerospace Industries Ltd.

- 6.1.7 RTX Corporation

- 6.1.8 Lockheed Martin Corporation

- 6.1.9 MBDA

- 6.1.10 Kongsberg Gruppen ASA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS