PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690188

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690188

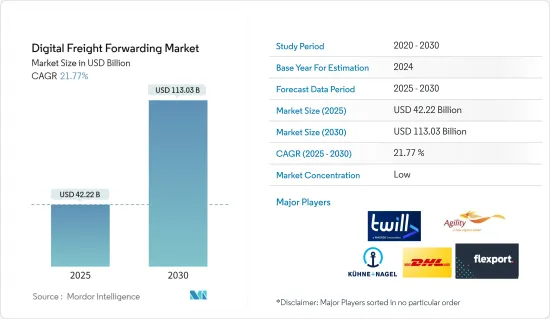

Digital Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Digital Freight Forwarding Market size is estimated at USD 42.22 billion in 2025, and is expected to reach USD 113.03 billion by 2030, at a CAGR of 21.77% during the forecast period (2025-2030).

Digitization is continuing to be one of the key drivers supporting growth of the current economy. Companies like convoy, Uber Freight and uShip are coming up with new platforms to fill in the gaps in the logistics industry. With Digital freight forwarding the manual process will be reduced. All the quotations for freight forwarding will be available at one platform without the hassle of hours of conversation and paper trails. The major benefits of digital freight forwarding include instant quotes, transparent pricing, comparison of rates and carriers, tracking, easy documentation and others. The logistics industry is developing to a paperless digitized industry supporting the growth of the market.

Digital Freight Forwarding Market Trends

Growth in E-Commerce driving Digital Freight Forwarding Market

In 2019, retail e-commerce sales worldwide amounted to around 3.53 trillion US dollars and e-retail revenues are projected to grow even further at a quicker pace in the coming few years. Online shopping is one of the most popular online activities worldwide, both domestic and cross-border e-commerce is booming in developing markets such as China, India, and Indonesia due to that reason. This encompasses not just direct-to-consumer retail, but also shipments of electronics, pharmaceuticals, and consumer packaged goods. With increasing access to internet even the manufacturers of products are gradually moving from traditional freight forwarding to digital freight forwarding. The major benefits of digital freight forwarding include instant quotes, transparent pricing, comparison of rates and carriers, tracking, easy documentation and others.

Flexport leading the Digital Freight forwarding market

Flexport is a San Francisco-based digital freight forwarder and logistics platform. Founded in 2013, the company has around half of its business in ocean freight and the other half in air freight. After its Series C round of funding in September 2017, Flexport had a valuation of $800 million. DST Global led this round; other investors include Founders Fund and Wells Fargo. In 2018, the company received USD 100 million from SF Express, a leading courier company in China. This brought Flexport's total funding to USD 300 million and its valuation to more than USD 1 billion.

The startup has a run-rate revenue of approximately USD 400 million and is growing steadily. It ships roughly 120,000 TEUs (20-foot equivalent units) annually, with a focus on transpacific trade lanes, where its shipment volume is the 20th largest on the transpacific eastbound route. It reached a revenue of USD 860 million in 2019 and became the leader in digital freight forwarding market as it provides high quality logistics service with added analytical reports.

Digital Freight Forwarding Industry Overview

The Digital Freight Forwarding Market is competitive and is highly fragmented with presence of many players. Digital freight forwarders (DFFs) use a digital platform to offer a broader range of logistics services than marketplaces and connectivity providers. DFFs build their core value proposition around a seamless user experience of shipping goods from one point to another while aggregating information on one platform with a single user interface. Some of the existing major players in the market include - Flexport, Twill, FreightHub, Fleet, InstaFreight, Transporteca, Kontainers, KN Freight Net, Turvo, iContainers, DHL Group, Kuehne + Nagel International AG and Agility Logistics Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Investment Scenarios

- 4.4 Government Regulations and Initiatives

- 4.5 Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Overview on E-commerce Logistics and Freight Forwarding

- 4.7 Value Propositions of E-platforms Vs Competitors

- 4.8 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transport

- 6.1.1 Land

- 6.1.2 Sea

- 6.1.3 Air

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 France

- 6.2.2.3 Netherlands

- 6.2.2.4 United Kingdom

- 6.2.2.5 Italy

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Australia

- 6.2.3.4 India

- 6.2.3.5 Singapore

- 6.2.3.6 Malaysia

- 6.2.3.7 Indonesia

- 6.2.3.8 South Korea

- 6.2.3.9 Rest of Asia-Pacific

- 6.2.4 Middle East & Africa

- 6.2.4.1 South Africa

- 6.2.4.2 Egypt

- 6.2.4.3 GCC Countries

- 6.2.4.4 Rest of Middle East & Africa

- 6.2.5 South America

- 6.2.5.1 Brazil

- 6.2.5.2 Chile

- 6.2.5.3 Rest of South America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Flexport

- 7.2.2 Twill

- 7.2.3 FreightHub

- 7.2.4 Fleet

- 7.2.5 InstaFreight

- 7.2.6 Transporteca

- 7.2.7 Kontainers

- 7.2.8 KN Freight Net

- 7.2.9 Turvo

- 7.2.10 iContainers

- 7.2.11 DHL Group

- 7.2.12 Kuehne + Nagel International AG

- 7.2.13 Agility Logistics Pvt. Ltd*

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 DISCLAIMER