PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851231

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851231

Molecular Weight Marker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

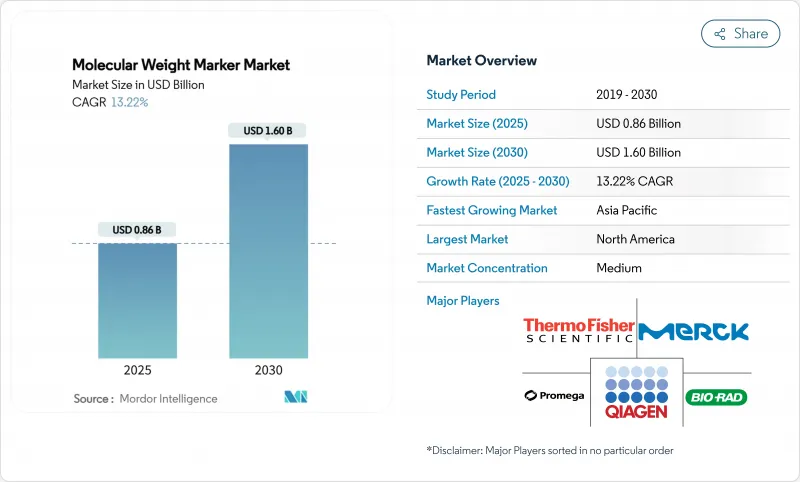

The global molecular weight markers market size is valued at USD 0.86 billion in 2025 and is forecast to reach USD 1.60 billion by 2030, translating into a 13.22% CAGR over the period.

This rapid advance reflects the convergence of genomics R&D funding, expanding molecular diagnostics volumes and stringent cell- and gene-therapy quality-control protocols that elevate demand for highly standardized ladders. AI-ready blot-imaging platforms are reshaping laboratory preferences toward fluorescent protein and DNA ladders that deliver consistent, machine-readable signals. The North American innovation ecosystem anchors early adoption, yet ambitious population-scale genomics programs in Asia-Pacific generate the largest incremental volume gains. Vendors are responding with vertically integrated offerings that bundle traditional electrophoresis consumables with automation, informatics and ready-to-use chemistries to mitigate skilled-labor shortages and regulatory complexity. These competitive moves position the molecular weight markers market at the center of emerging multi-omics workflows, creating new revenue pools as point-of-care (POC) diagnostics, microfluidic devices and continuous bioprocessing migrate from proof-of-concept to commercial deployment.

Global Molecular Weight Marker Market Trends and Insights

Rising Global R&D Expenditure in Genomics & Proteomics

Government-funded genomics programs are scaling sequencing output and standardizing analytical workflows. Japan plans to profile 100,000 cancer genomes within five years, requiring consistent molecular weight markers to harmonize data across institutions. India's 10,000-genome initiative employs the CARE ethical framework, favoring high-accuracy DNA ladders compatible with community oversight. The US National Nanotechnology Initiative earmarked USD 2.16 billion in 2024, part of which underwrites biotech tools such as molecular weight standards for nano-enabled drug design. AI-centric research budgets further amplify demand because machine-learning pipelines require uniform input quality to train reliable biomarker-discovery models.

Expanding Molecular Diagnostics Volumes (PCR/NGS)

POC and decentralized laboratories are increasing throughput and shortening turnaround times. A PCB-based real-time PCR chip heats at 8°C/s with +-0.1°C accuracy, enabling single-use assays that depend on low-range molecular weight ladders tailored to rapid runs. The Dragonfly LAMP-LAMP platform attains 96.1% viral-detection sensitivity in portable form factors, triggering demand for prestained ladders that remain stable in field conditions. High-throughput NGS workflows, such as the myeloMATCH trial, require robust DNA ladders to confirm library integrity ahead of same-day reporting. Microfluidic "lab-on-a-chip" systems finish nucleic-acid analysis within 28 minutes at USD 9.5 per test, pushing suppliers to package markers in single-use cartridges that align with cost-sensitive diagnostic economics.

Shortage of Skilled Electrophoresis Technicians

US molecular labs reported 13.4% unfilled positions in 2024, slowing test throughput and prompting automation investments. Recruitment challenges raise labor costs, so managers prefer single-tube, prestained ladders that cut prep steps. Academic collaborations are emerging to expand certification programs, but pipelines will take several years to stabilize. In Europe, retirement waves compound deficits, especially in rural hospitals where travel distances deter potential hires.

Other drivers and restraints analyzed in the detailed report include:

- Wider Availability of Ready-to-Use Prestained Ladders

- Cell & Gene-Therapy QC Protocols Require High-Accuracy DNA Ladders

- Stringent Reagent-Grade Regulatory Certifications (IVDR, USP)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

RNA markers are registering the fastest 14.25% CAGR to 2030 as mRNA vaccine pipelines mature and next-generation sequencing (NGS) protocols become ubiquitous. Accurate poly(A) tail and capping-efficiency verification relies on well-defined ladders that cover a broad 100-10,000 nt range, elevating adoption among therapeutic developers. DNA markers retained 51.51% molecular weight markers market share in 2024 due to entrenched PCR, cloning and Southern-blot routines. However, demand is shifting toward high-molecular-weight formats that resolve CRISPR-induced genomic alterations in synthetic biology programs. Protein markers benefit from rising proteomics funding, exemplified by Thermo Fisher's Olink acquisition, which added 5,300 biomarkers to high-throughput screening pipelines and invigorated need for calibrated protein ladders.

Commercial laboratories value prestained protein ladders that remain visible without staining, saving 30 minutes per run and improving lab productivity when technician bandwidth is scarce. Academic groups exploring structural proteomics increasingly adopt fluorescent dual-channel ladders to align with multiplex imaging systems. Meanwhile, RNA researchers prioritize nuclease-free packaging to maintain ladder integrity, prompting suppliers to shift toward foil-wrapped, single-use vials that eliminate freeze-thaw degradation.

Proteomics applications are advancing at 14.85% CAGR, narrowing the historical dominance of nucleic-acid workflows. Western blotting remains the primary use case, yet emerging disciplines such as top-down proteomics, ribosome profiling and thermal-shift assays now employ ladders for size confirmation in complex matrices. Automated gel extraction robots integrated with AI analysis cut sample-band excision time by 40%, driving greater ladder consumption per experiment. Nucleic-acid assays maintain a 60.53% share of the molecular weight markers market size, upheld by pandemic-era PCR capacity that persists for respiratory-virus surveillance.

In POC environments, 15-minute laser-heated PCR cycles require snap-cooling ladders that migrate predictably under rapid thermal transitions. Southern and Northern blotting remain relevant in epigenetics and long-read validation studies, respectively, but sequence-direct detection continues to pull some volume away. Researchers therefore prefer universal ladders covering overlapping size ranges for both nucleic-acid and protein analyses to streamline inventory.

The Molecular Weight Marker Market Report is Segmented by Product (DNA Markers, Protein Markers, and RNA Markers), Application (Nucleic-Acid Applications [PCR, and More] and Proteomics Applications [Western Blotting, and More]), Type (Prestained Markers, Unstained Markers and More), End User (Academic & Research Institutes and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 38.32% of the molecular weight markers market in 2024, supported by a mature biotech ecosystem, sustained federal R&D allocations and early adoption of AI-driven laboratory automation. The USD 2.16 billion 2024 National Nanotechnology Initiative budget underwrites molecular analysis tools, including size standards for nanoformulation research. M&A activity, exemplified by Thermo Fisher's USD 3.1 billion Olink integration, consolidates consumables portfolios and funnels resources into high-throughput proteomics. Yet a 13.4% vacancy rate in molecular diagnostics laboratories compels facilities to adopt turnkey ladders that minimize manual intervention. FDA guidance on batch uniformity further escalates quality expectations, favoring suppliers with validated, lot-stable products.

Asia-Pacific is the fastest-expanding region at 14.71% CAGR through 2030, underpinned by government-sponsored population genomics and the rise of indigenous vaccine manufacturing. Japan's 100,000-genome program and India's CARE-guided 10,000-genome initiative call for cross-lab standardization, boosting demand for high-precision DNA ladders. China's lung-cancer profiling work integrates germline-somatic mutation data, broadening applications for dual-size DNA and RNA ladders. Regional manufacturers focus on cost-optimized POC platforms, stimulating a parallel requirement for compact, lyophilized markers that withstand transit in humid climates.

Europe follows steady growth, benefiting from collaborative research networks and an emphasis on sustainability. IVDR implementation harmonizes quality standards, rewarding companies with robust documentation structures. AI-assisted gel analysis projects from leading universities amplify demand for fluorescent ladders compatible with automated imaging pipelines. Environmental directives prompt suppliers to reduce hazardous dyes and shift toward plant-derived pigments in prestained products, aligning with EU Green Deal objectives.

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Agilent Technologies

- Roche

- Merck KGaA (MilliporeSigma)

- New England Biolabs

- Promega

- QIAGEN

- Takara Bio

- VWR International (Avantor)

- HiMedia Laboratories

- GeneDireX Inc.

- Biovision

- GenScript Biotech Corp.

- Abcam

- Cytiva

- SMOBIO Technology

- Analytik Jena GmbH

- Norgen Biotek

- Boster Biological Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global R&D Expenditure In Genomics & Proteomics

- 4.2.2 Expanding Molecular Diagnostics Volumes (PCR/NGS)

- 4.2.3 Wider Availability Of Ready-To-Use Prestained Ladders

- 4.2.4 Cell & Gene-Therapy QC Protocols Require High-Accuracy DNA Ladders

- 4.2.5 Mini-Gel Platforms In Poc Devices Increase Low-Range Marker Demand

- 4.2.6 AI-Driven Blot-Imaging Software Pushes Need For Fluorescent Protein Ladders

- 4.3 Market Restraints

- 4.3.1 Shortage Of Skilled Electrophoresis Technicians

- 4.3.2 Stringent Reagent-Grade Regulatory Certifications (IVDR, USP)

- 4.3.3 Batch Variability Triggers Reproducibility Audits In Pharma QA

- 4.3.4 Shift Toward Microfluidic & Capillary-Electrophoresis Systems

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 DNA Markers

- 5.1.2 Protein Markers

- 5.1.3 RNA Markers

- 5.2 By Application

- 5.2.1 Nucleic-Acid Applications

- 5.2.1.1 PCR

- 5.2.1.2 Northern Blotting

- 5.2.1.3 Southern Blotting

- 5.2.1.4 Molecular Cloning

- 5.2.1.5 Other Nucleic-Acid Apps

- 5.2.2 Proteomics Applications

- 5.2.2.1 Western Blotting

- 5.2.2.2 Gel Extraction

- 5.2.2.3 Other Proteomics Apps

- 5.2.1 Nucleic-Acid Applications

- 5.3 By Type

- 5.3.1 Prestained Markers

- 5.3.2 Unstained Markers

- 5.3.3 Specialty / Fluorescent Markers

- 5.4 By End User

- 5.4.1 Academic & Research Institutes

- 5.4.2 Pharmaceutical & Biotechnology Companies

- 5.4.3 Contract Research Organizations

- 5.4.4 Clinical & Diagnostic Laboratories

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Bio-Rad Laboratories Inc.

- 6.3.3 Agilent Technologies Inc.

- 6.3.4 F. Hoffmann-La Roche AG

- 6.3.5 Merck KGaA (MilliporeSigma)

- 6.3.6 New England Biolabs

- 6.3.7 Promega Corporation

- 6.3.8 QIAGEN N.V.

- 6.3.9 Takara Bio Inc.

- 6.3.10 VWR International (Avantor)

- 6.3.11 HiMedia Laboratories

- 6.3.12 GeneDireX Inc.

- 6.3.13 BioVision Inc.

- 6.3.14 GenScript Biotech Corp.

- 6.3.15 Abcam plc

- 6.3.16 Cytiva (Danaher)

- 6.3.17 SMOBIO Technology

- 6.3.18 Analytik Jena GmbH

- 6.3.19 Norgen Biotek Corp.

- 6.3.20 Boster Biological Technology

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment