Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685916

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685916

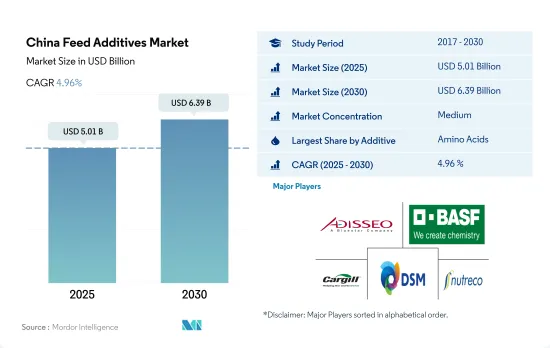

China Feed Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 416 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The China Feed Additives Market size is estimated at 5.01 billion USD in 2025, and is expected to reach 6.39 billion USD by 2030, growing at a CAGR of 4.96% during the forecast period (2025-2030).

- The Chinese feed additives market witnessed significant changes in 2020 due to the COVID-19 pandemic. In 2022, amino acids, binders, minerals, probiotics, and prebiotics emerged as the major feed additive types, accounting for nearly 59% of the market. Lysine and methionine, in particular, were popularly used in commercial cultivation due to their benefits, such as improved gut health and easy digestion in animals, making them the largest contributors to the feed amino acids market.

- Synthetic binders held the largest share of the Chinese binders market in 2022, accounting for 70.4% of the total market value. They serve not only in pellet feed but also help in preventing diseases by improving digestion and nutrition intake in animals. Among different animal types, poultry birds dominated the feed additives market, constituting 48.1% of the market, followed by swine and aquaculture species. The high feed intake and the higher feed production of poultry birds, which exceeded 0.13 billion metric ton in 2022, were the main factors for their higher market share.

- Antioxidants emerged as the fastest-growing segment in the Chinese feed additives market, with a CAGR of 5.7% during the forecast period. They play a crucial role in prolonging the shelf life of animal feeds, with citric acid having importance in reducing the colonization of pathogens and limiting the production of toxic metabolites while improving the availability of protein, Ca, P, Mg, and Zn.

- With the increase in the commercial cultivation of animals, the benefits of feed additives such as increased shelf life of feed, and the importance of feed additives in animal nutrition, the demand for feed additives is anticipated to register a CAGR of 4.9% during the forecast period.

China Feed Additives Market Trends

Increasing per capita consumption of poultry products and African Swine Fever (ASF) affecting swine helped in increasing the poultry demand and poultry production

- China's poultry industry holds a dominant position in the global market, with the major producers of poultry located in Beijing, Tianjin, Shanghai, Shandong, and Guangdong. The sector's growth is primarily attributed to rising population and urbanization, increased income levels, and shifting consumer preferences toward poultry meat as a result of the African swine fever outbreak that led to a reduction in the pork meat supply. From 2017 to 2022, China's per capita consumption of poultry increased by 2.06 kg, further driving the demand for poultry products.

- The country's poultry industry produces chickens, ostriches, and quails, with chickens being the major poultry bird, accounting for 495.9 million heads and 40% of the global egg production in 2022. The increasing adoption of layer farming has contributed to this, with over 900 million stock-laying hens and 60 million chicks hatching annually at the country's largest layer poultry farming center. Poultry meat consumption in China is on the rise due to favorable prices, increasing awareness of high-protein diets, and a shift in consumer preferences. As a result, broilers are raised at a higher rate to meet the demand for poultry meat. To improve productivity and meet the growing demand for poultry products, three domestic varieties of broiler genetics were released in 2021, including Shengze 901, Guangming No. 2, and Wode 188.

- The continued investment, and increasing per capita consumption, are expected to drive the growth of the poultry industry in China during the forecast period. Additionally, the increasing awareness of health benefits associated with high-protein diets and the nutritional value of poultry meat is also anticipated to fuel the growth of the poultry industry in the country.

Rising demand for seafood and shifting of producers from conventional feed to compound feed is increasing the feed production for aquaculture species

- The aquaculture feed production in China witnessed a significant increase of 54.1% in 2022, reaching 22.8 million metric tons compared to 2017. However, there was a 21.3% drop in 2020 from the previous year due to the COVID-19 pandemic and the resulting closure of feed industries. The rapid expansion of aquaculture production in China is driven by the increasing seafood demand in the country and the expansion of feed production units. For instance, Grobest China established a new aquaculture feed factory in Guangdong Leizhou with an investment of USD 37.7 million and an annual production capacity of 250,000 tons.

- Fish is the primary aquaculture species in China, and feed production increased by 3.2% in 2022 from the previous year due to increased demand for feed as the cultivation of fish increased to 37.5 million metric tons in 2022 from 37.4 million metric tons in 2018. Producers are shifting from conventional feed to compound feed due to the increasing awareness about nutrient management and good farming practices.

- In 2022, shrimp accounted for 2.9% of the aquafeed market share in the country, with a production of 0.6 million metric tons. The demand for shrimp feed in China is strongly driven by the increasing demand for shrimps as Chinese consumers undergo a nutrition transition. Shrimps are a good source of antioxidants and astaxanthin, which bolsters the nervous and musculoskeletal systems. The rapid expansion of the aquaculture sector and increasing awareness about nutrient management in aquaculture production are expected to boost market growth during the forecast period.

China Feed Additives Industry Overview

The China Feed Additives Market is moderately consolidated, with the top five companies occupying 41.65%. The major players in this market are Adisseo, BASF SE, Cargill Inc., DSM Nutritional Products AG and SHV (Nutreco NV) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49258

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Additive

- 5.1.1 Acidifiers

- 5.1.1.1 By Sub Additive

- 5.1.1.1.1 Fumaric Acid

- 5.1.1.1.2 Lactic Acid

- 5.1.1.1.3 Propionic Acid

- 5.1.1.1.4 Other Acidifiers

- 5.1.2 Amino Acids

- 5.1.2.1 By Sub Additive

- 5.1.2.1.1 Lysine

- 5.1.2.1.2 Methionine

- 5.1.2.1.3 Threonine

- 5.1.2.1.4 Tryptophan

- 5.1.2.1.5 Other Amino Acids

- 5.1.3 Antibiotics

- 5.1.3.1 By Sub Additive

- 5.1.3.1.1 Bacitracin

- 5.1.3.1.2 Penicillins

- 5.1.3.1.3 Tetracyclines

- 5.1.3.1.4 Tylosin

- 5.1.3.1.5 Other Antibiotics

- 5.1.4 Antioxidants

- 5.1.4.1 By Sub Additive

- 5.1.4.1.1 Butylated Hydroxyanisole (BHA)

- 5.1.4.1.2 Butylated Hydroxytoluene (BHT)

- 5.1.4.1.3 Citric Acid

- 5.1.4.1.4 Ethoxyquin

- 5.1.4.1.5 Propyl Gallate

- 5.1.4.1.6 Tocopherols

- 5.1.4.1.7 Other Antioxidants

- 5.1.5 Binders

- 5.1.5.1 By Sub Additive

- 5.1.5.1.1 Natural Binders

- 5.1.5.1.2 Synthetic Binders

- 5.1.6 Enzymes

- 5.1.6.1 By Sub Additive

- 5.1.6.1.1 Carbohydrases

- 5.1.6.1.2 Phytases

- 5.1.6.1.3 Other Enzymes

- 5.1.7 Flavors & Sweeteners

- 5.1.7.1 By Sub Additive

- 5.1.7.1.1 Flavors

- 5.1.7.1.2 Sweeteners

- 5.1.8 Minerals

- 5.1.8.1 By Sub Additive

- 5.1.8.1.1 Macrominerals

- 5.1.8.1.2 Microminerals

- 5.1.9 Mycotoxin Detoxifiers

- 5.1.9.1 By Sub Additive

- 5.1.9.1.1 Binders

- 5.1.9.1.2 Biotransformers

- 5.1.9.1.3 Other Mycotoxin Detoxifiers

- 5.1.10 Phytogenics

- 5.1.10.1 By Sub Additive

- 5.1.10.1.1 Essential Oil

- 5.1.10.1.2 Herbs & Spices

- 5.1.10.1.3 Other Phytogenics

- 5.1.11 Pigments

- 5.1.11.1 By Sub Additive

- 5.1.11.1.1 Carotenoids

- 5.1.11.1.2 Curcumin & Spirulina

- 5.1.12 Prebiotics

- 5.1.12.1 By Sub Additive

- 5.1.12.1.1 Fructo Oligosaccharides

- 5.1.12.1.2 Galacto Oligosaccharides

- 5.1.12.1.3 Inulin

- 5.1.12.1.4 Lactulose

- 5.1.12.1.5 Mannan Oligosaccharides

- 5.1.12.1.6 Xylo Oligosaccharides

- 5.1.12.1.7 Other Prebiotics

- 5.1.13 Probiotics

- 5.1.13.1 By Sub Additive

- 5.1.13.1.1 Bifidobacteria

- 5.1.13.1.2 Enterococcus

- 5.1.13.1.3 Lactobacilli

- 5.1.13.1.4 Pediococcus

- 5.1.13.1.5 Streptococcus

- 5.1.13.1.6 Other Probiotics

- 5.1.14 Vitamins

- 5.1.14.1 By Sub Additive

- 5.1.14.1.1 Vitamin A

- 5.1.14.1.2 Vitamin B

- 5.1.14.1.3 Vitamin C

- 5.1.14.1.4 Vitamin E

- 5.1.14.1.5 Other Vitamins

- 5.1.15 Yeast

- 5.1.15.1 By Sub Additive

- 5.1.15.1.1 Live Yeast

- 5.1.15.1.2 Selenium Yeast

- 5.1.15.1.3 Spent Yeast

- 5.1.15.1.4 Torula Dried Yeast

- 5.1.15.1.5 Whey Yeast

- 5.1.15.1.6 Yeast Derivatives

- 5.1.1 Acidifiers

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Ajinomoto Co., Inc.

- 6.4.3 Alltech, Inc.

- 6.4.4 Archer Daniel Midland Co.

- 6.4.5 BASF SE

- 6.4.6 Cargill Inc.

- 6.4.7 DSM Nutritional Products AG

- 6.4.8 Kerry Group Plc

- 6.4.9 Prinova Group LLC

- 6.4.10 SHV (Nutreco NV)

- 6.4.11 Solvay S.A.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.