Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693741

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693741

China Feed Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 183 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

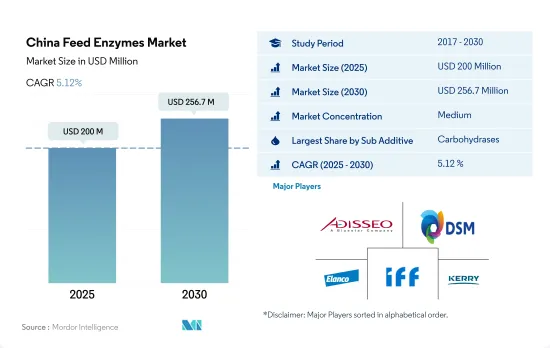

The China Feed Enzymes Market size is estimated at 200 million USD in 2025, and is expected to reach 256.7 million USD by 2030, growing at a CAGR of 5.12% during the forecast period (2025-2030).

- China dominated the feed enzymes market in the Asia-Pacific region with a market share of 43.6% in 2022, valued at USD 172 million. Due to the impact of COVID-19, the production of compound feed in the country had declined, leading to a decrease in the market for enzymes in 2020.

- Of all feed enzymes, carbohydrases were the largest concerning market value, representing 46% of the total feed enzymes market in China in 2022. This is because carbohydrases act in the stomach to break down and degrade carbohydrates such as fiber, starch, and non-starch polysaccharides into simple sugars that provide energy for use by the animal and lead to effective digestion.

- Poultry birds are the largest consumers of feed carbohydrases, with a market share of 49.6% in 2022, followed by swine (35%) and aquaculture (10.5%). In addition to carbohydrases, phytases are also growing in demand in China, with a projected CAGR of 5.1% during the forecast period (2023-2029).

- Phytases aid in reducing the antinutritional effect of phytate and improving the digestibility of phosphorus in monogastric species. They lower the level of phosphorus produced in feces by enhancing phosphorus absorption and increasing the availability of starch, protein, and amino acids in the animal body.

- As all animal species require one or more feed enzymes that cannot be synthesized naturally, such as carbohydrases and phytases, these should be provided through animal feed. It is therefore anticipated that the feed enzymes market in China will expand at a CAGR of 5% during the forecast period (2023-2029).

China Feed Enzymes Market Trends

Increasing per capita consumption of poultry products and African Swine Fever (ASF) affecting swine helped in increasing the poultry demand and poultry production

- China's poultry industry holds a dominant position in the global market, with the major producers of poultry located in Beijing, Tianjin, Shanghai, Shandong, and Guangdong. The sector's growth is primarily attributed to rising population and urbanization, increased income levels, and shifting consumer preferences toward poultry meat, as a result of the African Swine Fever outbreak that reduced the pork meat supply. From 2017 to 2022, China's per capita consumption of poultry increased by 2.06 kg, further driving the demand for poultry products.

- The country's poultry industry produces chickens, ducks, and quails, with chickens being the major poultry bird, accounting for 495.9 million heads and 40% of global egg production in 2022. The increasing adoption of layer farming led to over 900 million stock-laying hens and 60 million chicks hatching annually at the country's largest layer farming center. Poultry meat consumption in China increased due to favorable prices, increasing awareness of high-protein diets, and a shift in consumer preferences. As a result, broilers are raised at a higher rate to meet the demand for poultry meat. To improve productivity and meet the growing demand for poultry products, three domestic varieties of broiler genetics were released in 2021, including Shengze 901, Guangming No. 2, and Wode 188.

- The continued investment, commercialization, and release of new and improved breeds in the market, coupled with rising production of poultry and increasing per capita consumption, are expected to drive the growth of the poultry industry in China during the forecast period. Additionally, the increasing awareness of health benefits and the nutritional value of poultry meat is anticipated to fuel the growth of the poultry industry in the country.

Rising demand for seafood and shifting of producers from conventional feed to compound feed is increasing the feed production for aquaculture species

- The aquaculture feed production in China witnessed a significant increase of 54.1% in 2022, reaching 22.8 million metric tons, compared to 2017. However, there was a 21.3% drop in 2020 from the previous year due to the COVID-19 pandemic and the resulting closure of feed industries. The increasing seafood demand in the country and expansions of the feed production units drive the expansion of aquaculture production in China. For instance, Grobest China established a new aquaculture feed factory in Guangdong Leizhou with an investment of USD 37.7 million and an annual production capacity of 250,000 tons.

- Fish is the primary aquaculture species in China, and feed production increased by 3.2% in 2022 from the previous year due to increased demand for feed as the cultivation of fish increased to 37.5 million metric tons in 2022 from 37.4 million metric tons in 2018. Producers are shifting from conventional feed to compound feed due to the increasing awareness regarding nutrient management and good farming practices.

- In 2022, shrimp accounted for 2.9% of the aquafeed market share in the country, with a production of 0.6 million metric tons. The demand for shrimp feed in China is strongly driven by the increasing demand for shrimps, as Chinese consumers undergo a nutrition transition. Shrimps are a good source of antioxidants and astaxanthin, which bolsters the nervous and musculoskeletal systems. The rapid expansion of the aquaculture sector and increasing awareness about nutrient management in aquaculture production are expected to boost market growth during the forecast period.

China Feed Enzymes Industry Overview

The China Feed Enzymes Market is moderately consolidated, with the top five companies occupying 60.79%. The major players in this market are Adisseo, DSM Nutritional Products AG, Elanco Animal Health Inc., IFF(Danisco Animal Nutrition) and Kerry Group PLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93775

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Carbohydrases

- 5.1.2 Phytases

- 5.1.3 Other Enzymes

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Archer Daniel Midland Co.

- 6.4.3 BASF SE

- 6.4.4 DSM Nutritional Products AG

- 6.4.5 Elanco Animal Health Inc.

- 6.4.6 IFF(Danisco Animal Nutrition)

- 6.4.7 Kemin Industries

- 6.4.8 Kerry Group PLC

- 6.4.9 Novus International, Inc.

- 6.4.10 Olmix Group

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.