Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644953

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644953

Middle East Pipeline Maintenance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

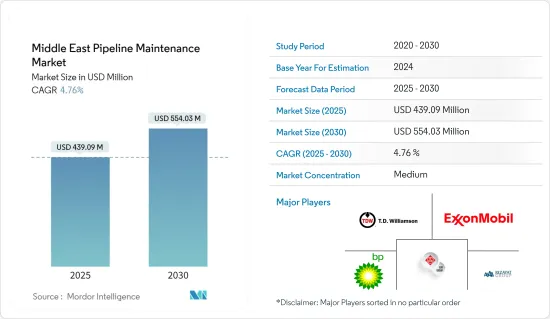

The Middle East Pipeline Maintenance Market size is estimated at USD 439.09 million in 2025, and is expected to reach USD 554.03 million by 2030, at a CAGR of 4.76% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, aging pipeline infrastructure, increasing domestic natural gas demand, and the increase in oil and gas production caused by unconventional reserve development is expected to drive the growth of the market studied.

- On the other hand, the high volatility of crude oil prices is one of the major restraints for the market.

- Nevertheless, the rise in offshore exploration and production projects is expected to create an excellent opportunity for the market players in the forecast period. These projects are paving the way for the pipeline industry to grow more.

Middle East Pipeline Maintenance Market Trends

Pigging Segment to have a Significant Share in the Market

- Pigging is a common technique used in pipeline maintenance and operations. It involves the use of specialized devices called "pigs" to perform various functions within the pipeline. These pigs are typically cylindrical or spherical in shape and are inserted into the pipeline to travel through it, propelled by the flow of the product or by external means such as compressed air or hydraulic pressure.

- Pigging is poised to be a dominant segment in Middle East pipeline maintenance due to several region-specific factors. The presence of aging pipeline infrastructure in the Middle East necessitates regular maintenance and cleaning, making pigging an essential technique. With the region being a major hub for oil and gas production and transportation, pipelines in the Middle East handle high volumes of hydrocarbons over long distances. Pigging plays a critical role in maintaining these pipelines' flow efficiency and integrity, optimizing operational efficiency, and minimizing disruptions.

- The increasing demand for natural gas in the Middle East as a cleaner energy source also contributes to the prominence of pigging in pipeline maintenance. Natural gas pipelines require regular pigging for cleaning, maintenance, and inspection to ensure efficient and safe gas transportation.

- For instance, in November 2022, the Iranian Petroleum Minister announced that his ministry had signed a cooperation agreement worth USD 40 billion with Gazprom for the construction of LNG complexes in the country, along with the development of gas fields and gas export transmission lines.

- Moreover, the construction of pipelines are on a rise in the region for instance, according to global energy monitor, as of May 2023, Iran is operating more than 6,000 KM oil pipeline, and Saudi Arabia is operating more than 4,600 KM oil pipeline

- Hence, owing to the above points, increasing investment in Pipeline Maintenance infrastructure will drive the market during the forecast period.

Saudi Arabia is the fastest growing region in the Pipeline Maintenance market

- Saudi Arabia is the world's second-largest crude oil producer, accounting for about 12.5% of the Middle East crude oil produced in 2021. The country is also one of the largest crude oil exporters in the world. Moreover, Saudi Arabia accounted for the second-largest proven oil reserves in the world, after Venezuela, in 2020.

- With an extensive network of pipelines supporting the country's substantial hydrocarbon production and export activities, Saudi Arabia's ongoing investments in expanding its oil and gas infrastructure will necessitate increased maintenance requirements. The aging nature of many pipelines in the country further emphasizes the need for regular maintenance and repairs to mitigate issues like leaks and corrosion. According to global energy monitor, as of May 2023, Saudi Arabia has 86.2 kms oil pipe line unde construction.

- Saudi Arabia's ambitious production and export targets also contribute to the rising demand for pipeline maintenance. The reliability and integrity of the pipeline network are vital in achieving these targets, necessitating proactive maintenance measures such as inspections, cleaning, and repairs. Additionally, the diverse geographical challenges present in the country, including deserts, mountains, and offshore areas, require specialized expertise and equipment for pipeline maintenance.

- In 2020, Saudi Arabia achieved a milestone in its dry natural gas production, reaching an average of 11 billion cubic feet per day. This marked a significant 30% increase compared to the production levels of 2010.

- As of 2021, Saudi Aramco, the national oil company, operated more than 90 pipelines and 12,000 miles of crude oil and petroleum product pipelines throughout the country, all of which linked the production areas to the processing facilities, export terminals, and consumption centers.

- Furthermore, due to the Russia-Ukraine conflict, the supply of natural gas has increased from the region, increasing the demand for pipelines, consequently increasing the demand for pipeline maintenance services.

- For instance, in November 2022, Saudi Arabia announced that it would assist with the commercial supply of LNG to Bangladesh on an emergency basis. This assurance came during the 14th meeting of the Joint Economic Commission of Saudi Arabia and Bangladesh

- Hence, owing to the above points, Saudi Arabia is expected to see significant market growth in the Pipeline Maintenance market during the forecast period.

Middle East Pipeline Maintenance Industry Overview

The Middle East Pipeline Maintenance market is consolidated. Some of the key players in this market (in no particular order) included are T.D. Williamson, Exxon Mobil, BP PLC, Rezayat Group, and EEW Group., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93762

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Expanding Pipeline Infrastructure

- 4.5.1.2 Growing Energy Demand

- 4.5.2 Restraints

- 4.5.2.1 Political Instability and Militant Attacks on Pipeline Infrastructure

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Pigging

- 5.1.2 Flushing & Chemical Cleaning

- 5.1.3 Pipeline Repair & Maintenance

- 5.1.4 Drying

- 5.1.5 Others

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Qatar

- 5.3.4 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Pipeline Operators

- 6.3.1.1 ExxonMobil Corporation

- 6.3.1.2 BP PLC

- 6.3.1.3 Saudi Aramco

- 6.3.1.4 Egyptian General Petroleum Corporation

- 6.3.1.5 Chevron Corporation

- 6.3.2 Pipeline Maintenance Services Providers

- 6.3.2.1 Arabian Pipes Company

- 6.3.2.2 Abu Dhabi Metal Pipes & Profiles Industries Complex LLC

- 6.3.2.3 Rezayat Group

- 6.3.2.4 Vallourec SA

- 6.3.2.5 STATS Group

- 6.3.2.6 Halliburton Company

- 6.3.2.7 EEW Group

- 6.3.2.8 T. D. Williamson Inc

- 6.3.1 Pipeline Operators

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Adoption Of Digital Technologies And Automation In Pipeline Maintenance

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.