PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690705

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690705

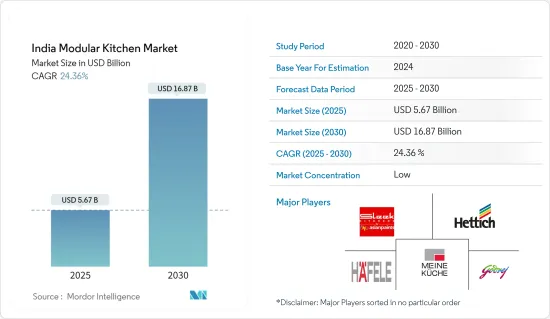

India Modular Kitchen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Modular Kitchen Market size is estimated at USD 5.67 billion in 2025, and is expected to reach USD 16.87 billion by 2030, at a CAGR of 24.36% during the forecast period (2025-2030).

Kitchens are gaining recognition in the home improvement category to augment both its functionality and decor. For homemakers and working professionals, restructuring and remodeling the kitchen with more attractive looks and features has become a trend. The significant share of the modular kitchen market is driven by a rising middle-class population and increasing partnerships between contractors and real estate project developers for designing modular kitchens. Rising nuclear families and a preference for small houses and space-saving ideas are driving the growth of the modular kitchen market.

Over the last few years, the kitchen market in India has witnessed an inclination towards modern designs and comfort. Among Indian consumers, the kitchen is no longer considered a separate unit but a regular space for socializing, relaxation, and imaginativeness. With consumers showcasing an inclination to experiment with design, textures, and adolescent color combinations, manufacturers have been set free to offer consumers world-class products. Consumers are progressively looking at premium plans and features such as magic corners and kitchen island concepts to add more luxury touch to the cooking space.

India Modular Kitchen Market Trends

Expanding Online Distribution Channel is Driving the Market

These online platforms allow customers to design their kitchens according to their choice, needs, and budget. With the business expansion strategy of companies including Panasonic, TTK Prestige, and Johnson into modular kitchen space, the number of branded modular kitchens available online in Tier 2 and Tier 3 cities of India is increasing. The increase in the availability of types of modular kitchens, including L-shaped, U-shaped, Simple kitchen designs, and Island kitchens by the distributors, is leading to more consumers adopting modular kitchens. In addition, the revenue of kitchen furniture in India is observing continuous growth with an increasing share of sales through online channels, providing buyers with discounts and other lucrative offers, generating a positive externality for online sales of Modular kitchens in India.

Rising Share Of Residential Segment in India Modular Kitchen Market

The growing middle class is driving the modular kitchen market, with rising income levels and improving living standards. The growth of the residential construction industry is expected to be a key driver for the market, with an increase in the number of kitchen spaces in India. Rising demand for space-saving and efficient storage that optimizes usage of small spaces among consumers is expected to raise demand for modular kitchens.

Annual household consumption expenditure in India is observing continuous growth in metropolitan cities of Delhi, Mumbai, Bangalore, Ahmedabad, and others, which exist among the cities with leading expenditure and higher penetration of modular kitchens. This trend is leading global players operating in modular kitchens to establish their stores and supply chain network in major Indian cities, where they expect positive market growth with rising employment and residential units.

India Modular Kitchen Industry Overview

The modular kitchen market is fragmented, with many small and regional competitors present in the market. Manufacturers are strategically involved in expanding their business by merging and acquiring companies in the market. The market is dominated by several small players holding a market share of more than 80%. The companies in the organized sector are executing strategies to expand their business into Tier II and Tier III cities. Some Existing players in India's Modular Kitchen market are Hettich India Private Limited, Sleek International Private Limited, Godrej & Boyce Manufacturing Company Limited, Hafele India Private Limited, and Meine Kuche India Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing in expenditure on Kitchen Renovation

- 4.3 Market Restraints

- 4.3.1 Increase in Price of Wooden material

- 4.4 Market Opportunities

- 4.4.1 Online sales channels are increasing market reach of Modular kitchen

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in India Modular Kitchen Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Floor Cabinet & Wall Cabinets

- 5.1.2 Tall Storage Cabinets

- 5.1.3 Other Products

- 5.2 By End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Offline (Contractors, Builders, and Others)

- 5.3.2 Online

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Hettich India Private Limited

- 6.3.2 Sleek International Private Limited

- 6.3.3 Godrej & Boyce Manufacturing Company Limited

- 6.3.4 Hafele India Private Limited

- 6.3.5 Meine Kuche India Pvt. Ltd.

- 6.3.6 Oren Kitchen Appliances Private Limited

- 6.3.7 IFB Industries Ltd.

- 6.3.8 Magppie Retail Limited

- 6.3.9 Lispo Kitchens Pvt. Ltd.

- 6.3.10 Ebco Private Limited*

7 MARKET FUTURE TREND

8 DISCLAIMER AND ABOUT US