Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690764

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690764

Asia-Pacific Pet Treats - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 261 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

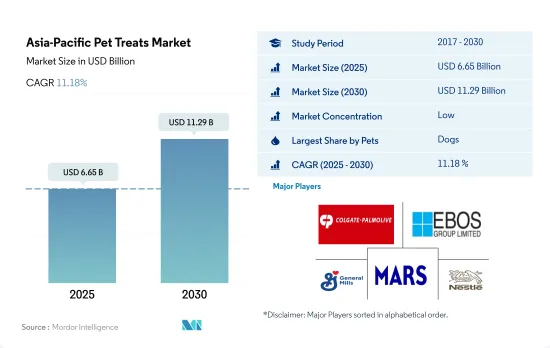

The Asia-Pacific Pet Treats Market size is estimated at 6.65 billion USD in 2025, and is expected to reach 11.29 billion USD by 2030, growing at a CAGR of 11.18% during the forecast period (2025-2030).

Dogs were the major pets, but cats are the fastest growing due to their growing adoption in the region

- The Asia-Pacific pet treats market is witnessing significant growth, primarily driven by the increasing pet population, which rose from 442.2 million in 2017 to 511.1 million in 2022. The growing trend of pet humanization resulted in increased demand for high-quality pet treats, which contributed to the market's growth.

- Among pets, dogs dominate the Asia-Pacific pet treats market, accounting for 51.4% of the market value in 2022. They were valued at USD 2.74 billion in the same year. The higher share of dogs can be attributed to the larger population of dogs compared to other pets in the region, accounting for 34.49% of the pet population in the same year. The higher preference of dogs for treats compared to other pets contributed to their higher share.

- The cats segment is the second-largest market segment, accounting for 31.8% in 2022, due to their significant population in the region. The cat population accounted for 26.1% of the pet population in the same year. The growing population of cats in the region and their adaptability to small living spaces compared to dogs are expected to drive the cat treats market as the fastest-growing segment, with a CAGR of 12.4% during the forecast period.

- The treats market for other pets reached a value of USD 895.4 million in 2022. There is a growing interest in other animals as pets due to their relatively lower maintenance compared to dogs and cats, which is anticipated to drive their market.

- The increasing pet population in the region is the major factor anticipated to drive the market during the forecast period.

Increased willingness of pet parents to spend on high-quality premium pet treats has driven the Asia-Pacific pet treats market

- Pet treats are the fastest-growing market segment in the Asia-Pacific pet food market. In 2022, the pet treats market accounted for 18.2% of the pet food market in Asia-Pacific, valued at USD 5.33 billion. The market grew by 70.2% in 2022 compared to 2017, in line with increasing pet adoption rates and growing awareness about high-quality healthy treats.

- In 2022, China was the largest country in the Asia-Pacific pet treats market, accounting for USD 2.58 billion in 2022. The higher share of the country was because of its higher pet population, along with the higher expenditure of pet owners on pet treats. For instance, the pet population in China accounted for 54% of the Asia-Pacific pet population in 2022. Additionally, Chinese pet owners spend an average of around USD 509 per pet on pet expenditure.

- Japan and Australia are the second and third-largest pet treat markets in the region, valued at USD 536.4 million and USD 436.4 million, respectively. Pet parents purchasing premium products and increasing demand for custom-made products have created high market demand in these countries.

- The Philippines is projected to be the fastest-growing country in the regional market, with a CAGR of 20.1% during 2023-2029, owing to the growing pet population and the continued rise in pet expenditures by around 20.9% between 2017 and 2022.

- Thailand, India, and Taiwan are the other significant countries in the regional market, together valued at USD 565 million in 2022. The demand for pet treats is estimated to increase in these countries over the coming years, with increasing pet expenditures.

- Factors such as the rising pet population, growing demand for premium foods, and growing awareness about health concerns are anticipated to help the growth of the treats market during 2023-2029.

Asia-Pacific Pet Treats Market Trends

The evolving ecosystem of pet cafes and pet stores that assist in taking care of the animals and offer a wide variety of cat food products and services is driving the population of cats

- In Asia-Pacific, cats have a lower share compared to dogs, accounting for 26.1% of the pet population in 2022. Countries such as China, India, and Australia witnessed an increase in pet ownership due to health benefits such as feeling relaxed and less stressed and companionship. Therefore, the cat population grew by 0.28% between 2017 and 2022. The shares of cat parents are higher than dog parents in Indonesia and Malaysia, accounting for 47% and 34%, respectively, in 2021. The religious cultures of these countries and the preference for cats as pets over dogs drove the cat population. This trend may help the companies invest more in cat food in these countries.

- In China, there has been an increase in the no. of pets, including cats, in urban areas, and the pet population, including cats, grew by 10.2% between 2018-2020, reaching 100.8 million in 2020. The cat population grew from 74.4 million in 2020 to 82.5 million in 2022 due to a rise in the need for companionship during the pandemic. This trend may have long-term effects as the life span of cats is more than 20 years.

- A new pet adoption and purchase ecosystem is evolving in the region in the form of pet cafes and pet stores that assist in purchasing and taking care of animals through a wide variety of pet food products and services. For instance, in Vietnam, the Meow House by R House is a cat cafe that serves vegetarian and vegan food and serves as a home for cats. Factors such as the rising adoption of cats due to health benefits, the region's culture, and changes in the pet ecosystem are helping boost cat adoption in the region.

Increased demand for premium pet treats such as grain-free and natural products is boosting pet expenditure

- In Asia-Pacific, there has been a rise in pet expenditure because of the availability of different types of pet food and pet parents' preference for good quality pet food as they are willing to pay premium prices. Traditionally, pet parents had a higher number of pet dogs, but there has been an increase in the cat population in recent years. However, pet dogs had a higher share of expenditure in 2022, i.e., 45.4%. This high share was due to higher consumption of high-quality pet food and a high demand for customized treats for dogs. Dogs are most popular in Australia, and about 40% of households had a pet dog in 2022, which increased the demand for pet treats.

- China, India, and South Korea are the major pet markets in the region, further registering growth in pet expenditure. These countries witnessed a high number of pet adoptions and high consumption of good quality, premium pet food, especially after the pandemic, as pet parents became more aware of the nutritional requirements of their pets. For instance, in Hong Kong's cat food market, the premium pet food segment accounted for 75% of the pet food sales in 2022. Online pet food sales are high, especially in China, due to the vast number of products on the websites and the ease of placing orders. For instance, in 2022, China's pet food sales from online channels were 58.9% compared to the offline pet stores' contribution of 27.5%.

- The rising demand for pet food and growing awareness about good quality pet food are expected to increase pet expenditure in the region during the forecast period.

Asia-Pacific Pet Treats Industry Overview

The Asia-Pacific Pet Treats Market is fragmented, with the top five companies occupying 15.71%. The major players in this market are Colgate-Palmolive Company (Hill's Pet Nutrition Inc.), EBOS Group Limited, General Mills Inc., Mars Incorporated and Nestle (Purina) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71494

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Product

- 5.1.1 Crunchy Treats

- 5.1.2 Dental Treats

- 5.1.3 Freeze-dried and Jerky Treats

- 5.1.4 Soft & Chewy Treats

- 5.1.5 Other Treats

- 5.2 Pets

- 5.2.1 Cats

- 5.2.2 Dogs

- 5.2.3 Other Pets

- 5.3 Distribution Channel

- 5.3.1 Convenience Stores

- 5.3.2 Online Channel

- 5.3.3 Specialty Stores

- 5.3.4 Supermarkets/Hypermarkets

- 5.3.5 Other Channels

- 5.4 Country

- 5.4.1 Australia

- 5.4.2 China

- 5.4.3 India

- 5.4.4 Indonesia

- 5.4.5 Japan

- 5.4.6 Malaysia

- 5.4.7 Philippines

- 5.4.8 Taiwan

- 5.4.9 Thailand

- 5.4.10 Vietnam

- 5.4.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Affinity Petcare SA

- 6.4.3 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 6.4.4 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 6.4.5 EBOS Group Limited

- 6.4.6 General Mills Inc.

- 6.4.7 IB Group (Drools Pet Food Pvt. Ltd.)

- 6.4.8 Mars Incorporated

- 6.4.9 Nestle (Purina)

- 6.4.10 Vafo Praha, s.r.o.

- 6.4.11 Virbac

7 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.