PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850081

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850081

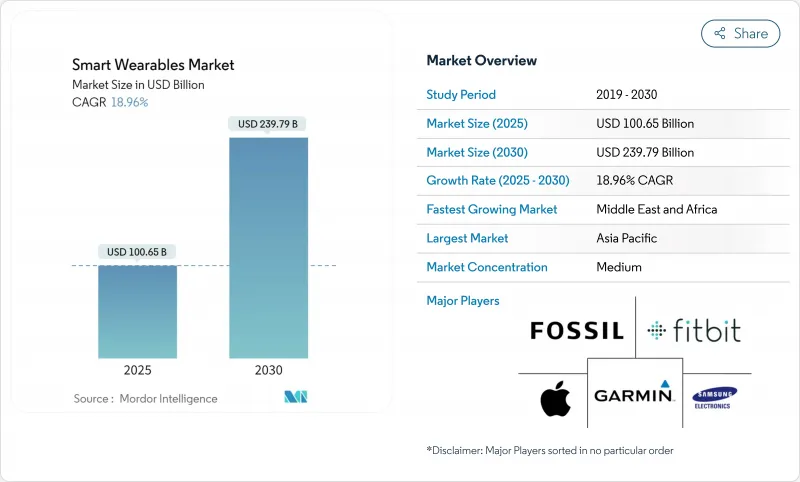

Smart Wearable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart wearable market size stands at USD 100.65 billion in 2025 and is forecast to reach USD 239.79 billion by 2030, advancing at an 18.96% CAGR.

Accelerating sensor innovation, better on-device AI, and broader cellular coverage are expanding use cases from casual wellness to regulated healthcare. Growing insurer reimbursement for remote monitoring, rising enterprise safety mandates, and 5G Stand-Alone roll-outs are opening new addressable segments. Hardware remains dominant, yet recurring services revenue is reshaping vendor economics. Platform-centric strategies and cross-device ecosystems are becoming decisive for user retention and lifetime value across the smart wearable market.

Global Smart Wearable Market Trends and Insights

Insurance-approved wearables for cardiac remote monitoring in North America

Rapid adoption of remote patient monitoring codes under the 2025 Physician Fee Schedule is motivating primary-care practices to prescribe ECG-class wearables. Monthly reimbursements of USD 15-110 per patient lower cost barriers for providers, and hospitals report 15% fewer readmissions for congestive heart failure.] Nearly one-third of US clinics have already embedded continuous monitoring into chronic-care workflows, reflecting a material shift from episodic to longitudinal data capture. Higher patient adherence stems from untethered form factors and real-time clinician feedback loops, reinforcing the growth outlook of the smart wearable market.

China's dual-use smartwatch subsidies under Healthy China 2030

Government incentives that reimburse part of the retail price for devices certified to deliver both lifestyle and medical functions are stimulating local R&D and domestic demand. Brands such as Xiaomi and Huawei leveraged the program to scale unit shipments, accelerating time-to-market for SpO2-grade sensors and arrhythmia detection algorithms. The policy is also harmonizing consumer electronics and medical device standards, reducing regulatory friction for exports across the wider Asia-Pacific smart wearable market.

Data-residency mandates limiting cloud companion apps in Europe

EU regulators now require health data to reside within regional borders, compelling vendors to build local processing stacks or risk feature downgrades. Smaller players face higher compliance costs, while user willingness to share sensitive data remains low, curbing network-effect benefits. Fragmented architectures can lengthen update cycles and complicate multi-region releases, tempering the near-term expansion of the smart wearable market in Europe.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise-grade hearables shaped by EU hybrid-work norms

- Rise of AI-on-chip wearables enabling non-invasive glucose monitoring

- High-density battery thermal-runaway concerns in ultra-slim smartwatches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smartwatches retained clear leadership in 2024 with a 46.5% revenue share. Flagship models combine multi-band GPS, ECG, and medical-grade photoplethysmography while improving battery life through low-temperature poly-silicon OLED panels. Dual-sensor arrays support atrial-fibrillation alerts that comply with FDA Class II requirements, strengthening the clinical utility proposition across the smart wearable market.

Smart rings and jewelry record the fastest growth as miniaturized MCU packages and solid-state batteries support continuous SpO2 and heart-rate tracking in a 3-gram form factor. Premium variants target sleep optimization, whereas mass-market models emphasize discreet activity logging. Hearables broaden the category footprint by integrating temperature and cognitive-load sensors, creating an audio-first gateway into workplace safety programs. Fitness trackers move upscale into recovery analytics and VO2-based training readiness, while head-mounted displays gain traction in surgical guidance and field maintenance. Early-generation smart textiles embed stretchable electrodes for posture correction and stress detection, hinting at future expansion of the smart wearable market into everyday apparel.

Core silicon, optical modules, and batteries accounted for 74.1% of 2024 revenue. Suppliers advance 6-nanometer chipsets with neural acceleration to enable on-device classification for arrhythmia and blood-oxygen anomalies. Flexible AMOLED panels and low-loss RF front ends improve efficiency, extending single-charge endurance to seven days on flagship watches.

Recurring services are growing on the back of premium analytics, personalized coaching, and EHR integration. Vendors bundle AI-based sleep improvement plans or nutrition guidance into monthly tiers, lifting average revenue per user and smoothing upgrade cycles. Software remains the glue layer, supporting over-the-air feature extensions that lengthen device lifetimes and fortify ecosystem lock-in in the smart wearable market.

The Smart Wearable Market Report is Segmented by Product (Smartwatches, Hearables, and More), Component (Hardware, Software and Apps, and Services and Subscriptions), Connectivity Technology (Bluetooth/BLE, Cellular, and More), Application/End-use (Consumer Electronics and Lifestyle, Healthcare and Medical, and More), Distribution Channel (Online, Offline), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 34.9% of 2024 revenue. Vertically integrated supply chains enable rapid cost declines and two-month model refreshes. Government programs subsidize ECG-enabled wearables, raising adoption among first-time buyers and chronic-disease patients.

North America remains the premium epicenter, underpinned by early medical credentialing and robust payer engagement. Reimbursement for remote patient monitoring widens device access, and institutional research validates predictive models, reinforcing trust in the smart wearable market.

Europe balances strong demand with strict data-sovereignty rules. Vendors deploy edge-only analytics and in-region data lakes to comply with GDPR, while corporate safety mandates accelerate hearables roll-outs.

The Middle East and Africa post the highest growth at 20.7% CAGR, catalyzed by 5G Advanced coverage and national e-health blueprints that leverage wearables to extend care to under-served communities. South America sees uneven uptake due to currency swings and 5G cost, but localization partnerships and wellness subsidies in Brazil and Mexico provide momentum.

- Apple Inc.

- Samsung Electronics Co. Ltd

- Alphabet Inc. (Fitbit and Google Pixel)

- Garmin Ltd

- Huawei Technologies Co. Ltd

- Xiaomi Corp.

- BOBOVR

- Sony Corp.

- Microsoft Corp.

- Meta Platforms Inc. (Oculus)

- Huami Corp. (Zepp Health)

- Withings SA

- Omron Healthcare Inc.

- Cyberdyne Inc.

- Ekso Bionics Holdings Inc.

- GoPro Inc.

- Fossil Group Inc.

- Nuheara Ltd.

- Bragi GmbH

- Sensoria Inc.

- AIQ Smart Clothing Inc.

- Polar Electro Oy

- Coros Wearables Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Insurance-approved Wearables for Cardiac Remote Monitoring in North America

- 4.2.2 China's Dual-Use (Consumer + Medical) Smartwatch Subsidies through Healthy China 2030

- 4.2.3 Enterprise-grade Hearables Adoption Driven by EU's Hybrid-Work Safety NormsPost-COVID

- 4.2.4 Rise of AI-on-Chip Wearables Enabling Continuous Glucose Monitoring without Needles

- 4.2.5 Defense Exoskeleton Procurements under United States Soldier Lethality Program

- 4.2.6 Pay-as-you-Lift Industrial Exoskeleton Leasing in South-East Asia's Construction Sector

- 4.3 Market Restraints

- 4.3.1 Data-Residency Mandates Limiting Cloud Companion Apps in Europe

- 4.3.2 High-Density Battery Thermal Runaway Concerns in Ultra-Slim Smartwatches

- 4.3.3 Patent-Licensing Litigation Costs for Gesture-Based Smart Rings

- 4.3.4 Low ARPU in LATAM Limiting 5G Stand-alone Wearable Roll-outs

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product

- 5.1.1 Smartwatches

- 5.1.2 Hearables (Ear-Worn/Smart Earbuds)

- 5.1.3 Fitness and Activity Trackers

- 5.1.4 Head-Mounted Displays (AR/VR/MR)

- 5.1.5 Smart Clothing and Textiles

- 5.1.6 Body-worn Cameras

- 5.1.7 Smart Rings and Jewelry

- 5.1.8 Medical Wearable Patches and Biosensors

- 5.1.9 Powered Exoskeletons

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software and Apps

- 5.2.3 Services and Subscriptions

- 5.3 By Connectivity Technology

- 5.3.1 Bluetooth/BLE

- 5.3.2 Cellular (3G/4G/LTE-M)

- 5.3.3 5G Stand-Alone

- 5.3.4 NFC/RFID

- 5.3.5 Wi-Fi/WLAN

- 5.3.6 Others (UWB, ANT+)

- 5.4 By Application/End-use

- 5.4.1 Consumer Electronics and Lifestyle

- 5.4.2 Healthcare and Medical

- 5.4.3 Fitness and Sports

- 5.4.4 Industrial and Enterprise Safety

- 5.4.5 Military and Defense

- 5.5 By Distribution Channel

- 5.5.1 Online (Brand E-store, Marketplaces)

- 5.5.2 Offline (Consumer Electronics Stores, Specialty, Clinics)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 South East Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Apple Inc.

- 6.4.2 Samsung Electronics Co. Ltd

- 6.4.3 Alphabet Inc. (Fitbit and Google Pixel)

- 6.4.4 Garmin Ltd

- 6.4.5 Huawei Technologies Co. Ltd

- 6.4.6 Xiaomi Corp.

- 6.4.7 BOBOVR

- 6.4.8 Sony Corp.

- 6.4.9 Microsoft Corp.

- 6.4.10 Meta Platforms Inc. (Oculus)

- 6.4.11 Huami Corp. (Zepp Health)

- 6.4.12 Withings SA

- 6.4.13 Omron Healthcare Inc.

- 6.4.14 Cyberdyne Inc.

- 6.4.15 Ekso Bionics Holdings Inc.

- 6.4.16 GoPro Inc.

- 6.4.17 Fossil Group Inc.

- 6.4.18 Nuheara Ltd.

- 6.4.19 Bragi GmbH

- 6.4.20 Sensoria Inc.

- 6.4.21 AIQ Smart Clothing Inc.

- 6.4.22 Polar Electro Oy

- 6.4.23 Coros Wearables Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment