Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693909

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693909

United Kingdom Full Service Restaurants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 153 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

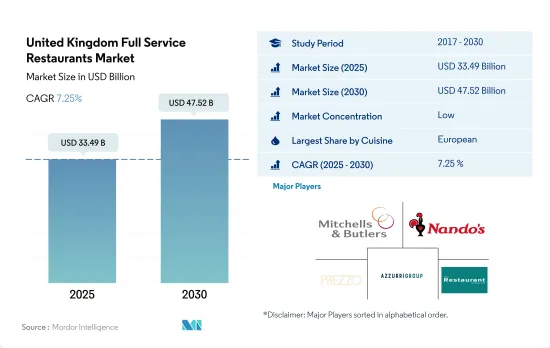

The United Kingdom Full Service Restaurants Market size is estimated at 33.49 billion USD in 2025, and is expected to reach 47.52 billion USD by 2030, growing at a CAGR of 7.25% during the forecast period (2025-2030).

A significant rise in tourist arrivals is driving substantial growth in the market, and new trends in dining contributing the market growth

- The full service restaurant in the United Kingdom is driven by the rise in the consumption of international cuisine. Due to the wide variety of delicacies, there is a growing desire to dine out and consume on-the-go food. Thus, European cuisines dominate the overall full service restaurant segment. It was observed that the sales growth of the segment increased from 2020 to 2022, accounting for 32.18%. As of 2021, more than 3.4 million nationals from different European countries permanently lived in the United Kingdom. This has led to the demand for Italian, French, and British cuisines.

- The second-largest cuisine in terms of value is Asian. This is due to the popularity of Indian, Japanese, Chinese, and Cantonese cuisines that are being accepted by the localities in the country. As of 2020, Chinese cuisine consumed outside the home was 12 grams on average per person per week. Restaurants offer Cantonese dishes that are mainly prepared as per the taste of British pallets.

- The full service restaurant segment's fastest-growing sub-segment is Latin American cuisine, which is expected to register a CAGR of 7.72% during the forecast period. Latin American cuisine is popular due to Mexican food preferences. Since people have grown accustomed to eating beef and pork, there is a demand for pork fajitas and burritos. Several large-scale operators are investing in incorporating Mexican food in restaurants with other cuisines.

- In addition, with the popularity of nutrient-rich food, Middle Eastern cuisines have gained popularity. Falafel, Hummus, and Koftas are a few popular cuisines. This has encouraged entrepreneurs to establish Turkish restaurants in cities like London and Birmingham. Thus, the FSR segment is expected to register a CAGR of 6.64% during the forecast period.

United Kingdom Full Service Restaurants Market Trends

Italian cuisine gains traction in the United Kingdom, driven by demand for cosmopolitan cuisines

- Around 35,129 full service restaurants were operating within the United Kingdom in 2022, down from 42,070 in 2021. In addition to the changes brought about by the COVID-19 pandemic, the technology industry is also evolving rapidly. Restaurants may revolve around good quality food and service, but technology also plays a significant role in the foodservice market. For example, in 2020, QR codes became far more filtered into the mainstream restaurant market. Over 84% of UK citizens have used a QR code to pay for a meal, establishing their presence as a staple in restaurant payment options. This trend grew in 2022 and will further play an important role in the growth of full service restaurants.

- European cuisine held a major market share of 46.9% of the full service market in 2022. Italian cuisine is becoming more common among consumers around the country. The demand for cosmopolitan cuisines, vibrant ingredients, and less sugary desserts is rising. In 2020, an average of 88 g of pizza was consumed per person per week in the United Kingdom. Some popular Italian dishes in the country are pastas, tomato sauces, pesto, Prosciutto di Parma, Prosciutto San Daniele, and Prosecco. Likewise, many Italian cheeses, such as Parmigiano Reggiano, Mascarpone, and mozzarella, are also popular.

- Independent restaurants held a major share of 67.6% of the full service market in 2022. In the United Kingdom, small, independently-run restaurants continue to trade and thrive. In contrast to the impersonal franchises, the proprietors of these small businesses frequently designate comfortable corners where customers may gather, mingle, and enjoy a meal in casual and frequently homely conditions. Tourists visit local restaurants to explore the culture of the region.

Demand for full service restaurants to grow in the United Kingdom, driven by consumer preferences for innovation and local cuisines

- The demand for full service restaurants is expected to increase due to changes in consumer behavior and demand for local cuisines. Consumers, at present, are looking for innovation in food and technology. Around 40% of restaurant consumers are comfortable dining out regardless of contactless payment options, but 56% of restaurant consumers say that such options are of importance to them. In 2022, popular dishes in the country included lamb chops, chicken/lamb biryani, salmon sashimi, and falafel, priced at USD 14.5, USD 12.5, USD 7.2, and USD 7.1 per 300 g, respectively. The demand for innovation and customization in food menus will fuel the full service market's growth.

- As Latin American cuisine has become so popular, restaurants offering Mexican cuisine have increased the variety of dishes they offer. Due to the increasing demand, many Mexican restaurants are increasingly offering a variety of specialized tacos, quesadillas, burritos, and nachos on their menus. Popular Mexican dishes, including falafel and hummus, were priced at USD 5.4 and 7.2, respectively, per 300 g in the country. Operators will have to compete for the most compelling offerings due to the shift in consumer demand. The average order value for FSR was priced at USD 21.45 in 2022. The demand for full service restaurants in the United Kingdom is a growing premiumization trend, and there is an increasing demand for various international cuisines by tourists. The number of overseas visits to the United Kingdom totaled nearly 30 million in 2022, increasing by over 20 million from 2021. In the country, the most popular international cuisines are Chinese, Indian, and Mexican cuisines. Chinese cuisines were most popular in cities like Glasgow, London, Birmingham, Belfast, and Cardiff.

United Kingdom Full Service Restaurants Industry Overview

The United Kingdom Full Service Restaurants Market is fragmented, with the top five companies occupying 16.93%. The major players in this market are Mitchells & Butlers PLC, Nando's Group Holdings Limited, Prezzo Holdings Limited, The Azzuri Group and The Restaurant Group PLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50000872

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Number Of Outlets

- 4.2 Average Order Value

- 4.3 Regulatory Framework

- 4.3.1 United Kingdom

- 4.4 Menu Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Cuisine

- 5.1.1 Asian

- 5.1.2 European

- 5.1.3 Latin American

- 5.1.4 Middle Eastern

- 5.1.5 North American

- 5.1.6 Other FSR Cuisines

- 5.2 Outlet

- 5.2.1 Chained Outlets

- 5.2.2 Independent Outlets

- 5.3 Location

- 5.3.1 Leisure

- 5.3.2 Lodging

- 5.3.3 Retail

- 5.3.4 Standalone

- 5.3.5 Travel

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Chennai Dosa Group

- 6.4.2 Mitchells & Butlers PLC

- 6.4.3 Nando's Group Holdings Limited

- 6.4.4 Pizza Hut (U.K.) Limited

- 6.4.5 PizzaExpress (Restaurants) Limited

- 6.4.6 Prezzo Holdings Limited

- 6.4.7 TGI Fridays Franchisor LLC

- 6.4.8 The Azzuri Group

- 6.4.9 The Big Table Group Limited

- 6.4.10 The Restaurant Group PLC

- 6.4.11 YO! Company

7 KEY STRATEGIC QUESTIONS FOR FOODSERVICE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.