Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690736

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690736

Electric Propulsion Satellites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 164 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

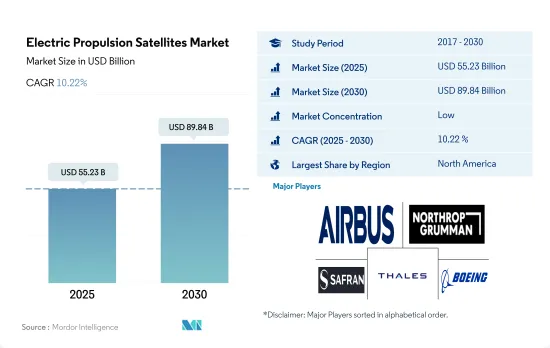

The Electric Propulsion Satellites Market size is estimated at 55.23 billion USD in 2025, and is expected to reach 89.84 billion USD by 2030, growing at a CAGR of 10.22% during the forecast period (2025-2030).

The growing interest of governments and private players in space exploration have fueled the expansion of this market

- The global market for electric satellite propulsion systems witnessed robust growth in recent years, driven by the increasing demand for satellite deployments across various sectors. North America has emerged as a dominant player in the global space propulsion market, mainly due to the presence of established space agencies such as NASA and private companies like SpaceX, Blue Origin, and Boeing. These entities have undertaken ambitious space missions and satellite deployments, driving the demand for advanced propulsion systems. NASA is also working on the Solar Electric Propulsion project, which aims to extend the duration and capabilities of ambitious discoveries and science missions.

- Asia-Pacific has witnessed a rapid expansion of its space capabilities in recent years. Countries like China, India, and Japan have made significant strides in space technology and satellite manufacturing, positioning themselves as formidable players in the global market. In May 2022, Kongtian Dongli, a Chinese satellite electric propulsion company, secured multi-million yuan angel round financing amid a proliferation of Chinese constellation plans.

- Europe has a strong tradition of collaboration in space exploration through organizations like the ESA. ESA's partnerships with multiple member states have resulted in significant advancements in space technology, satellite manufacturing, and launch capabilities. In February 2023, IENAI SPACE, an in-space mobility provider based in Spain, received two ESA contracts within the General Support Technology Program to mature and further develop ATHENA (Adaptable THruster based on Electrospray powered by NAnotechnology) propulsion systems.

Global Electric Propulsion Satellites Market Trends

The increased emphasis on electric propulsion system is expected to aid in the growth of spending on its related space programs

- The grant for research and investment has been a major driver of innovation and growth in the North American satellite launch vehicle market. It has helped to fund the development of new technologies, such as reusable launch vehicles, which have the potential to significantly reduce the cost of satellite launches. In FY2023, according to the President's budget request summary from FY2022 to FY2027, NASA is expected to receive USD 98 million for the development of Solar Electric Propulsion. In March 2021, NASA, along with Maxar Technologies and Busek Co., successfully completed a test of the 6-kilowatt (kW) solar electric propulsion subsystem

- Additionally, in November 2022, ESA announced that it had proposed a 25% boost in space funding over the next three years to maintain Europe's lead in space projects. The ESA is asking its 22 nations to back a budget of EUR 18.5 billion for 2023-2025. In April 2023, Dawn Aerospace was awarded a contract to conduct a feasibility study with DLR (German Aerospace Center) to increase the performance of a nitrous-oxide-based green propellant for satellites and deep-space missions.

- In Asia-Pacific, the demand for space propulsion is driven by increasing space programs. In May 2022, Kongtian Dongli, a Chinese satellite electric propulsion company, announced that it had secured multi-million yuan angel round financing amid a proliferation of Chinese constellation plans. The company's main products are hall thrusters and microwave electric propulsion systems. Likewise, in February 2023, the Indian government announced that ISRO is expected to receive USD 2 billion for various space-related activities, including the development of the Liquid Propulsion Systems Centre (LPSC) and ISRO Propulsion Complex.

Electric Propulsion Satellites Industry Overview

The Electric Propulsion Satellites Market is fragmented, with the top five companies occupying 23%. The major players in this market are Airbus SE, Northrop Grumman Corporation, Safran SA, Thales and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71313

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Spending On Space Programs

- 4.2 Regulatory Framework

- 4.2.1 Global

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 France

- 4.2.7 Germany

- 4.2.8 India

- 4.2.9 Iran

- 4.2.10 Japan

- 4.2.11 New Zealand

- 4.2.12 Russia

- 4.2.13 Singapore

- 4.2.14 South Korea

- 4.2.15 United Arab Emirates

- 4.2.16 United Kingdom

- 4.2.17 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Full Electric

- 5.1.2 Hybrid

- 5.2 End User

- 5.2.1 Commercial

- 5.2.2 Military

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.2 Europe

- 5.3.3 North America

- 5.3.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Accion Systems Inc.

- 6.4.2 Ad Astra Rocket Company

- 6.4.3 Aerojet Rocketdyne Holdings, Inc

- 6.4.4 Airbus SE

- 6.4.5 Busek Co. Inc.

- 6.4.6 Northrop Grumman Corporation

- 6.4.7 Safran SA

- 6.4.8 Sitael S.p.A.

- 6.4.9 Thales

- 6.4.10 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.