PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1429224

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1429224

South Korea Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

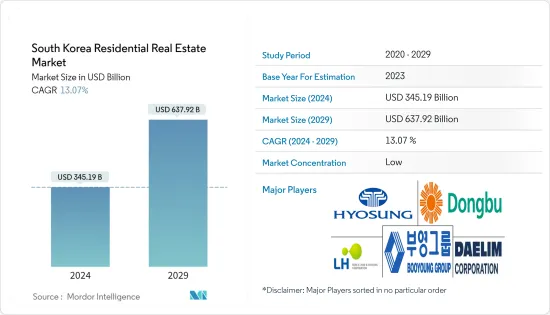

The South Korea Residential Real Estate Market size is estimated at USD 345.19 billion in 2024, and is expected to reach USD 637.92 billion by 2029, growing at a CAGR of 13.07% during the forecast period (2024-2029).

The increasing housing demand drives the market. Furthermore, the market is driven by the increasing construction of apartments in the country due to land scarcity.

Key Highlights

- The COVID-19 pandemic brought a huge difference in the residential real estate market in South Korea. The number of private apartments sold in Seoul from January 2021 to July 2021 was 1,895 units, a decrease of 86% from the same period last year (13,782 units), while in the metropolitan area, 40,876 households were sold during the same period.

- In January 2021, South Korea's finance ministry prioritized increasing housing supply, with construction regulations in heavily crowded urban areas relaxed and redevelopment projects supported to stabilize and drive the housing market. Further, the government announced its plan to develop 830,000 housing units nationwide, including 320,000 units in Seoul, in two years. In Asia, South Korea has developed its green building certification system, the Green Standard for Energy and Environmental Design (G-SEED), which assesses the eco-friendliness of buildings by evaluating eight environmental areas.

- High-rise apartments, detached homes, and row houses are Korea's primary housing types. In South Korea, apartments are the most prevalent type of housing. These flats are frequently located in residential high-rise structures with five to twenty levels. The most popular form of housing for South Koreans is an apartment since the neighbourhood is readily constructed around the apartment complex. An apartment complex often houses hundreds to thousands of households with retail stores, recreation areas, and childcare facilities. Nevertheless, detached homes are becoming more popular as it has become more fashionable to live outside cities.

South Korea Residential Real Estate Market Trends

Urbanization in the Country is Driving the Market

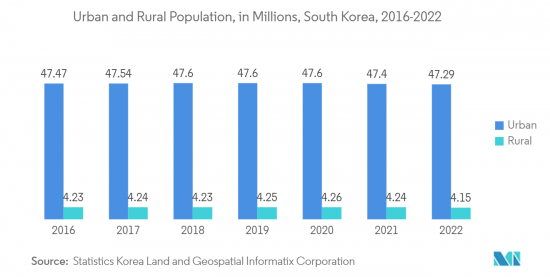

- Asia-Pacific is urbanizing faster than Europe and North America. It will likely continue to have most of the world's megacities (urban agglomeration areas with a population of over 10 million). The rapid industrialization that Korea experienced has accelerated migration patterns and demographic trends from rural to urban areas. Due to the increasing population, the country has experienced unbalanced land distribution and demographic patterns.

- Rapid urbanization, demographic changes, and technological advancements are trends driving cities' residential real estate market. These factors contributed to the rising house prices, affordable housing shortages, and limited housing stock in many cities. These problems, in turn, threaten not just financial market stability but also the quality of life and integration and city competitiveness on the national and international scale.

- In response, the cities are focusing on creating more housing, including a more diverse range of options for the housing stock to meet the needs of different types and income levels of households. Further, through applying the principles of 'good density, ' integrated urban environments can be created with high-quality placemaking that cater to a range of income and population groups and contribute to the vibrancy and authenticity of a city.

Affordable Housing Supply in the Country

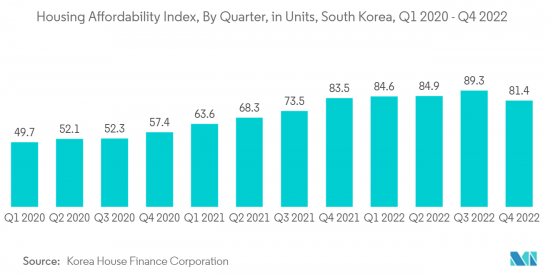

- South Korea ranked third from the bottom, with a property affordability score of 3.94 (in December 2021). With relatively low salaries and high apartment costs, South Koreans may find it challenging to afford houses.

- As reported in February 2021, South Korea planned to supply 830,000 housing units in Seoul and other big cities in two years through housing redevelopment projects led by state-run agencies, marking the largest-scale supply measure envisioned by the Moon Jae-in administration. Of the 830,000 housing units, 323,000 new houses will be built in Seoul and 293,000 in the Gyeonggi Province and Incheon. The ministry also plans to add over 220,000 new homes in major cities, including Busan, Daegu, and Daejeon, which saw hikes in property prices.

- Additionally, the Ministry of Land, Infrastructure and Transport announced its real estate plan to provide affordable housing in big cities to meet the demand from young people and tackle soaring home prices. The focal point of the new measure is to have public developers, such as the state-run Korea Land and Housing and Seoul Housing and Communities create fast-track approval processes to expand the housing supply swiftly.

South Korea Residential Real Estate Industry Overview

The South Korea Residential Real Estate Market is fragmented, with many regional and local players and a few global companies. Public services mostly dominate the housing or residential development in South Korea. Government agencies, such as the Korea National Housing Corporation and the Korea Land Development Corporation, primarily undertake housing developments in Korea. Dongbu Corporation, Hines, Shinyoung (Greensys), Korea Land and Housing Corporation, Booyoung Group, and HDC Hyundai Development are prominent players in the market. Growing residential and affordable house construction in the country generates several opportunities for companies in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Current Scenario of South Korea's Economy and the Residential Real Estate Market)

- 4.2 Insights into the Interest Rate Regime for General Economy and Real Estate Lending

- 4.3 Demographic Analysis of South Korea

- 4.4 Data and Commentary on Key Residential Real Estate Parameters

- 4.5 Insights into Real Estate Purchasers

- 4.6 Spotlight on Real Estate Contract Types

- 4.7 Spotlight on the Trends in the South Korean Residential Real Estate Market

- 4.8 Insights into the Primary and Secondary Markets in South Korea

- 4.9 Spotlight on Affordable Housing Supply in South Korea

- 4.10 Technological Innovations in South Korea's Residential Real Estate Market

- 4.11 Insights into Environment Friendliness in the South Korea Construction Market

- 4.12 Government Policies and Initiatives

- 4.13 Insights into Rental Yields and Prices in the Real Estate Segment

- 4.14 Insights into Unit Based Metrics

- 4.15 Insights into Return Metrics for Transactions of the Residential Real Estate Market in South Korea

- 4.16 Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Government's Plans to Supply New Homes

- 5.2 Restraints

- 5.2.1 Rising Interest Rates

- 5.3 Opportunities

- 5.3.1 Unmet Housing Demand for Foreigners

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Apartments and Condominiums

- 6.1.2 Landed Houses and Villas

- 6.2 By Geography

- 6.2.1 Seoul

- 6.2.2 Other Locations

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles (Key and Upcoming Players in the Residential Real Estate Market in South Korea)

- 7.2.1 Hyosung Corporation

- 7.2.2 Dongbu Corporation

- 7.2.3 Daelim Corporation

- 7.2.4 Booyoung Group

- 7.2.5 Korea Land and Housing Corporation

- 7.2.6 ShinYoung Greensys

- 7.2.7 Hyundai Development Company

- 7.2.8 Hines

- 7.2.9 Knight Frank

- 7.2.10 Cushman And Wakefield*

- 7.3 Competition Overview in Other Real Estate Services and Allied Segments (Brokers, Property Managers, and Facility Managers such as CBRE Korea, Savills Korea, Cushman and Wakefield Korea, KOREIT, JLL Korea, Hines Korea, Golden Planners Korea, Chestertons South Korea, Taekwang, and Libeto)

- 7.4 Company Profiles in Real Estate Tech (Real Estate Tech Startups Across Various Disciplines such as Zigbang, Fast Five, Neighborhood, nemoapp, Sugarhill, Hogaeng Nono, r.square, Disco, Mangrove, and Stayes)

8 FUTURE OF THE MARKET

9 INVESTMENT ANALYSIS

10 APPENDIX

- 10.1 Macroeconomic Indicators (GDP Breakdown by Sector, the Contribution of Construction to the Economy, etc.)

- 10.2 Other Relevant Data (Most Expensive Apartments in South Korea Based on Actual Transaction Value, Most Expensive Areas in Seoul, etc.)