PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643223

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643223

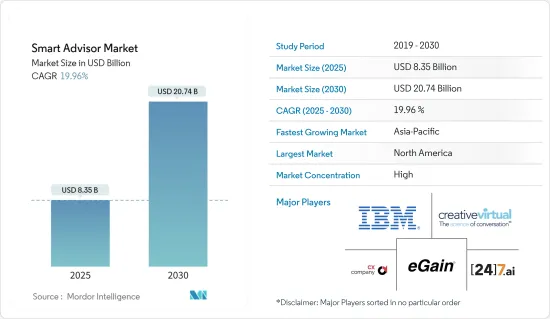

Smart Advisor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Smart Advisor Market size is estimated at USD 8.35 billion in 2025, and is expected to reach USD 20.74 billion by 2030, at a CAGR of 19.96% during the forecast period (2025-2030).

An application program that is used to understand the natural language and complete all the electronic tasks for an end user is called the smart advisor program. A smart advisor provides operational data for better decision-making. A smart advisor is an intelligent search engine that gives agents access to the knowledge bases of multiple businesses. Additionally, it allows knowledge base managers and chatbot content creators to collaborate while agents chat with clients.

Key Highlights

- Many instances of financial fraud were reported during the COVID-19 pandemic, resulting in fraud claims costing governments worldwide billions of dollars. The Fintech companies started to move towards innovative tools to handle these frauds. UK Govt., in collaboration with fintech company Quantexa, launched "Spotlight," an automated due-diligence tool. Using Spotlight, a lot of data can be collected, and risk indicators can be provided against those data points, resulting in a better informed and timely award decision.

- Increasing cybercrimes are posing challenges to the smart advisor market. A recent KPMG survey identified cyber security risk as the biggest threat to the organization's growth in the near future. This will impact the security of software that help agents in real time based on what the visitor is asking in the chat. A survey revealed cybercrime costs the global economy USD 470 billion in annual losses due to consumer data breaches, financial crimes, market manipulation, and intellectual property theft.

- A financial counselor is necessary for successful business operations in every area. The healthcare sector is one industry implementing smart advice for improved performance. Companies that have analytical capacity handle the most urgent healthcare demands. Storage, query, and analysis of clinical data are currently tricky due to the need for more data consolidation. These Business Intelligence companies provide decision-makers with the right tools to assess the use of resources and find economies of scale.

- In January 2023, Creative Virtual, one of the global leaders in conversational AI for customer and employee engagement, published a buyer's guide written to assist with chatbot purchasing decisions in the current year. The in-depth guide includes a comparison chart that evaluates the capabilities of conversational AI solutions. A conversational AI specialist differs from an add-on bot vendor, and their core product is their conversational AI platform and established history of delivering highly successful virtual agent and chatbot solutions.

- Real estate companies also look forward to technological advancements to gain valuable insights into buyer portfolios. Tools like the suitable intelligent document processor (IDP) are being used to feed more data into desired end systems with little to no manual intervention. AI's in-depth knowledge of various document types will equip the company to make profitable deals and financial decisions.

Smart Advisor Market Trends

The Retail Segment is Expected to Witness Significant Adoption for Smart Advisor Solutions.

- Automated tools like robo-advisors and passive investing are attracting investors. Therefore advisors are switching to data analytics to improve the client experience. Smart advisor applications like Live Connections help advisors to approach marketing, business development, and lead generation in the digital age.

- Financial Advisors (FA) often need help to keep up with real-time market changes and client needs. To overcome this gap, next-gen AI/ML technologies are becoming essential in developing intelligent solutions. These AI-powered smart advisor tools can scan multiple data sources for market data, events, and news. These tools also manage numerous client portfolios simultaneously, like social media footprints, to determine their life events. Thus, FA can analyze critical market insights more quickly and take timely action to reduce risk or improve returns on investment.

- Advisory firms are collaborating across borders for business expansion. In December 2022, the National Association of Software and Services Companies (NASSCOM) partnered with New South Wales Government's economic development, called NSW, to organize roadshows for Indian technology companies to highlight business and investment opportunities in Australia.

- October 2022 - AccessFintech joined hands with Deloitte to assist financial institutions in their struggle to comply with the impending Consolidated Audit Trail regulation (CAT). By using AccesssFintech's CAT Error Resolution workflow, Clients will be saved from monetary penalties as it will be easy to investigate errors and collaborate in a structured manner.

- In a survey conducted by Accenture, eight in ten advisors accepted that using a one-stop platform or digitalizing applications into a single screen would help improve their efficiency. The research pointed out that this would boost advisor productivity three to seven times in the next three years.

European Market is Expected to Grow Significantly

- Fintech activity is expanding throughout Europe. According to a report by Mckinsey, pricing and customer experience are the top reasons for banking with fintech, for consumers, as per the survey. European banks rely on various fintech collaborations in major sectors, including operations and payments. Fintech Sector creates more than 1 million jobs across Europe, with huge potential for growth. Fintechs in Europe represented a total valuation of almost 453 billion USD as of June 2022.

- According to Finch Capital insights, more than 250 fintech businesses specialize in KYC compliance in Europe, while more than 300 provide cost management software. Spain's government passed the Startups Law to encourage entrepreneurship and make the country more appealing to foreign investors and creative thinkers. Although Spain's Fintech market is less developed than its European neighbors France and Germany, the EU offers intriguing potential for Spanish Fintechs.

- In January 2022, ABN Amro invested in Laka, a bicycle insurance provider for retail and commercial customers. The growing demand for e-mobility prompted ABN AMRO Ventures to invest. This will assist Laka in its mission to become the top green mobility insurtech in Europe. On the other side, ABM AMRO will increase its clientele by providing world-class digital services and assisting them in making the switch to a more sustainable way of life.

Smart Advisor Industry Overview

The smart advisor market is highly competitive because of many players. Some prominent smart advisory companies are dominating the market with their trust among customers. The advisors must find the appropriate balance of data-driven analytics and empathetically-driven discussions to be successful in the business. Data protection is a problem as smart advisor solutions handle the firm's sensitive data. Customers, therefore, favor well-established companies for smart adviser solutions. Some of the known players in this service are eGain, IBM, Cisco, and more.

- May 2023 - Creative Virtual, one of the leading conversational AI companies that enables businesses to deliver seamless, personalized digital support to customers, employees, and contact center agents, released Gluon, a new version of its V-PersonTM technology. Powering Creative Virtual's V-PortalTM and V-Person product suites, the Gluon release has new technical capabilities and provides a better user experience.

- September 2022 - eGain partners with Feet Management company to provide a centralized omnichannel knowledge hub to transform their customer service experience. With its knowledge management expertise and ease of connection with leading CRM systems, eGain Knowledge Hub will support agents in 19 languages in service contact centers across the globe for this fleet management company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Burgeoning Demand for Intelligent Customer Engagement

- 4.2.2 Demand for Automation for Cost Management in the Healthcare

- 4.2.3 Increasing Penetration of Websites and Mobile Applications Integrated with Cloud Computing

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness and Information and Availability as add-in Under Analytics

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment on the Impact of COVID-19 on the Market

5 EMERGING TECHNOLOGY TRENDS

6 MARKET SEGMENTATION

- 6.1 By Offerings

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By End-user Verticals

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Travel and Hospitality

- 6.2.4 Government

- 6.2.5 Other End-user Verticals (Healthcare and Consumer Electronics)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 eGain Corporation

- 7.1.3 Creative Virtual Pvt. Ltd

- 7.1.4 CX Company Limited

- 7.1.5 24/7 Customer Inc.

- 7.1.6 Nuance Communications Inc.

- 7.1.7 Artificial Solutions International AB

- 7.1.8 Next IT Corporation

- 7.1.9 Speakoit Inc.

- 7.1.10 Codebaby Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS