Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693731

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693731

Middle East Feed Amino Acids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 204 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

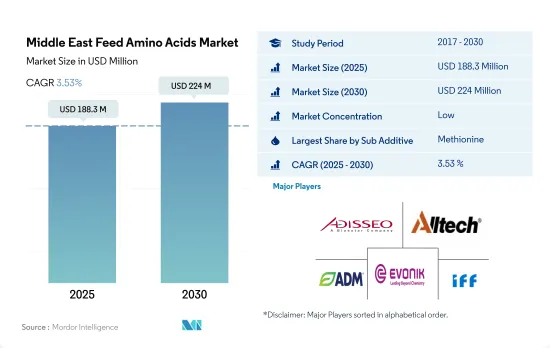

The Middle East Feed Amino Acids Market size is estimated at 188.3 million USD in 2025, and is expected to reach 224 million USD by 2030, growing at a CAGR of 3.53% during the forecast period (2025-2030).

- The Middle Eastern region is experiencing an increasing demand for amino acids in animal feed. Amino acids are essential for animal growth, muscle development, and improved meat productivity. In 2022, the market value of amino acids in the Middle East was 20.4% of the total feed additives market in the region. However, the market value fluctuated between 2018-2021 due to the occurrence of infectious animal diseases such as foot and mouth disease, African swine fever, and Avian influenza.

- Methionine and lysine were the most significant feed amino acids in the Middle East, accounting for over 63.5% of the total market value in 2022. These amino acids have been attributed to greater efficiency in animals, such as improved gut health, efficient digestion, and higher meat output. Tryptophan is also a significant amino acid in the region, and it is expected to register a CAGR of 3.7% during the forecast period. Although it has the lowest market share due to its scarcity, it is essential for early animal growth and increased feed consumption.

- Threonine is another crucial amino acid for animal health, and its market value is projected to increase from USD 27.4 million in 2022 to USD 35 million by 2029. The increasing demand for meat and meat products and the growing awareness of amino acid usage in balancing gut pH and preventing infection is expected to drive the region's feed amino acids market. The market is expected to register a CAGR of 3.5% during the forecast period, indicating a significant potential for growth and investment in the animal feed industry.

- The Middle Eastern feed additives market registered a 20.4% share value for feed amino acids in 2022, with an increase of 3.7% during 2020-2022. The dip in the market in 2019-2020 was due to COVID-19, which disrupted global trade and local supply chains, causing reduced feed production in those years.

- Saudi Arabia held the largest market share in the Middle Eastern feed amino acids market, accounting for USD 60.7 million in 2022, followed by Iran with a market share of USD 45.6 million. Saudi Arabia's high adoption of feed additives in animal diets compared to other countries in the region contributes to its high consumption.

- Poultry birds accounted for the largest share of feed amino acids consumed in the Middle East, with a 58% share value in 2022. Ruminants accounted for 38.9% of the market. The demand for poultry meat is high in countries like Saudi Arabia and Iran, where 59% of the region's poultry birds were raised in 2021.

- Iran alone accounted for over 45% of the compound feed production in the Middle East, producing around 24 million metric tons for all animal types in 2022. The country has a high animal population, with over 18% of ruminant cattle in the region in 2021.

- The Middle East is witnessing a rising demand for meat and increased awareness of healthy diets in animal feeds, leading to the increased usage of feed amino acids. The market in the region is expected to register a strong CAGR of 3.5% during the forecast period (2023-2029).

Middle East Feed Amino Acids Market Trends

Expanding poultry sector in the Middle East region with establishment of new farms with increasing per capita consumption of poultry has been increasing the demand for poultry production

- In the Middle East, the poultry industry is the largest segment in the agriculture sector. It represented 90% of the animal headcount in the region in 2022. The sector experienced significant growth, with production increasing by 10.9% in 2022 compared to 2017. The rise in demand for meat and egg products in the region has been the primary driver of this growth. Additionally, the demand from tourism, business travel, and the hotels, restaurants, and institutional (HRI) sector contributed to a 2.5% increase in poultry production in 2022 compared to the previous year. This increased production also led to a 2.9% rise in the value of feed additives used in poultry production.

- To meet the growing demand, Middle Eastern countries are investing in their poultry sectors to expand production. Saudi Arabia's Almarai company, for example, is investing USD 1.12 billion to establish a factory and new farms to increase poultry production. In 2022, the Saudi Arabian Ministry of Environment, Water, and Agriculture issued 275 poultry project licenses, including 119 for broiler projects, 26 for egg production with a capacity of more than two billion eggs per year, and 12 for breeding and producing broiler mothers and operating hatcheries with a capacity of 480.5 million chicks per year.

- The per capita consumption of poultry products in the region also increased, from 44.9 kg in 2017 to 45.5 kg in 2022, further driving the demand for increased production. As a result, factors such as increasing investment in the poultry industry and growing demand for poultry products are expected to continue to fuel the growth of poultry animal production during the forecast period.

Government in the countries such as Saudi Arabia, Oman and the United Arab Emirates invested to establish large fish farms which will increase the demand for aqua feed in the region

- The aquaculture industry in the Middle East experienced significant growth in recent years, leading to increased demand for aquaculture feed. Between 2017 and 2022, demand for this type of feed increased by 25.1%. This growth is due to the expansion of the aquaculture industry in the region, which led to increased production of aquaculture species. In 2022, aquaculture feed production accounted for 2.1% of total feed production in the region, totaling 0.5 million metric tons. Iran was the largest producer of aquaculture feed in the region, with a production of 0.28 million metric tons in 2022. This high production is attributed to the country's strong aquaculture production, which benefits from the availability of freshwater resources for cultivating different types of aquaculture species.

- Fish were the largest aquaculture species produced in the region, accounting for 78.6% of aquaculture feed production in 2022. Countries such as Saudi Arabia, Oman, and the United Arab Emirates have invested in aquaculture and partnered with international experts and organizations to establish productive local fish farms. For example, aquaculture organizations in the Gulf region are working with the UK Government's Centre for Environment Fisheries and Aquaculture Science (Cefas) through the UK Gulf Marine Environment Partnership (GMEP) Programme to improve fish farming and tackle biodiversity loss.

- Oman and the United Arab Emirates have the highest per capita consumption of aquaculture species in the region, with consumption reaching 28.6 kg per person per year. In an effort to reduce exports and increase domestic production, the Omani government aims to transform the fisheries and aquaculture industry from a subsidy sector to a significant contributor to the country's economy.

Middle East Feed Amino Acids Industry Overview

The Middle East Feed Amino Acids Market is fragmented, with the top five companies occupying 36.01%. The major players in this market are Adisseo, Alltech, Inc., Archer Daniel Midland Co., Evonik Industries AG and IFF(Danisco Animal Nutrition) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93765

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Iran

- 4.3.2 Saudi Arabia

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Lysine

- 5.1.2 Methionine

- 5.1.3 Threonine

- 5.1.4 Tryptophan

- 5.1.5 Other Amino Acids

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 Iran

- 5.3.2 Saudi Arabia

- 5.3.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 Archer Daniel Midland Co.

- 6.4.4 Evonik Industries AG

- 6.4.5 IFF(Danisco Animal Nutrition)

- 6.4.6 Kemin Industries

- 6.4.7 Marubeni Corporation (Orffa International Holding B.V.)

- 6.4.8 Novus International, Inc.

- 6.4.9 Saudi Mix

- 6.4.10 SHV (Nutreco NV)

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.