PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640506

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640506

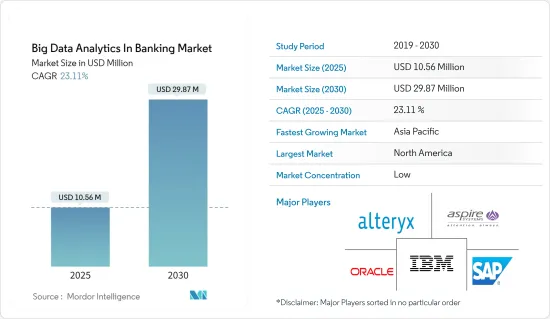

Big Data Analytics In Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Big Data Analytics In Banking Market size is estimated at USD 10.56 million in 2025, and is expected to reach USD 29.87 million by 2030, at a CAGR of 23.11% during the forecast period (2025-2030).

Based on the inputs obtained from numerous insights, such as investment patterns, shopping trends, investment motivation, and personal or financial background, big data analytics can help banks understand client behavior.

Key Highlights

- The considerable increase in the volume of data generated and governmental requirements are the main forces behind adopting Big Data analytics in the banking sector. With the development of technology, consumers are using more and more devices to start transactions (such as smartphones), which impacts the volume of transactions. Given the current data growth rate, better data collection, organization, integration, and analysis are necessary.

- Government rules and considerable data gathering are affecting the banking industry. As technology develops, more consumers are using more devices to start transactions (such as smartphones), which boosts the volume of transactions. This motivates big data analytics, which gives data analysts a single location to see and quickly locate all data points. Thanks to this consolidated picture, team members can exchange insights that could enhance the banking industry.

- A Big Data Analytics solution offers the processing, persistence, and analytic capabilities necessary to unearth fresh business insights while enabling a company to store all its data in a flexible, affordable environment. An analytics tool for big data gathers and keeps track of structured and unstructured data and techniques for arranging enormous amounts of wildly different data from various sources.

- The majority of legacy systems are unable to handle the rising burden. The entire system's stability may be compromised if the necessary amounts of data are gathered, stored, and analyzed utilizing an obsolete infrastructure. Organizations must either improve their processing capacity or entirely redesign their systems to tackle the issue.

Big Data Analytics in Banking Market Trends

Risk Management and Internal Controls Across the Bank to Witness the Growth

- With the use of cutting-edge technologies, banks can reduce credit risk and make better decisions based on a variety of risk criteria. Banks can control credit risk and avert default circumstances thanks to the big data and analytics platform.

- Additionally, a blatant indicator is the retail bank's use of Big Data analytics for credit risk management. It has been demonstrated that applying credit risk indicators based on behavioral patterns in payment transactions allows for the detection of credit events much sooner than conventional indicators based on overdrawn accounts and late payments.

- Real-time fraud detection using data and analytics tools helps reduce credit and liquidity risk by enabling close monitoring of debtors and the ability to foresee loan default.

- Big data can be used to identify high-risk accounts, as demonstrated by The Bank of America. For 9.5 million mortgages, the Corporate Investment Group is responsible for calculating the likelihood of default, which helped Bank of America forecast losses from loan defaults. By cutting the time needed to calculate loan defaults from 96 to 4 hours, the bank was able to increase its efficiency.

Europe to Expected to Witness Significant Growth

- The most well-known rule governing how financial organizations exchange and safeguard customers' private information continues to be the General Data Protection Rule of the European Union.

- Moreover, data exchange was made possible through open application programming interfaces (APIs) as a result of the Payment Services Directive (PSD2) by the European Union. Due to an environment where data can be shared freely, the capacity to collect, handle, and analyze data has grown in importance.

- Additionally, it is anticipated that both the number of customers and regulatory revisions will rise shortly. The demand for customer analytics and intelligence technologies should consequently increase.

- The UK-based Lloyds Banking Group employed data analytics to meet the needs of diverse client categories while optimizing growth in targeted segments.

- European retail banks are using Big Data analytics solutions due to the "open banking" trend, which addresses problems that traditional financial institutions have faced for decades.

Big Data Analytics in Banking Industry Overview

Big Data Analytics In Banking Market is quite fragmented due to the existence of numerous global firms that provide a range of big data analytics solutions for banks for diverse applications, such as fraud detection and management, customer analytics, social media analytics, etc. Oracle Corporation, IBM Corporation, and SAP SE are some of the major market participants.

- February 2023 - Alteryx announced new self-service and enterprise-grade capabilities to its Alteryx Inc cloud-based analytics tool to support clients in making quicker and more informed decisions. With full access to Designer Cloud now included, the platform has been improved to provide employees of all skill levels with an approachable, simple-to-use drag-and-drop interface without compromising data governance or security standards.

- August 2022 - Aspire Systems launches the holistic approach to accelerate implementation. This innovation is powered by AI and drives implementation speeds. With this new autonomous application implementation methodology, Aspire Systems is geared to help businesses derive maximum value out of their Oracle Cloud ERP Application implementation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enforcement of Government Initiatives

- 5.1.2 Risk Management and Internal Controls Across the Bank to Witness the Growth

- 5.1.3 Increasing Volume of Data Generated by Banks

- 5.2 Market Challenges

- 5.2.1 Lack of Data Privacy and Security

6 RELEVANT CASE STUDIES AND USE CASES

7 MARKET SEGMENTATION

- 7.1 By Solution Type

- 7.1.1 Data Discovery and Visualization (DDV)

- 7.1.2 Advanced Analytics (AA)

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia

- 7.2.4 Australia and New Zealand

- 7.2.5 Latin America

- 7.2.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 IBM Corporation

- 8.1.2 SAP SE

- 8.1.3 Oracle Corporation

- 8.1.4 Aspire Systems Inc.

- 8.1.5 Adobe Systems Incorporated

- 8.1.6 Alteryx Inc.

- 8.1.7 Microstrategy Inc.

- 8.1.8 Mayato GmbH

- 8.1.9 Mastercard Inc.

- 8.1.10 ThetaRay Ltd

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET