Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693932

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693932

Asia-Pacific Satellite Launch Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 152 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

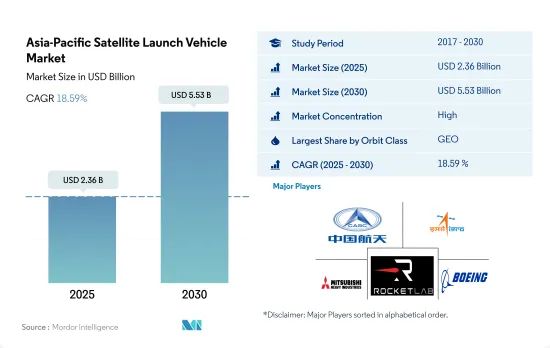

The Asia-Pacific Satellite Launch Vehicle Market size is estimated at 2.36 billion USD in 2025, and is expected to reach 5.53 billion USD by 2030, growing at a CAGR of 18.59% during the forecast period (2025-2030).

The demand for orbital launch systems in Asia-Pacific is driven by LEO satellites

- In Asia-Pacific, the demand for LEO-based orbital launch systems has been on the rise. Countries such as China, India, Japan, South Korea, Australia, and Taiwan have been actively developing and utilizing orbital launch systems to deploy satellites into LEO for various applications. For instance, China's Long March series of rockets, India's PSLV and GSLV, Japan's H-IIA and H3 rockets, and South Korea's Korea Space Launch Vehicle-II (KSLV-II) have been used to launch satellites for Earth observation, remote sensing, weather monitoring, and communication purposes in LEO.

- MEO is well-suited for applications such as GNSS and satellite-based communications. In the region, China's Long March 3B and Long March 3B/G2 are some of the launch systems being developed or utilized by countries in the region to deploy satellites into MEO. These satellites provide services such as satellite-based navigation systems like the BeiDou Navigation Satellite System (BDS) developed by China, communication services for remote and rural areas, maritime and aviation industries, and disaster management.

- GEO is ideal for applications such as telecommunications, broadcasting, and meteorological observations, as satellites in GEO appear to be stationary relative to Earth. China's Long March 3B/G2, India's GSLV Mk III, Japan's H3, and South Korea's KSLV-II are some launch systems utilized for launching satellites into GEO for telecommunications, broadcasting, and meteorological observation purposes. Overall, the market is expected to grow in the coming years by 219% in 2029 compared to 2023.

China's satellite industry is expected to witness significant growth

- Asia-Pacific has emerged as a leading market for satellites in recent years. This market is projected to grow rapidly, driven by increasing demand for Earth observation, communication, and scientific research.

- China is stepping up to become a dominant space power. Hence, in October 2020, the country unveiled its ambitious moon mission slated for 2024 and beyond. On this note, China planned to launch a mission to collect samples from the far side of the moon by the end of 2020.

- The Indian Space Research Organisation (ISRO) is working on its Small Satellite Launch Vehicle (SSLV). The SSLV is a three-stage launch platform powered entirely by solid fuel, with a lift-off mass of 120 metric tons and capable of lifting 500 kg to LEO and 300 kg to the sun-synchronous orbit. The first static fire test of SS1 conducted in March 2021 was unsuccessful. The first demonstration flight was expected to take place in October 2021.

- NewSpace India Limited, a newly formed commercial arm of the Indian space agency, is tasked with enabling the Indian industry to scale up high-technology manufacturing and production base for Indian space efforts. It will be involved in the manufacture of SSLV in collaboration with the private sector.

- South Korea's space program has seen slow progress as other countries are reluctant to transfer core technologies. In February 2021, the Ministry of Science and ICT announced a space budget of USD 553.1 million for manufacturing satellites, rockets, and other key space equipment. Such initiatives will drive the demand for launch vehicles in Asia-Pacific during the forecast period.

Asia-Pacific Satellite Launch Vehicle Market Trends

Growing demand and competition in the Asia-Pacific launch vehicle market

- Asia-Pacific has witnessed significant growth in the space industry in recent years, with a number of companies emerging as major players in the development and deployment of launch vehicles. CASC developed a range of launch vehicles, including the Long March series, which has become one of the most reliable launch vehicles in the world. During 2017-2022, CASC's Long March rocket launched approximately 372 satellites into space for various satellite operators across the world. Russia's Roscosmos State Corporation is responsible for the development of the Soyuz and Proton rockets, which have been used to launch a range of satellites and crewed missions to space. During 2017-2022, the Soyuz rocket launched approximately 611 satellites into space for various satellite operators across the world.

- The Japan Aerospace Exploration Agency (JAXA) has developed a number of launch vehicles, including the H-IIA and H-IIB rockets. During 2017-2022, JAXA's H-IIA rockets launched approximately 25 satellites into space for various satellite operators across the world. India's ISRO is playing a key role in the development of the country's launch vehicles. ISRO has developed a range of launch vehicles, including the PSLV and the GSLV, which have been used to launch a range of satellites. During 2017-2022, ISRO's rockets launched approximately 171 satellites into space for various satellite operators across the world. In addition to these established players, there are also a number of emerging companies, such as Rocket Lab, which is based in New Zealand and has developed the Electron rocket. During 2017-2022, the Electron rocket launched approximately 87 satellites into space for various satellite operators globally.

Increased spending by China, India, Japan, and South Korea is driving the market's growth

- The demand for satellite launch vehicles is driven by projects such as manufacturing and launching a national satellite internet constellation of up to 13,000 satellites. China SatNet has been engaging with commercial companies as it develops a blueprint for constructing the Guowang constellation. Hence, several space agencies in the region are developing space launch vehicle technologies. In February 2023, the Indian government announced that ISRO is expected to receive USD 2 billion for various space-related activities. Under the outlay on major schemes, a partial split up of the budget of INR 9441 crore has been allocated for space technology (including launch activity, R&D on rockets, engines, satellites, etc.). In March 2021, Japan announced that it expended USD 4.14 billion for space-related activities. The country mentioned that it had allocated JPY 18.9 billion for the H3 rocket development. In January 2020, JAXA mentioned that JPY 3.6 billion was allocated to fund the research and development of core engine technologies that significantly improve fuel consumption and reduce environmental burden, as well as the research and development of the silent supersonic airplane and emission-free aircraft (electric-powered propulsion systems).

- In March 2023, South Korea announced that it would spend USD 674 million on space programs to expand its domestic space industry, develop a next-generation launch vehicle, and bolster space defense capabilities. Approximately USD 113.6 million will be expended on developing a next-generation carrier rocket, the KSLV-2. The new rocket KSLV-3, expected to debut in 2030, is designed to be a kerosene and liquid oxygen-fueled two-stage vehicle.

Asia-Pacific Satellite Launch Vehicle Industry Overview

The Asia-Pacific Satellite Launch Vehicle Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are China Aerospace Science and Technology Corporation (CASC), Indian Space Research Organisation (ISRO), Mitsubishi Heavy Industries, Rocket Lab USA, Inc. and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001243

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Owner Of Launch Vehicle

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 Australia

- 4.4.2 China

- 4.4.3 India

- 4.4.4 Japan

- 4.4.5 New Zealand

- 4.4.6 Singapore

- 4.4.7 South Korea

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Orbit Class

- 5.1.1 GEO

- 5.1.2 LEO

- 5.1.3 MEO

- 5.2 Launch Vehicle Mtow

- 5.2.1 Heavy

- 5.2.2 Light

- 5.2.3 Medium

- 5.3 Country

- 5.3.1 China

- 5.3.2 India

- 5.3.3 New Zealand

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Ariane Group

- 6.4.2 Blue Origin

- 6.4.3 China Aerospace Science and Technology Corporation (CASC)

- 6.4.4 Indian Space Research Organisation (ISRO)

- 6.4.5 Mitsubishi Heavy Industries

- 6.4.6 Rocket Lab USA, Inc.

- 6.4.7 Space Exploration Technologies Corp.

- 6.4.8 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.