PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686540

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686540

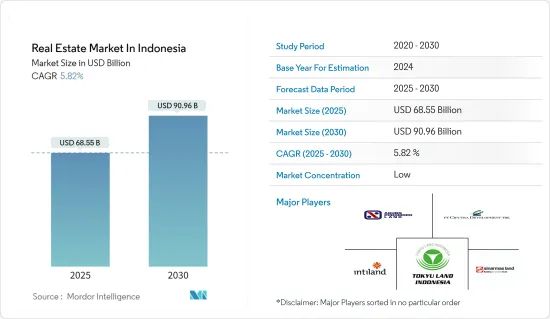

Real Estate In Indonesia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Real Estate Market In Indonesia Market size is estimated at USD 68.55 billion in 2025, and is expected to reach USD 90.96 billion by 2030, at a CAGR of 5.82% during the forecast period (2025-2030).

Key Highlights

- Indonesia has improved its macroeconomic and structural policies over the last 15 years. With a strong and stable growth rate, its economy is catching up with other countries in the region, allowing Indonesia to focus on its development agenda.

- As property demand and prices rise due to rapid population growth and high urbanization, the real estate market in Indonesia is one of the most vital sectors in the region. It was one of the few sectors not significantly affected by the COVID-19 crisis in the country.

- The official figures from Statistics Indonesia reflected that the GDP from real estate activities in Indonesia amounted to IDR 488.31 trillion (USD 31 billion) in 2022. Indonesian GDP derived from real estate activities has gradually increased over the decade.

- The affordable housing projects in Indonesia supported by the government, foreign investors, and associations such as the World Bank are anticipated to enhance the real estate market's growth during the forecast period.

- The Indonesian government introduced the 'One Million Houses' (OMH) program to construct at least 1 million units annually. According to the Ministry of Public Works and Public Housing (PUPR), about 634,132 housing units were recorded until August 2023 under the program.

- Due to a better, growth-stimulating economy, the first wave of Proptech in Indonesia began with increased demand for homes from the middle-class populace. With a large concentration of selling, purchasing, and leasing on search portal firms, the proptech segment is gaining popularity.

Indonesia Real Estate Market Trends

Jakarta Emerging as a Prime Rental Market

In Jakarta, serviced apartments showed a continued improvement in average occupancy rate during 3Q 2023, reflecting the normalcy of business activities after the complete lifting of restrictions and increased demand from expatriates, especially from Asian countries, including Japan, South Korea, and India.

As of Q3 2023, the occupancy rate increased by about 3.5% QOQ to 60.5%. All serviced apartments in the CBD area maintained steady rental rates. In contrast, new supply in the form of new serviced apartment projects (Citadines Gatot Subroto and Grand Mansion Menteng by The Crest Collection) pushed rents up in the non-CBD area. The average rental rates registered were IDR 445,986/sq m/month (USD 28.85) and IDR410,707/sq m/month (USD 26.57) in the CBD and South Jakarta (including non-prime areas), respectively.

Experts expect some increment in the average rental rate given the forthcoming entry of new upscale serviced apartment projects that offer higher rental rates compared to the market.

Rising Residential Property Sales In Indonesia

- According to industry experts, Indonesia's residential property market remains slow, with the composite-16 property price index growing only by 1.53% in Q3 2022. When adjusted for inflation, property prices declined by 3.48%. When inflation is considered, only one of the eighteen major Indonesian cities recorded house price increases in Q3 2022.

- While the market showed improvements recently, it remains far below its pre-crisis levels. From 2018 to 2023, Indonesia's house price index averaged 103.04 points, reaching an all-time high of 107.26 points in Q2 of 2023 and a record low of 99.32 points in the first quarter of 2018.

- National laws effectively ban non-citizens from complete freehold ownership of the property, limiting their rights to a leasehold of a maximum of 80 to 100 years with no access to mortgage finance. In addition, the government has set a minimum price for real estate that can be bought by foreign investors, ranging from around USD 65,000 for an apartment in northern Sumatra to USD 325,000 for a house in Bali, Jakarta, and parts of Java.

Indonesia Real Estate Industry Overview

The Indonesian real estate market, including both residential and commercial, is highly competitive and fragmented. The market presents opportunities for growth during the forecast period. Higher competition among market players is impacting selling and land prices, further leading to oversupply in the market. Some of the major players present in the market include Agung Podomoro Land, Sinar Mas Land, Ciptura Group, and Tokyu Land Indonesia. The players are also adapting to technological trends, owing to the rising internet penetration and expansion of e-commerce.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Policies and Regulations

- 4.3 Insights into Interest Rate Regime for General Economy, and Real Estate Lending

- 4.4 Insights into Real Estate Tech and Startups Active in the Real Estate Segment

- 4.5 Insights into Capital Market Penetration and REIT Presence in Residential Real Estate

- 4.6 Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.7 Impact of COVID-19 on the Market

- 4.8 Value Chain/Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Population

- 5.1.2 Increase in Demand for Residential Real Estate

- 5.2 Market Restraints

- 5.2.1 Increase in Costs

- 5.3 Market Opportunities

- 5.3.1 Tourism-related Real Estate

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Property Type

- 6.1.1 Residential

- 6.1.2 Office

- 6.1.3 Retail

- 6.1.4 Hospitality

- 6.1.5 Industrial

- 6.2 By City

- 6.2.1 Jakarta

- 6.2.2 Bali

- 6.2.3 Rest of Indonesia

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 PT Intiland Development Tbk

- 7.2.2 Tokyu Land Indonesia

- 7.2.3 Agung Podomoro Land

- 7.2.4 Ciptura Group

- 7.2.5 Sinar Mas Land

- 7.2.6 PP Properti

- 7.2.7 Lippo Group

- 7.2.8 Trans Property

- 7.2.9 Agung Sedayu Group

- 7.2.10 PT. Pakuwon Jati Tbk*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX