PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851991

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851991

E-prescribing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

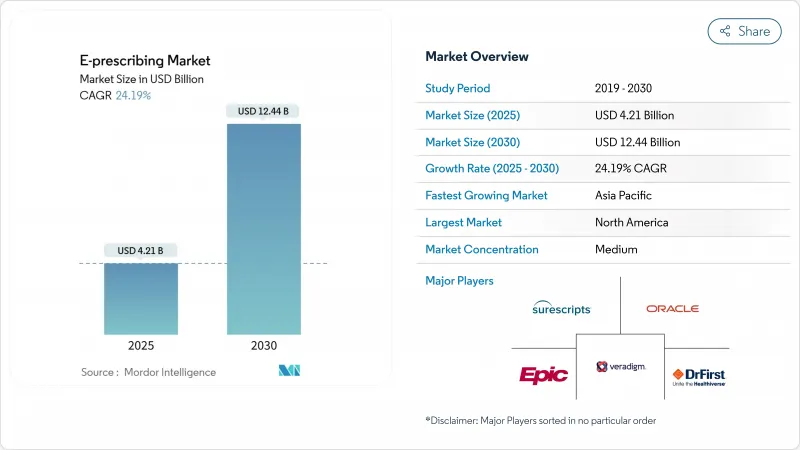

The electronic prescribing market size reached USD 4.21 billion in 2025 and is forecast to climb to USD 12.44 billion by 2030, advancing at a 24.19% CAGR.

Regulatory mandates, healthcare digitization, and the need to curb prescription fraud that costs the United States about USD 250 billion every year continue to accelerate demand. Momentum is further supported by the Drug Enforcement Administration's decision to extend telemedicine prescribing flexibilities for Schedule II-V medications through December 2025. Rapid adoption across hospitals, clinics, pharmacies, and growing telehealth networks keeps the electronic prescribing market on a robust growth path.

North America held 38.54% of the electronic prescribing market in 2024, lifted by the Centers for Medicare & Medicaid Services (CMS) rule obligating providers to write at least 70% of controlled substance prescriptions electronically, with enforcement that began in 2023. Asia-Pacific is expanding at a 25.45% CAGR through 2030 due to Japan's medical DX program that links My Number cards to electronic prescriptions and China's three-medical linkage reforms that connect care, insurance, and pharmaceutical supply chains. Software remained dominant with 65.45% share in 2024, yet services are the fastest-growing component at 26.45% CAGR. Integrated EHR or hospital information systems account for 72.34% of usage, but mobile-first apps are rising at 26.56% CAGR. Cloud delivery leads with 54.34%, and controlled substances (EPCS) form the largest prescription class at 38.54%, while specialty drugs grow fastest at 25.67% CAGR.

Global E-prescribing Market Trends and Insights

Government Mandates for Electronic Prescription Adoption

Mandatory e-prescribing laws are realigning prescription workflows worldwide. The DEA's forthcoming special registration framework introduces three tiers of telemedicine authorization, obliging clinicians to hold state-specific telemedicine credentials and use electronic prescriptions for Schedule II-V drugs. California's rule that all prescriptions-controlled or not-be electronic since January 2022 shows how quickly mandates expand, with 35 states now enforcing EPCS legislation. CMS has already confirmed the transition to NCPDP SCRIPT Standard version 2023011 in January 2028, compelling systems to support real-time benefit tools and enhanced formulary data. A federal requirement to check state Prescription Drug Monitoring Programs is set for implementation within three years, further cementing e-prescribing as the only secure route for controlled substances. These cascading rules create a replacement cycle that drives the electronic prescribing market far beyond organic growth.

Rising Focus On Medication Safety And Quality Of Care

Patient-safety imperatives push healthcare systems to adopt advanced prescribing tools that reduce errors linked to 125,000 deaths a year in the United States. Surescripts' Sig IQ translated 4.1 billion patient directions in 2024, converting free text to structured instructions that cut emergency department visits for adverse events. Epic Systems embedded more than 100 AI-based prescription management features that screen interactions and suggest optimal dosing. The DEA also requires biometric authentication with a false match rate below 0.001 for EPCS, escalating security needs that favor premium platforms. Medication therapy management systems now combine prescription histories with real-time adherence monitoring, addressing USD 250 billion in annual non-adherence costs. Real-time benefit tools further enhance safety by saving patients USD 37 per prescription through on-screen cost and formulary feedback.

Data Privacy And Cybersecurity Concerns

Healthcare remains a prime ransomware target. The Change Healthcare attack interrupted prescription workflows for more than one-third of U.S. patients, forcing emergency paper-based processes. The DEA has also warned about EHR credential theft that allows criminals to generate massive volumes of fraudulent scripts. Legislative proposals like the Health Care Cybersecurity Improvement Act would tie Medicare payments to security readiness, adding cost burdens for small practices. Mandatory two-factor authentication, digital signatures, and detailed audit trails further raise operating complexity. Rural or small providers often lack funds and expertise to meet stringent requirements, slowing adoption and narrowing the electronic prescribing market in underserved regions.

Other drivers and restraints analyzed in the detailed report include:

- Need For Healthcare Cost Reduction And Operational Efficiency

- Growing Penetration Of Cloud-Based Healthcare IT Infrastructure

- Lack Of Interoperability And Data Standardization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024 software accounted for 65.45% of revenue, reflecting core licensing demand across hospitals and clinics. Services, however, projected at a 26.45% CAGR, underline how organizations now value onboarding support, regulatory guidance, and continuous optimization. Surescripts' 4.1 billion Sig IQ instructions in 2024 illustrate a shift from basic data transport to value-added medication management.

The services boom reinforces that technology alone does not solve prescribing challenges. Implementation now routinely covers classroom training, change-management workshops, and help-desk outsourcing. This service overlay creates sticky, subscription-like income for vendors and sustains the electronic prescribing market even in mature geographies. Recurrent upgrades to meet DEA biometrics or upcoming SCRIPT standards secure the segment's long-term growth trajectory.

Integrated EHR or HIS solutions held 72.34% of the electronic prescribing market in 2024, capitalizing on their embedded role in point-of-care workflow. Mobile-first apps are catching up with a 26.56% CAGR thanks to secure tablets and smartphones that enable immediate order entry during rounds or home visits. Stand-alone systems stay relevant in niche environments where full EHR rollouts remain impractical.

Epic's wave of AI-enabled prescribing tools demonstrates how EHR giants defend share, while smaller mobile entrants compete on usability and low upfront cost. Mobile solutions also serve outreach programs, pop-up clinics, and disaster zones. Yet integrated suites still provide deeper access to lab values, problem lists, and decision support-capabilities crucial for complex polypharmacy management.

The E-Prescribing Market Report is Segmented by Component (Hardware, and More), Type of System (Stand-Alone Systems, and More), Delivery Mode (Cloud-Based, Web-Based, and More), Prescription Type (NewRx. And More), End User (Hospitals, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated the electronic prescribing market with 38.54% share in 2024, sustained by mature network infrastructure and strong federal mandates. Surescripts routed 2.5 billion prescriptions on its U.S. platform that year, highlighting entrenched adoption. Persistent cybersecurity events such as the Change Healthcare breach and ongoing data-sharing challenges underscore the region's future investment needs, yet incentives embedded in Medicare and commercial insurance maintain growth momentum.

Asia-Pacific posted the fastest trajectory at 25.45% CAGR through 2030. Japan is rolling out a nationwide database that links every citizen's My Number ID to prescription histories, while China builds integrated treatment-insurance-pharmacy networks under its three-medical linkage policy. Governments in India, South Korea, and Australia are equally prioritizing national drug monitoring systems, creating leapfrog opportunities that let providers deploy cloud and mobile solutions without legacy constraints. A projected USD 138 billion healthcare outlay in China by 2027 offers substantial room for electronic prescribing market expansion.

Europe exhibits steady progress driven by Germany's e-Rezept program and the NHS mobile-app prescription service that now handles 3.1 million repeat requests monthly. Diverse regulatory environments across 27 EU states slow harmonization, but strict data-protection frameworks bolster consumer trust. South America along with the Middle East & Africa remain nascent but attractive; public-sector digitization drives early projects in Brazil, Saudi Arabia, and the United Arab Emirates. The global outlook therefore pairs mature usage in North America and Europe with rapid scale-up in Asia-Pacific and selective pilot adoption across emerging regions, sustaining long-term growth for the electronic prescribing market.

- Veradigm

- Surescripts

- Epic Systems

- Oracle

- DrFirst

- eClinicalWorks

- NextGen Healthcare

- Meditech

- Greenway Health

- Practice Fusion

- McKesson (CoverMyMeds)

- Omnicell

- RelayHealth (Change Healthcare)

- RxNT

- DoseSpot

- CompuGroup Medical (eMDs)

- WellSky

- Altera Digital Health

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Mandates for Electronic Prescription Adoption

- 4.2.2 Rising Focus on Medication Safety And Quality of Care

- 4.2.3 Need For Healthcare Cost Reduction and Operational Efficiency

- 4.2.4 Growing Penetration of Cloud-Based Healthcare IT Infrastructure

- 4.2.5 Expansion of Telehealth and Digital Pharmacy Ecosystems

- 4.2.6 Emerging Value-Based Care and Medication Price Transparency

- 4.3 Market Restraints

- 4.3.1 Data Privacy and Cybersecurity Concerns

- 4.3.2 Lack of Interoperability and Data Standardization

- 4.3.3 Provider Workflow Disruption and Usability Barriers

- 4.3.4 Limited Technical Expertise in Small and Rural Practices

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type of System

- 5.2.1 Stand-alone Systems

- 5.2.2 Integrated EHR/HIS Systems

- 5.2.3 Mobile-first Apps

- 5.3 By Delivery Mode

- 5.3.1 Cloud-based

- 5.3.2 Web-based

- 5.3.3 On-premise

- 5.3.4 API Platform-as-a-Service

- 5.4 By Prescription Type

- 5.4.1 NewRx

- 5.4.2 Refill / Renewal

- 5.4.3 Controlled Substances (EPCS)

- 5.4.4 Specialty Drugs

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Clinics

- 5.5.3 Pharmacies & Mail-order

- 5.5.4 Telehealth Providers

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Veradigm LLC

- 6.3.2 Surescripts

- 6.3.3 Epic Systems Corporation

- 6.3.4 Oracle (Cerner)

- 6.3.5 DrFirst

- 6.3.6 eClinicalWorks

- 6.3.7 NextGen Healthcare

- 6.3.8 MEDITECH

- 6.3.9 Greenway Health

- 6.3.10 Practice Fusion

- 6.3.11 McKesson (CoverMyMeds)

- 6.3.12 Omnicell

- 6.3.13 RelayHealth (Change Healthcare)

- 6.3.14 RxNT

- 6.3.15 DoseSpot

- 6.3.16 CompuGroup Medical (eMDs)

- 6.3.17 WellSky

- 6.3.18 Altera Digital Health

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment