Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687138

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687138

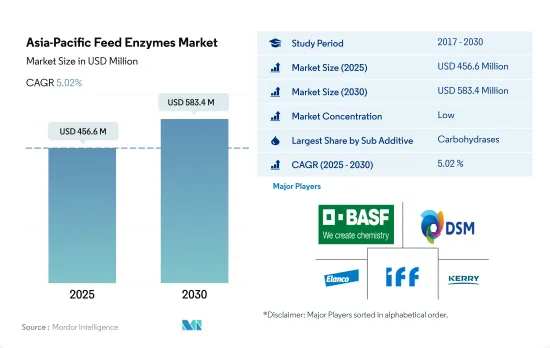

Asia-Pacific Feed Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 235 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Asia-Pacific Feed Enzymes Market size is estimated at 456.6 million USD in 2025, and is expected to reach 583.4 million USD by 2030, growing at a CAGR of 5.02% during the forecast period (2025-2030).

- The Asia-Pacific feed enzymes market witnessed substantial growth in 2022, with enzymes holding a market share of 3.8%. Enzymes play a vital role in animal nutrition and breaking down starch, protein, and fat in the animal body, making them a crucial component in animal feed. In 2022, carbohydrates were the largest segment by value, accounting for USD 174.3 million, primarily due to their ability to boost energy, digest starch, and lower feed costs.

- Phytases were the second-largest segment in the Asia-Pacific feed enzymes market, accounting for USD 128.1 million in 2022. The increasing demand for animal protein and the growing awareness of the benefits of enzymes have significantly contributed to the growth of the feed enzymes market in the region.

- Poultry birds were the market's largest segment by animal type, accounting for 48.2% in 2022. The higher usage of feed enzymes in poultry birds is associated with their higher consumption of cereal, which has a high non-starch polysaccharides content, thus requiring enzymes for digestion.

- China held the largest share of the Asia-Pacific feed enzymes market, with a share of 43.7% in 2022, primarily due to the country's increased poultry headcount by 1.6% during 2017-2022. Owing to such factors and the importance of feed enzymes in animal nutrition, the market is expected to record a CAGR of 5.0% during the forecast period (2023-2029).

- The Asia-Pacific market for feed enzymes has grown steadily in recent years, with feed enzymes accounting for 3.8% of the region's feed additives market value and 1.9% of its volume in 2022. The market is expected to register a CAGR of 4.9% during the forecast period, driven by the essential role that enzymes play in animal breathing and digestion.

- China currently holds the largest share of the Asia-Pacific feed enzymes market, valued at USD 172.9 million in 2022. The large share is due to the country's high meat consumption per person, which is expected to continue rising, as well as a growing livestock population and a shift toward organized livestock farming. India is the second-largest market, and it is expected to register a CAGR of 4.7% during the forecast period to reach a value of USD 51.5 million by 2029. Carbohydrases and phytases are the most widely consumed feed enzymes in India, accounting for 44.3% and 30.4% of the market, respectively.

- Japan is the fastest-growing country in the region, and it is expected to register a CAGR of 5.9% during the forecast period. The country's market is expected to reach a value of USD 32.8 million by 2029, up from USD 21.9 million in 2022, owing to the increasing use of feed enzymes. In the Rest of Asia-Pacific, the growth of the market can be attributed to the increase in feed production, which reached 108.8 million metric tons in 2022.

- The rising use of feed enzymes to support the nutritional requirements of animals is expected to drive the growth of the feed enzymes market in the Asia-Pacific region. The market is expected to reach a value of USD 349.1 million by 2029, registering a CAGR of 4.9%.

Asia-Pacific Feed Enzymes Market Trends

The growing disposable income in developing countries of Asia-Pacific and government support schemes for poultry industry, and China is largest producer of eggs are helping in growth of poultry population in the region

- The Asia-Pacific region dominates the global agricultural sector, with poultry being the largest segment and accounting for 42.4% of global poultry production in 2022. This increase in poultry consumption is driven by the rising popularity of poultry, rapid urbanization, and the growing disposable incomes in developing countries, such as India and Vietnam, which recorded a 37.3% increase in poultry population in 2021 compared to 2017.

- In 2021, China, Indonesia, and India held a significant share of the poultry market in the region, with market shares of 39.7%, 25.3%, and 5.7%, respectively. This growing demand for poultry products can be attributed to the increasing demand for eggs and meat and government schemes supporting the poultry industry. For instance, the Department of Animal Husbandry & Dairy in India is introducing capital fund schemes to support poultry businesses and educate farmers on how to improve their yield quality, which may further boost the market's growth. China is the largest producer of eggs in the world, with consumption and production accounting for over 40% of global production. With over 900 million stock-laying hens and the country's largest layer poultry farming center hatching 60 million chicks per year, the country's layer farming is recording significant growth.

- Broiler production in the region is also rapidly growing due to the increased consumer demand for chicken meat. The Philippines, for instance, recorded a 2.2% increase in chicken meat production in 2021 compared to 2017. The region's poultry production is expected to increase further, driven by a shift in consumer preferences toward poultry meat and the rapid development of the poultry industry. This growth in poultry production may boost the demand for feed additives.

Improvement in fish farming technologies, expansion in number of feed mills and Indian government initiatives are helping in increasing the aquaculture feed production

- The Asia-Pacific region is a major player in the global aquaculture feed production market, with fish and shrimp being the primary products. In 2021, the region produced 37.6 million metric ton of aquaculture feed, which accounted for 8.7% of the region's total feed production. Several countries in the region are focusing on expanding and intensifying their aquaculture production through technological advancements and increased use of feed to meet the growing demand. For instance, India increased its budget allocation to the Department of Fisheries to boost production.

- Fish holds a significant share of aquaculture feed, accounting for 31.1 million metric ton in 2022, an increase of 66% compared to 2017. This growth was due to the conversion of agricultural land to aquaculture ponds, the improvement of fish farming technologies, and the intensification of production. Shrimp feed production accounted for 4.2% of the aquafeed production in the region in 2022. It is expected to increase rapidly during the forecast period as some Asia-Pacific countries are implementing a self-sufficient aquaculture system through several government initiatives to increase the production of certified sustainable seafood.

- China dominated the aquafeed market in the Asia-Pacific region, accounting for 51.2% of the market share in 2022 due to an increase in the number of feed mills with higher capacities. For instance, AB Agri opened its ninth feed mill in China, with an annual capacity of 240,000 ton. Factors such as increasing aquaculture production, expanding aqua farming, and rising feed consumption are expected to drive the growth of aquafeed production in the region during the forecast period.

Asia-Pacific Feed Enzymes Industry Overview

The Asia-Pacific Feed Enzymes Market is fragmented, with the top five companies occupying 26.67%. The major players in this market are BASF SE, DSM Nutritional Products AG, Elanco Animal Health Inc., IFF(Danisco Animal Nutrition) and Kerry Group PLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 55558

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Indonesia

- 4.3.5 Japan

- 4.3.6 Philippines

- 4.3.7 South Korea

- 4.3.8 Thailand

- 4.3.9 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Carbohydrases

- 5.1.2 Phytases

- 5.1.3 Other Enzymes

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Philippines

- 5.3.7 South Korea

- 5.3.8 Thailand

- 5.3.9 Vietnam

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 BASF SE

- 6.4.4 Biovet S.A.

- 6.4.5 Cargill Inc.

- 6.4.6 CBS Bio Platforms Inc.

- 6.4.7 DSM Nutritional Products AG

- 6.4.8 Elanco Animal Health Inc.

- 6.4.9 IFF(Danisco Animal Nutrition)

- 6.4.10 Kerry Group PLC

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.