PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849885

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849885

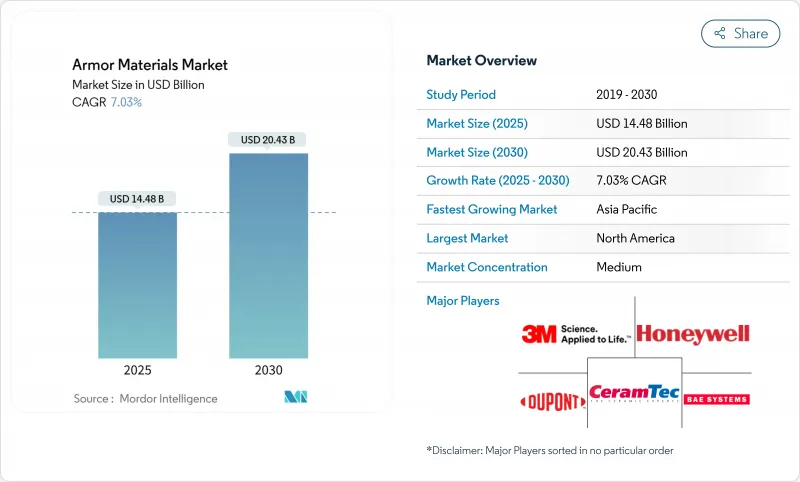

Armor Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The armor materials market is valued at USD 14.48 billion in 2024 and is forecast to reach USD 20.43 billion by 2030, expanding at a 7.03% CAGR from 2025 to 2030.

Current demand is driven by higher threat levels across military, law enforcement, and critical-infrastructure settings, alongside rapid advances in ceramics, metal matrix composites, and ultra-high-molecular-weight polyethylene (UHMWPE). Faster adoption of lightweight hybrid solutions, government programs that subsidize protective gear for police officers, and accelerated naval and space programs all contribute to rising procurement budgets. Meanwhile, supply insecurity for strategic minerals such as titanium and boron carbide forces buyers to redesign material portfolios and build contingency stocks, opening niche opportunities for recyclers and secondary processors. Competitive activity is moderate; large chemical and advanced-materials companies still dominate, but start-ups that specialize in nano-enhanced ceramics are gaining traction, especially where sustainability credentials and circular-economy services matter.

Global Armor Materials Market Trends and Insights

Development of body armor & advanced weapons

Angel Armor's 2024 Truth SNAP plate system demonstrated how magnetic couplings deliver modularity while plates as light as 0.65 lb keep operators agile. Hybrid lay-ups such as UHMWPE/carbon-fiber reinforced plastic (CFRP) now achieve 28% lower back-face deformation than legacy laminates, proving that multi-material stacks can equal Level IV protection at lower mass. Field trials confirm that ceramic-UHMWPE hybrids survive multiple hits, while aluminum-titanium-carbide metal-matrix composites boost ballistic-limit velocity by 30% versus rolled homogeneous armor. These innovations increase the performance ceiling of the armor materials market and push procurement toward lighter configurations without sacrificing survivability.

Increasing homeland-security concerns

Federal and state funding flows directly to local agencies. The FBI Legacy Body Armor Program has already transferred nearly USD 700,000 in plates and vests to small departments where 41% of officers previously had no mandatory-wear policy. The U.S. Department of Homeland Security is requesting USD 107.4 billion for FY 2025, including grants that earmark USD 1.008 billion for protective equipment upgrades. Similar schemes in Europe and parts of Asia accelerate purchase cycles and sustain volume growth for the armor materials market.

Volatile titanium & boron-carbide feedstock prices

The 2025 U.S. Geological Survey summaries note frequent spot-price swings for strategic metals, including titanium sponge, caused by concentrated supply in a handful of producers. Meanwhile, GAO data show that the Department of Defense recorded 99 material shortfalls, a 167% jump versus 2019, with boron-carbide repeatedly flagged as "single-source". As suppliers impose surcharges, armor makers wrestle with cost-plus contracts that seldom adjust quickly, eroding margins across the armor materials market.

Other drivers and restraints analyzed in the detailed report include:

- Rising incidence of asymmetric warfare & IED threats

- Accelerated Modernization of Naval Fleets

- Stringent export-control regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metals and alloys retained 52% of sales in 2024, yet ceramic & composite lines are pacing the overall armor materials market at a 7.22% CAGR. Silicon-carbide tiles now deliver like-for-like ballistic resistance at densities below 3.2 g/cm3, trimming war-fighter loadouts by several kilograms per torso kit. Study results on staggered half-lap joint designs confirm that optimized ceramic shapes yield full compliance with U.S. military protocols at lower thickness. Consequently, procurement agencies recalibrate specifications toward lighter plates, a trend that reshapes supplier mix within the armor materials market.

Structural ceramics partner well with UHMWPE backings, producing multi-hit capability gains of 35%. Parallel research into Kevlar/UHMWPE laminates using Elium thermoplastic resin recorded 25% higher energy absorption and a 22.44% weight reduction, helping law-enforcement agencies extend patrol duration without fatigue penalties. Growth in para-aramid fiber adoption remains steady, but UHMWPE fibers now post the fastest uptake due to superior tensile strength and improved thermal aging properties. Together, these dynamics shift investment from traditional steel to hybrid stacks, cementing the armor materials market's pivot toward advanced composites.

The Armor Materials Market Report Segments the Industry by Product Type (Metal and Alloy, Ceramic and Composite, Para-Aramid Fiber, and More), Application (Body Armor, Vehicle Armor, and More), End User (Defense, Homeland Security and Law-Enforcement, and Civil and Commercial), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 38% of 2024 revenue, anchored by the U.S. defense budget and vigorous R&D. Ongoing Air Force Research Laboratory programs funnel breakthroughs in high-entropy alloys and nano-engineered ceramics straight into production, shortening technology-transition timelines. Federal Buy-American statutes further insulate regional suppliers and stabilize the armor materials market.

Asia-Pacific is the fastest-growing cluster at a 7.45% CAGR. China funnels substantial resources into indigenous silicon-carbide sintering, while India's DRDO advances fiber-reinforced polymer composites tailored for hot climates. Parallel naval procurement in South Korea and Australia boosts demand for corrosion-resistant armor steels and composite bow inserts, broadening the regional customer base.

Europe grapples with strategic-mineral access. The EU Critical Raw Materials Act targets 40% domestic processing and 15% recycling rates by 2030, prompting fresh investment in boron-carbide recovery and titanium-scrap upgrading. Cross-border collaboration under the Permanent Structured Cooperation (PESCO) framework accelerates next-generation helmet programs, keeping the armor materials market innovative despite tight budgets.

The Middle East and Africa record mid-single-digit growth. Procurement centers on counter-IED vehicle kits and perimeter fortifications for energy installations. Nations such as the UAE also fund micrometeoroid shielding research for planned near-space tourism, extending the armor materials market into emergent aerospace domains.

- 3M

- Arconic

- ArmorSource, LLC

- ATI Inc.

- BAE Systems

- CeramTec GmbH

- CoorsTek Inc.

- CPS Technologies

- dsm-firmenich

- DuPont

- Honeywell International Inc.

- HS HYOSUNG ADVANCED MATERIALS

- JPS Composite Materials

- Koninklijke Ten Cate BV

- Morgan Advanced Materials

- NP Aerospace

- Plasan

- PPG Industries, Inc.

- Rochling SE & Co. KG

- SafeGuard Armor

- Saint-Gobain

- Schunk Carbon Technology

- Tata Steel

- Teijin Aramid

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development of body armor and advanced weapons

- 4.2.2 Increasing homeland security concerns

- 4.2.3 Rising incidence of asymmetric warfare and IED threats elevating demand for blast-resistant vehicle armor

- 4.2.4 Expansion of commercial spaceflight and near-space tourism requiring micrometeoroid-shielding materials

- 4.2.5 Accelerated modernization of naval fleets driving need for corrosion-resistant armor steels

- 4.3 Market Restraints

- 4.3.1 Volatile titanium and boron-carbide feedstock prices inflating production costs

- 4.3.2 Stringent export-control regulations limiting cross-border technology transfer

- 4.3.3 Recycling and end-of-life challenges for composite armor materials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Metal and Alloy

- 5.1.2 Ceramic and Composite

- 5.1.3 Para-aramid Fiber

- 5.1.4 Ultra-high-molecular-weight Polyethylene (UHMWPE)

- 5.1.5 Other Product Types (e.g., fiberglass, carbon, nano-enhanced)

- 5.2 By Application

- 5.2.1 Body Armor

- 5.2.2 Vehicle Armor

- 5.2.3 Aerospace

- 5.2.4 Marine Armor

- 5.2.5 Civil Armor

- 5.3 By End User

- 5.3.1 Defense

- 5.3.2 Homeland Security and Law-Enforcement

- 5.3.3 Civil and Commercial

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JV, Agreements)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arconic

- 6.4.3 ArmorSource, LLC

- 6.4.4 ATI Inc.

- 6.4.5 BAE Systems

- 6.4.6 CeramTec GmbH

- 6.4.7 CoorsTek Inc.

- 6.4.8 CPS Technologies

- 6.4.9 dsm-firmenich

- 6.4.10 DuPont

- 6.4.11 Honeywell International Inc.

- 6.4.12 HS HYOSUNG ADVANCED MATERIALS

- 6.4.13 JPS Composite Materials

- 6.4.14 Koninklijke Ten Cate BV

- 6.4.15 Morgan Advanced Materials

- 6.4.16 NP Aerospace

- 6.4.17 Plasan

- 6.4.18 PPG Industries, Inc.

- 6.4.19 Rochling SE & Co. KG

- 6.4.20 SafeGuard Armor

- 6.4.21 Saint-Gobain

- 6.4.22 Schunk Carbon Technology

- 6.4.23 Tata Steel

- 6.4.24 Teijin Aramid

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Defense Budgets