Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692477

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692477

Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 349 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

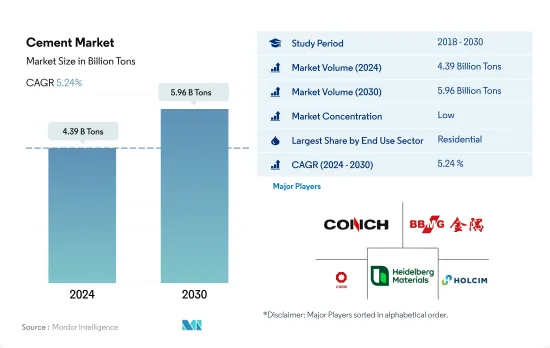

The Cement Market size is estimated at 4.39 billion Tons in 2024, and is expected to reach 5.96 billion Tons by 2030, growing at a CAGR of 5.24% during the forecast period (2024-2030).

The commercial sector's fast-paced growth is leading to higher cement demand

- The demand for cement across the sectors was reduced in 2022 over 2021, resulting in a nearly 3.83% lower demand worldwide due to very low growth and even declines in the new floor area under construction. As the demand across sectors was projected to rise in 2023, the overall increase was estimated to be 0.70% higher than in 2022.

- The residential sector is the largest consumer of cement in the world, as most countries have concrete homes that directly convert to a large volume of cement demand from this sector. The cement market experiences the highest demand from Asia-Pacific. The region accounted for 67% of the world's total cement demand in 2022, owing to its vast population.

- Infrastructure is the sector in which most countries utilize a significant portion of their cement stock. Cement is among the primary raw materials of concrete, which is essential for all types of infrastructure construction, such as roads, dams, ports, etc. Asia-Pacific accounts for the largest cement consumption in this sector, primarily due to China, India, South Korea, and Japan. These countries together constituted 90% of the region's infrastructure sector's cement demand in 2022.

- Construction activities are expected to rise the fastest in the commercial sector. For instance, the new floor area of the commercial sector among all the sectors is poised to grow with the fastest CAGR of around 4.56% during the forecast period (2023-2030). Hence, the cement demand from the commercial sector is expected to increase the fastest globally at a CAGR of 6.18% during the forecast period and is expected to reach USD 764.6 million by 2030.

The demand for cement to rise in the Middle East & Africa owing to investments in construction

- In 2022, global cement demand saw a 3.83% decline in volume compared to 2021, largely driven by a 6.37% drop in the Asia-Pacific region. Projections suggested that cement demand in 2023 would remain relatively steady, with the Asia-Pacific expected to witness a further decline.

- The Asia-Pacific consistently leads in construction project volumes, exemplified by India's dominance with over USD 25 million worth of infrastructure projects in the pipeline as of May 2022, surpassing other nations. China and Australia followed closely in the third and fourth positions, respectively. Consequently, the Asia-Pacific stands as the global cement consumption hub.

- Following the Asia-Pacific, the Middle East & Africa emerge as a significant consumer of cement. Saudi Arabia and the United Arab Emirates take the lead, buoyed by their governments' consistent investments in infrastructure and sector initiatives. Notably, infrastructure investments in the United Arab Emirates surged by 82% from 2021 to 2022. In 2022, Saudi Arabia and the United Arab Emirates accounted for 12% and 3% of the global cement volume, respectively.

- Anticipated data indicates that the Middle East & Africa will witness the highest cement demand growth, registering a CAGR of 7.07% in volume during the forecast period (2023-2030). Notably, Saudi Arabia's recent agreements and MoUs, totaling nearly USD 2.66 billion, focus on establishing investment funds to bolster commercial, tourism, and residential projects, further fueling the cement demand in the region.

Global Cement Market Trends

Asia-Pacific's surge in large-scale office building projects is set to elevate the global floor area dedicated to commercial construction

- In 2022, the global new floor area for commercial construction witnessed a modest growth of 0.15% from the previous year. Europe stood out with a significant surge of 12.70%, driven by a push for high-energy-efficient office buildings to align with its 2030 carbon emission targets. As employees returned to offices, European companies, resuming lease decisions, spurred the construction of 4.5 million square feet of new office space in 2022. This momentum is poised to persist in 2023, with a projected global growth rate of 4.26%.

- The COVID-19 pandemic caused labor and material shortages, leading to cancellations and delays in commercial construction projects. However, as lockdowns eased and construction activities resumed, the global new floor area for commercial construction surged by 11.11% in 2021, with Asia-Pacific taking the lead with a growth rate of 20.98%.

- Looking ahead, the global new floor area for commercial construction is set to achieve a CAGR of 4.56%. Asia-Pacific is anticipated to outpace other regions, with a projected CAGR of 5.16%. This growth is fueled by a flurry of commercial construction projects in China, India, South Korea, and Japan. Notably, major Chinese cities like Beijing, Shanghai, Hong Kong, and Taipei are gearing up for an uptick in Grade A office space construction. Additionally, India is set to witness the opening of approximately 60 shopping malls, spanning 23.25 million square feet, in its top seven cities between 2023 and 2025. Collectively, these endeavors across Asia-Pacific are expected to add a staggering 1.56 billion square feet to the new floor area for commercial construction by 2030, compared to 2022.

South America's estimated fastest growth in residential constructions due to increasing government investments in schemes for affordable housing to boost the global residential sector

- In 2022, the global new floor area for residential construction declined by around 289 million square feet compared to 2021. This can be attributed to the housing crisis generated due to the shortage of land, labor, and unsustainably high construction materials prices. This crisis severely impacted Asia-Pacific, where the new floor area declined 5.39% in 2022 compared to 2021. However, a more positive outlook is expected in 2023 as the global new floor area is predicted to grow by 3.31% compared to 2022, owing to government investments that can finance the construction of new affordable homes capable of accommodating 3 billion people by 2030.

- The COVID-19 pandemic caused an economic slowdown, due to which many residential construction projects got canceled or delayed, and the global new floor area declined by 4.79% in 2020 compared to 2019. As the restrictions were lifted in 2021 and pent-up demand for housing projects was released, new floor area grew 11.22% compared to 2020, with Europe having the highest growth of 18.28%, followed by South America, which rose 17.36% in 2021 compared to 2020.

- The global new floor area for residential construction is expected to register a CAGR of 3.81% during the forecast period, with South America predicted to develop at the fastest CAGR of 4.05%. Schemes and initiatives like the Minha Casa Minha Vida in Brazil announced in 2023 with a few regulatory changes, for which the government plans an investment of USD 1.98 billion to provide affordable housing units for low-income families, and the FOGAES in Chile also publicized in 2023, with an initial investment of USD 50 million, are aimed at providing mortgage loans to families for affordable housing and will encourage the construction of new residential units.

Cement Industry Overview

The Cement Market is fragmented, with the top five companies occupying 32.78%. The major players in this market are Anhui Conch Cement Company Limited, BBMG Corporation, China National Building Material Group Corporation, Heidelberg Materials and Holcim (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91436

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Product

- 5.2.1 Blended Cement

- 5.2.2 Fiber Cement

- 5.2.3 Ordinary Portland Cement

- 5.2.4 White Cement

- 5.2.5 Other Types

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 By Country

- 5.3.1.1.1 Australia

- 5.3.1.1.2 China

- 5.3.1.1.3 India

- 5.3.1.1.4 Indonesia

- 5.3.1.1.5 Japan

- 5.3.1.1.6 Malaysia

- 5.3.1.1.7 South Korea

- 5.3.1.1.8 Thailand

- 5.3.1.1.9 Vietnam

- 5.3.1.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 By Country

- 5.3.2.1.1 France

- 5.3.2.1.2 Germany

- 5.3.2.1.3 Italy

- 5.3.2.1.4 Russia

- 5.3.2.1.5 Spain

- 5.3.2.1.6 United Kingdom

- 5.3.2.1.7 Rest of Europe

- 5.3.3 Middle East and Africa

- 5.3.3.1 By Country

- 5.3.3.1.1 Saudi Arabia

- 5.3.3.1.2 United Arab Emirates

- 5.3.3.1.3 Rest of Middle East and Africa

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Adani Group

- 6.4.2 Anhui Conch Cement Company Limited

- 6.4.3 BBMG Corporation

- 6.4.4 CEMEX, S.A.B. de C.V.

- 6.4.5 Cemros

- 6.4.6 China National Building Material Group Corporation

- 6.4.7 China Resource Cement Holdings

- 6.4.8 CRH

- 6.4.9 Dangote Cement Plc.

- 6.4.10 Heidelberg Materials

- 6.4.11 Holcim

- 6.4.12 SIG

- 6.4.13 TAIWAN CEMENT LTD.

- 6.4.14 UltraTech Cement Ltd.

- 6.4.15 Votorantim Cimentos

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.