PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907330

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907330

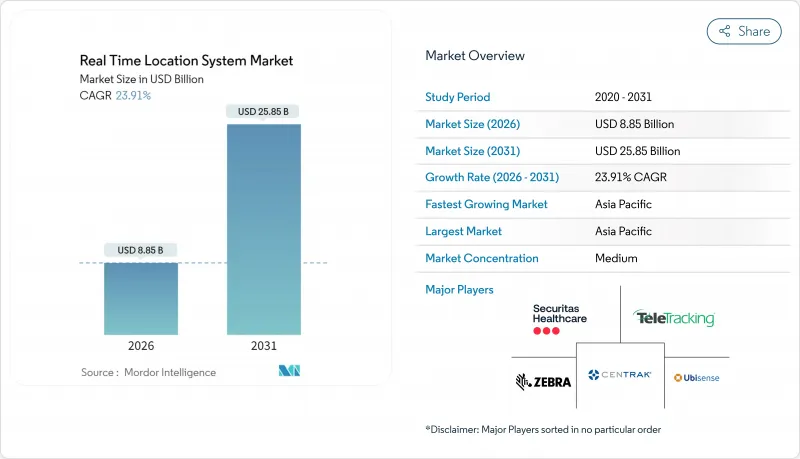

Real Time Location System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Real Time Location System Market is expected to grow from USD 7.14 billion in 2025 to USD 8.85 billion in 2026 and is forecast to reach USD 25.85 billion by 2031 at 23.91% CAGR over 2026-2031.

Healthcare mandates, ultra-wideband (UWB) accuracy gains, and digital-twin rollouts underpin demand expansion in the real time loaction system market, while managed services and cloud delivery models reshape vendor revenue streams. Competitive advantage hinges on precision, interoperability, and cybersecurity assurance as end users migrate from reactive asset handling to predictive workflow orchestration. UWB, Bluetooth Low Energy (BLE), and hybrid platforms widen deployment choices, and regulatory momentum around patient safety and workplace compliance lowers adoption barriers. Capital spending tilts toward software and consulting as enterprises seek quick time-to-value and scalable analytics.

Global Real Time Location System Market Trends and Insights

Need for Cost Reduction and Process Optimisation

Hospitals cite annual savings nearing USD 200,000 from equipment tracking alone, cutting asset search time that once absorbed 30% of clinical shifts . Manufacturing plants overlay RTLS on digital-twin dashboards to flag bottlenecks and enable predictive maintenance that trims downtime by 10%. AI algorithms mine live location data to reveal hidden process waste, delivering measurable ROI in labor-constrained settings. These gains resonate most where payroll inflation and supply-chain volatility squeeze margins, positioning RTLS as a strategic lever for efficiency.

Rapid Adoption in Healthcare and Patient-Safety Mandates

The American Hospital Association expects healthcare RTLS revenue to quadruple by 2032 as systems tackle patient flow, staff duress, and infection control. Panic buttons tied to RTLS precision cut emergency response times by 30%. Hand-hygiene monitoring integrated with badges curbs healthcare-associated infections by more than 40%. Regulatory frameworks increasingly label RTLS as essential infrastructure, accelerating budget approvals and standardizing deployment blueprints. Value-based care payment models further reinforce the link between operational visibility and financial performance within the broader RTLS industry.

Legacy Infrastructure Across End Users

Brown-field factories often run on proprietary protocols with bandwidth limits that choke RTLS data streams, forcing costly network upgrades and phased rollouts. Integration complexity inflates services spend and prolongs deployment cycles, deterring budget-sensitive sectors. Cloud-native RTLS and overlay networks now offer retrofit pathways, but full benefits materialize only after broader IT modernization.

Other drivers and restraints analyzed in the detailed report include:

- Advances in UWB Accuracy and Multi-Modal Tracking Platforms

- Integration with Industry 4.0 Digital-Twin Initiatives

- Privacy and Cyber-Security Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Healthcare generated 41.62% of the real-time location system market size in 2025, reinforcing its role as the anchor vertical that finances ecosystem innovation. Patient flow dashboards tie location telemetry to electronic health records, shortening emergency department wait times and elevating reimbursement metrics. Over the forecast horizon, transportation and logistics will post the steepest revenue climb at a 24.72% CAGR, propelled by last-mile visibility and cold-chain compliance needs. Manufacturing follows as Industry 4.0 retrofits gain policy support in Asia-Pacific.

Healthcare's heavy share of the real-time location system market underscores its regulatory push around infection control and staff safety, creating durable demand for clinical-grade accuracy solutions. Conversely, logistics operators favor ruggedized tags and battery-sipping BLE beacons to scale across containers and trailers. Retailers apply shelf-level tracking to fight out-of-stock losses, while defense agencies pilot autonomous swarm navigation that leans on UWB's resilience to spoofing.

Hardware captured 40.08% of the real-time location system market share in 2025, led by ongoing anchor refresh cycles and tag miniaturization projects. Yet managed services revenue is expanding at 28.13% CAGR, reflecting buyers' preference for outcome-based contracts that bundle hardware, software, and analytics. Edge-ready anchor firmware reduces calibration labor, steering integrators toward subscription models.

Hardware innovation now centers on system-on-chip UWB radios and BLE 5.3 tags with multi-year battery life. Meanwhile, cloud orchestration suites translate raw X-Y-Z data into heatmaps and predictive alerts, unlocking cross-departmental ROI and sustaining services renewal rates. As mid-market buyers enter, turnkey "RTLS-as-a-service" offerings lower capex and shorten negotiation cycles.

The Real-Time Location System (RTLS) Market Report is Segmented by End-User Vertical (Healthcare, Transportation and Logistics, and More), Component (Hardware, Software, Services, and More), Technology (RFID, Wi-Fi, and More), Application (Asset Tracking, Work-In-Process Tracking, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 43.76% of the real-time location system market share in 2025 on the back of extensive healthcare digitization and OSHA-aligned worker safety rules. U.S. providers adopt RTLS to optimize value-based reimbursement, while Canadian hospitals standardize on HL7-integrated location feeds. Logistics carriers across Mexico invest in trailer telematics, widening regional density.

Asia-Pacific is forecast for a 22.88% CAGR through 2031 in the real-time location system (RTLS) market as Chinese smart-factory incentives subsidize UWB anchor installs and Japanese automakers embed real-time tracking in lean production lines. India accelerates hospital modernization via public-private partnerships, while South Korea combines RTLS with private 5G to steer autonomous forklifts in semiconductor fabs.

Europe records steady uptake driven by GDPR-compliant design and industrial IoT frameworks. German automakers deploy hybrid UWB-BLE grids in body-in-white shops, and British NHS trusts expand patient-flow pilots. Middle East and Africa see early wins in oil-and-gas safety zoning, whereas South American miners deploy RFID for underground personnel tracking, signaling diversified growth corridors.

- Zebra Technologies Corporation

- Ubisense Limited

- Securitas Healthcare LLC (Securitas AB)

- TeleTracking Technologies Inc.

- Savi Technology Inc.

- CenTrak Inc. (Halma plc)

- AiRISTA Flow Inc.

- Midmark Corporation

- IDENTEC SOLUTIONS AG

- Sonitor Technologies AS

- Kontakt.io Inc.

- Alien Technology LLC

- Impinj Inc.

- Stanley Healthcare (Stanley Black & Decker)

- Ekahau Inc.

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company (Aruba Networks)

- Honeywell International Inc.

- Siemens Healthineers AG

- Trimble Inc.

- Quuppa Oy

- BlueIOT Technology Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need for cost reduction and process optimisation

- 4.2.2 Rapid adoption in healthcare and patient-safety mandates

- 4.2.3 Advances in UWB accuracy and multi-modal tracking platforms

- 4.2.4 Integration with Industry 4.0 digital-twin initiatives

- 4.2.5 AI-enabled location analytics for hyper-automation

- 4.2.6 Regulatory push for workplace-safety/contact-tracing compliance

- 4.3 Market Restraints

- 4.3.1 Legacy infrastructure across end users

- 4.3.2 Privacy and cyber-security concerns

- 4.3.3 High upfront hardware and calibration costs

- 4.3.4 RF interference risk in dense IoT environments

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End-user Vertical

- 5.1.1 Healthcare

- 5.1.1.1 Major Applications

- 5.1.1.2 Segmentation by Technology

- 5.1.2 Manufacturing

- 5.1.2.1 Major Applications

- 5.1.2.2 Segmentation by Technology

- 5.1.3 Retail

- 5.1.4 Transportation and Logistics

- 5.1.5 Government and Defense

- 5.1.6 Oil and Gas

- 5.1.7 Aerospace and Aviation

- 5.1.8 Mining

- 5.1.9 Agriculture and Livestock

- 5.1.10 Education

- 5.1.11 Hospitality and Entertainment

- 5.1.1 Healthcare

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.2.4 Integration and Consulting

- 5.3 By Technology

- 5.3.1 RFID (Active and Passive)

- 5.3.2 Wi-Fi

- 5.3.3 Bluetooth Low Energy (BLE)

- 5.3.4 Ultra-Wideband (UWB)

- 5.3.5 Infrared (IR)

- 5.3.6 ZigBee

- 5.3.7 GPS / GNSS

- 5.3.8 Ultrasound

- 5.4 By Application

- 5.4.1 Asset Tracking

- 5.4.2 Work-in-Process Tracking

- 5.4.3 Personnel Safety and Security

- 5.4.4 Patient / Resident Monitoring

- 5.4.5 Inventory and Supply-Chain Visibility

- 5.4.6 Environmental and Condition Monitoring

- 5.4.7 Hand-Hygiene Compliance

- 5.4.8 Contact Tracing

- 5.4.9 Theft and Loss Prevention

- 5.4.10 Proximity-Based Marketing

- 5.4.11 Vehicle and Fleet Management

- 5.4.12 Autonomous-Platform Navigation

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Israel

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Turkey

- 5.5.5.1.5 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Zebra Technologies Corporation

- 6.4.2 Ubisense Limited

- 6.4.3 Securitas Healthcare LLC (Securitas AB)

- 6.4.4 TeleTracking Technologies Inc.

- 6.4.5 Savi Technology Inc.

- 6.4.6 CenTrak Inc. (Halma plc)

- 6.4.7 AiRISTA Flow Inc.

- 6.4.8 Midmark Corporation

- 6.4.9 IDENTEC SOLUTIONS AG

- 6.4.10 Sonitor Technologies AS

- 6.4.11 Kontakt.io Inc.

- 6.4.12 Alien Technology LLC

- 6.4.13 Impinj Inc.

- 6.4.14 Stanley Healthcare (Stanley Black & Decker)

- 6.4.15 Ekahau Inc.

- 6.4.16 Cisco Systems Inc.

- 6.4.17 Hewlett Packard Enterprise Company (Aruba Networks)

- 6.4.18 Honeywell International Inc.

- 6.4.19 Siemens Healthineers AG

- 6.4.20 Trimble Inc.

- 6.4.21 Quuppa Oy

- 6.4.22 BlueIOT Technology Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment