PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849825

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849825

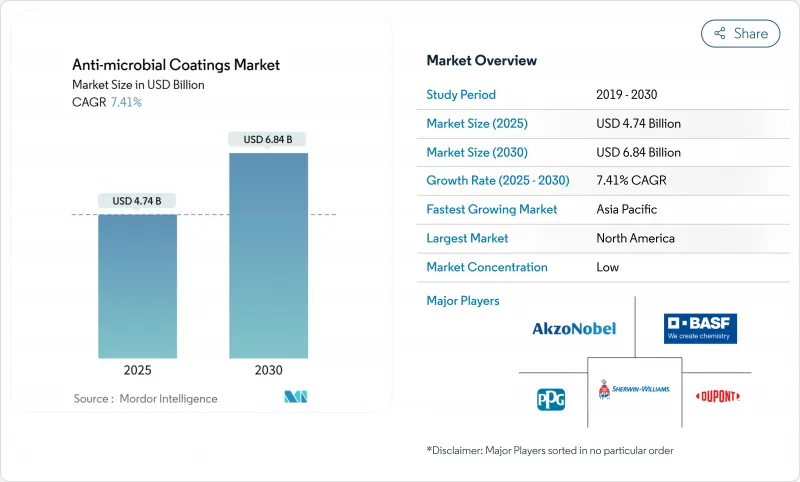

Anti-microbial Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Anti-microbial Coatings Market size is estimated at USD 4.74 billion in 2025, and is expected to reach USD 6.84 billion by 2030, at a CAGR of 7.41% during the forecast period (2025-2030).Heightened infection-control standards in hospitals, cold-chain logistics growth, and tighter volatile-organic-compound rules are reinforcing long-term demand.

Silver-based formulations retained primacy with 49% of 2024 revenue, yet waterborne organic chemistries are accelerating on a 9.67% CAGR as buyers prioritize lower environmental impact. North America accounted for the largest regional demand, supported by strict hospital-acquired infection (HAI) protocols, whereas Asia-Pacific is advancing fastest on a broad industrial base and expanding manufacturing capacity. Competitive intensity centers on functional innovation, nanostructured actives, non-leaching binders, and multi-property systems capable of bonding to composites and engineered polymers, rather than on price. Smaller specialists are gaining traction by tailoring solutions to touch-interface electronics, refrigerated logistics, and high-hygiene construction materials.

Global Anti-microbial Coatings Market Trends and Insights

HAI-reduction initiatives in North America

Hospital administrators are installing surface treatments after clinical studies recorded 36% lower pooled HAIs and 75-79% bacterial load reductions on treated intensive-care surfaces. Although antimicrobial paints cost 20-50% more than standard coatings, shorter recovery times and lower readmission rates justify the premium. Transparent top-coats enable retrofits without altering aesthetics; nano-enabled variants sustain efficacy between routine cleanings.

Cold-chain Growth in India and ASEAN

Temperature-controlled warehousing is expanding, and end users prefer powder systems that cure uniformly at lower temperatures and resist abrasion inside refrigeration units. Harmonized ASEAN food-safety rules are standardizing antimicrobial specifications, prompting factory-installed solutions for conveyer frames, shelving, and insulated panels.

Lack of technological awareness

Facility managers in many developing countries remain unconvinced of life-cycle savings, and contractors often lack application training. Fragmented distribution limits access to technical support, slowing uptake even where financing exists. Industry coalitions are piloting demonstration projects in public hospitals to showcase healthcare cost reductions from infection prevention.

Other drivers and restraints analyzed in the detailed report include:

- Touch-interface Hygiene Adoption

- VOC-cap Regulations

- Emission of active ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silver commanded 49% of the anti-microbial coatings market in 2024 thanks to broad-spectrum efficacy and regulatory familiarity. Silver nanoparticles disrupt bacterial respiration and enzyme activity, stalling resistance development and supporting adoption in high-risk settings. Advances in biogenic silver systems now deliver antioxidant benefits alongside antimicrobial protection, widening food-contact use cases.

Organic chemistries, rooted in natural antimicrobials, are forecast to rise at 9.67% CAGR. They appeal to brands seeking heavy-metal-free labels and improved end-of-life profiles. Copper remains a durable option, yet supply volatility-intensified by labor strikes at Chilean mines-tightens margins and extends lead times. Polymeric actives occupy niche roles where flexibility, clarity, or compatibility with elastomers outweigh maximum microbicidal strength.

Silver's premium pricing historically limited use outside healthcare, but nano-enabled surface area gains and lower dosage thresholds now support cost-effective deployment in HVAC fins, elevator buttons, and consumer appliances. Organic systems based on quaternary ammonium, chitosan, or plant-derived extracts demonstrate high kill rates while meeting allergen-safety thresholds, unlocking school, office, and residential coatings. Adoption accelerates as formulators optimize dispersion to preserve film clarity and hardness comparable to conventional acrylics.

The Antimicrobial Coatings Market Report Segments the Industry by Material (Silver, Copper, Polymeric, Organic, and Other Materials), Coating Form (Powder, Liquid, and Others), Application (Building and Construction, Food Processing, Textiles, Home Appliances, Healthcare, Marine, and Other Applications) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

North America represented 45% of the anti-microbial coatings market revenue in 2024. Stringent HAI standards drive hospital retrofits, and federal infrastructure spending includes allocations for hygienic public-facility materials. Asia-Pacific is forecast to post an 8.98% CAGR through 2030. China scales advanced manufacturing, India's "Make in India" accelerates domestic output of functional additives, and ASEAN capital spending on refrigerated logistics boosts powder-coating orders.

Europe holds a sizeable share, underpinned by chemical-safety legislation. The region's REACH framework hastens the pivot to metal-free systems and drives research and development tax incentives for bio-based actives.

The Middle East and Africa, and South America show nascent but rising demand. Gulf Cooperation Council hospitals invest in infection-control measures as medical tourism grows, while Brazilian meat-processing plants retrofit cold rooms to meet export standards. Limited local manufacturing capacity opens partnership opportunities for global suppliers.

- 3M

- Advanced Nanotech Lab

- AGC Inc.

- Akzo Nobel N.V.

- AST Products, Inc.

- Axalta Coating Systems, LLC

- BASF

- BioCote Limited

- Bio-Fence

- Covalon Technologies Ltd.

- Diamond Vogel

- dsm-firmenich

- DuPont

- Henkel AG & Co. KGaA

- Hydromer

- Lonza

- Microban International

- NEI Corporation

- Novapura AG

- PPG Industries, Inc.

- Sciessent LLC

- Sono-Tek Corporation

- Specialty Coating Systems Inc.

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 HAI-Reduction Programs Accelerating Hospital Surface Coating Uptake in North America

- 4.2.2 Cold-Chain Expansion in India and ASEAN Propelling Antimicrobial Powder Demand

- 4.2.3 Touch-Interface Hygiene Requirements Driving Electronics OEM Coating Integration

- 4.2.4 Increasing Demand for Germ Resistant Durable Goods

- 4.2.5 VOC-Cap Compliance Shifting Demand Toward Water-borne and Nano Formulations in North America and Europe

- 4.3 Market Restraints

- 4.3.1 Lack of Technological Awareness in Developing and Under-developed Nations

- 4.3.2 Emission of Active Ingredients

- 4.3.3 Chilean Copper-Ore Supply Strikes Inflating Raw-Material Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 Silver

- 5.1.2 Copper

- 5.1.3 Polymeric

- 5.1.4 Organic

- 5.1.5 Other Materials

- 5.2 By Coating Form

- 5.2.1 Powder

- 5.2.2 Liquid (Solvent- and Water-borne)

- 5.2.3 Others (Nano-Engineered Sprays and Films, Surface Modification Treatments)

- 5.3 By Application

- 5.3.1 Building and Construction

- 5.3.2 Food Processing

- 5.3.3 Textiles

- 5.3.4 Home Appliances

- 5.3.5 Healthcare

- 5.3.6 Marine

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JV, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Advanced Nanotech Lab

- 6.4.3 AGC Inc.

- 6.4.4 Akzo Nobel N.V.

- 6.4.5 AST Products, Inc.

- 6.4.6 Axalta Coating Systems, LLC

- 6.4.7 BASF

- 6.4.8 BioCote Limited

- 6.4.9 Bio-Fence

- 6.4.10 Covalon Technologies Ltd.

- 6.4.11 Diamond Vogel

- 6.4.12 dsm-firmenich

- 6.4.13 DuPont

- 6.4.14 Henkel AG & Co. KGaA

- 6.4.15 Hydromer

- 6.4.16 Lonza

- 6.4.17 Microban International

- 6.4.18 NEI Corporation

- 6.4.19 Novapura AG

- 6.4.20 PPG Industries, Inc.

- 6.4.21 Sciessent LLC

- 6.4.22 Sono-Tek Corporation

- 6.4.23 Specialty Coating Systems Inc.

- 6.4.24 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Development of Multi-functional Coatings

- 7.3 Growing Demand for HVAC Applications