PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911408

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911408

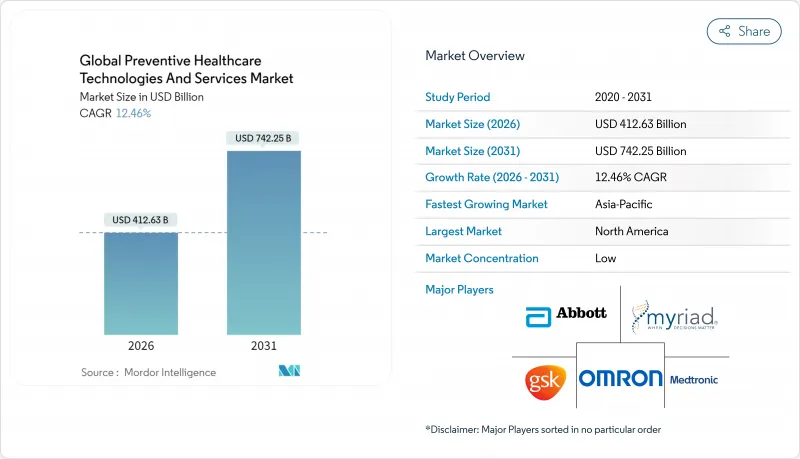

Global Preventive Healthcare Technologies And Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The preventive health technologies and services market was valued at USD 366.91 billion in 2025 and estimated to grow from USD 412.63 billion in 2026 to reach USD 742.25 billion by 2031, at a CAGR of 12.46% during the forecast period (2026-2031).

Escalating chronic-disease treatment costs, rising employer spending on value-based care contracts, and the mainstreaming of AI-driven risk stratification widen the addressable base for screening devices, virtual coaching, and population-level diagnostics. North America captured 42.23% revenue share in 2024 on the back of mature reimbursement frameworks, whereas Asia-Pacific is set to expand at a 14.19% CAGR through 2030 as governments scale digital-health infrastructure and mobile-first screening programs.

Global Preventive Healthcare Technologies And Services Market Trends and Insights

Rising Chronic-Disease Burden Fuelling Proactive Health Screening

Employer medical outlays climbed 7-9% per year in 2024, while diabetes costs alone reached USD 327 billion in the United States, prompting payers and providers to pivot from episodic care to early-detection programs. AI-enabled stratification flags high-risk individuals months before symptom onset, lowering emergency-department use by 20-30% in corporate cohorts with comprehensive screening benefits. Value-based care contracts covering 4.7 million Optum patients underscore the economic case for prevention, as health systems earn shared savings for keeping populations healthier. Aging demographics and lifestyle-driven morbidity amplify demand for screening kits, mobile diagnostics, and virtual nutrition counseling across every segment of the preventive health technologies and services market. Multinational employers are embedding these offerings into benefits packages to mitigate absenteeism and retain talent in tight labor markets.

Consumer Adoption of Wearable Monitoring Devices

Continuous glucose monitors, smartwatches with ECG, and patch-based blood-pressure sensors have shifted from wellness gadgets to reimbursable medical devices as payers recognize their clinical utility. Apple's February 2025 expansion of the Apple Heart & Movement Study positions its watch ecosystem as a large-scale research platform, while Google's MedLM conversational agent provides real-time coaching based on streaming biometric data. Coverage expansions by Medicare and Medicaid for remote patient monitoring drove a surge in physician-initiated wearables prescriptions, turning personal devices into clinical endpoints. Patients share biometric feeds in exchange for personalized risk reports, though 40% of Europeans remain cautious amid GDPR-heightened privacy expectations. Integration of wearable streams with EHRs enriches longitudinal datasets, enhancing diagnostic precision and fueling AI algorithm development.

Data-Privacy & Cybersecurity Concerns

Europe's AI Act, in effect since August 2024, mandates algorithmic transparency and bias monitoring, increasing compliance overhead for vendors rolling out preventive health algorithms. High-profile breaches continue to dampen public trust; 40% of surveyed patients hesitate to share data with digital platforms even when benefits are clear. Each node-from wearable OEMs to EHR vendors-presents an attack surface, compelling organizations to balance openness for analytics with zero-trust architectures. Implementation delays and higher insurance premiums for cybersecurity coverage erode margins for smaller digital-health providers.

Other drivers and restraints analyzed in the detailed report include:

- Government-Funded Population Screening & Vaccination Programs

- Employer-Sponsored Wellness Incentives Tied to Insurance Premiums

- Reimbursement Gaps for Preventive Services

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Products retained the largest slice of the preventive health technologies and services market size at USD 238.2 billion in 2025, buoyed by recurring sensor sales and app subscriptions. However, services are forecast to climb 13.56% annually, propelled by capitated contracts that reward prevention over acute interventions. Health-risk assessments, lifestyle coaching, and chronic-disease management bundles have proliferated as providers align to shared-savings models that monetize improved outcomes.

Tele-preventive consultations top the growth charts, aided by policy parity and employer adoption for hybrid workforces. Disease-specific management programs-diabetes, hypertension, obesity-anchor sticky revenue via continuous data feeds and algorithmic titration protocols that reduce hospitalization events. Lifestyle-coaching solutions appeal to large enterprises that document double-digit reductions in health-plan liabilities after rolling out comprehensive wellness schemes.

The Preventive Health Technologies and Services Market Report is Segmented by Product and Services (Products, Services), Delivery Mode (In-Person, Remote/Virtual), End User (Healthcare Providers, Employers, Payers & Insurers, Individuals, Government/Public Health Agencies), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led spending with a 41.76% stake in 2025, fueled by Medicare reimbursement for remote monitoring, employer wellness incentives, and robust venture-funding pipelines. Integration of wearables with EHRs and established HIPAA frameworks eases data interoperability, shortening deployment cycles for AI-supported preventive platforms. Market headwinds include reimbursement gaps for emerging genomic assays and rising cybersecurity-insurance premiums that inflate provider overhead.

Asia-Pacific registers the highest growth at a 13.98% CAGR, buoyed by smartphone ubiquity, large-scale disease-burden pressures, and supportive government e-health blueprints. China's Healthy China 2030 and India's Ayushman Bharat Digital Mission accelerate investments in cloud-based registries and AI triage bots, catalyzing preventive health technologies and services market adoption. Mobile first-time users leapfrog legacy care pathways, employing chat-based risk assessments and e-pharmacy logistics to bridge rural access gaps.

Europe grows steadily on the strength of universal-coverage models and policy mandates that embed screening and vaccination targets into national budgets. The European Health Data Space standardizes cross-border data interoperability, enabling scale economics for predictive-analytics vendors. EU AI Act compliance raises upfront development costs but offers long-term regulatory certainty, improving investor confidence in preventive-health solutions. South America, the Middle East, and Africa contribute modest shares today yet represent attractive white space, with pilots such as Brazil's UBS+Digital proving tele-prevention can thrive even amid infrastructure constraints.

- Apple

- Alphabet Inc.

- Koninklijke Philips

- Roche

- Teladoc Health

- Johnson & Johnson

- Abbott Laboratories

- Dexcom

- Garmin

- Omron Healthcare Co., Ltd.

- Illumina

- 23andMe Holding Co.

- Myriad Genetics

- UnitedHealth Group Incorporated (Optum)

- AliveCor

- Virta Health Corp.

- Ping An HealthCloud Co., Ltd.

- Resmed

- Hims & Hers Health, Inc.

- Liva Healthcare A/S

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising chronic-disease burden fuelling proactive health screening

- 4.2.2 Consumer adoption of wearable monitoring devices

- 4.2.3 Government-funded population screening & vaccination programs

- 4.2.4 Employer-sponsored wellness incentives tied to insurance premiums

- 4.2.5 AI-driven predictive analytics enabling risk stratification (under-reported)

- 4.2.6 Direct-to-consumer genomic testing price collapse (under-reported)

- 4.3 Market Restraints

- 4.3.1 Data-privacy & cybersecurity concerns

- 4.3.2 Reimbursement gaps for preventive services

- 4.3.3 Algorithmic bias in risk-prediction models (under-reported)

- 4.3.4 Low digital-literacy in aging populations (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product & Services

- 5.1.1 Products

- 5.1.1.1 Screening & Diagnostic Devices

- 5.1.1.2 Wearable Health Trackers

- 5.1.1.3 Genetic-Testing Kits

- 5.1.1.4 Mobile Health Apps

- 5.1.1.5 Vaccination Platforms

- 5.1.2 Services

- 5.1.2.1 Health-Risk Assessment

- 5.1.2.2 Corporate Wellness Programs

- 5.1.2.3 Lifestyle Coaching

- 5.1.2.4 Disease-Management Services

- 5.1.2.5 Tele-preventive Consultations

- 5.1.1 Products

- 5.2 By Delivery Mode

- 5.2.1 In-Person

- 5.2.2 Remote / Virtual

- 5.3 By End User

- 5.3.1 Healthcare Providers

- 5.3.2 Employers

- 5.3.3 Payers & Insurers

- 5.3.4 Individuals

- 5.3.5 Government / Public-Health Agencies

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Apple Inc.

- 6.3.2 Alphabet Inc.

- 6.3.3 Koninklijke Philips N.V.

- 6.3.4 F. Hoffmann-La Roche Ltd

- 6.3.5 Teladoc Health, Inc.

- 6.3.6 Johnson & Johnson

- 6.3.7 Abbott Laboratories

- 6.3.8 Dexcom, Inc.

- 6.3.9 Garmin Ltd.

- 6.3.10 Omron Healthcare Co., Ltd.

- 6.3.11 Illumina, Inc.

- 6.3.12 23andMe Holding Co.

- 6.3.13 Myriad Genetics, Inc.

- 6.3.14 UnitedHealth Group Incorporated (Optum)

- 6.3.15 AliveCor, Inc.

- 6.3.16 Virta Health Corp.

- 6.3.17 Ping An HealthCloud Co., Ltd.

- 6.3.18 ResMed Inc.

- 6.3.19 Hims & Hers Health, Inc.

- 6.3.20 Liva Healthcare A/S

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment