PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408391

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408391

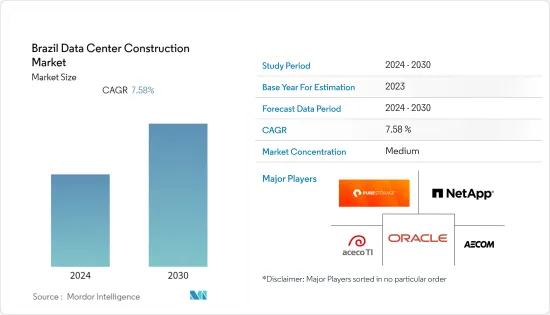

Brazil Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030

The Brazil Data Center Construction Market is projected to register a CAGR of 7.58% during the forecast period.

Under Construction IT Load Capacity: The upcoming IT load capacity of the Brazil data center construction market is expected to reach 1205 MW in six years.

Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase by 4.6 million sq. ft in six years.

Planned Racks: The country's total number of racks to be installed is expected to reach 231,802 units in six years.

Planned Submarine Cables: Close to 15 submarine cable systems connect Brazil; many are under construction. One such submarine cable, estimated to be built by the end of the current year, is Firmina, which stretches over 14517 km with landing points in Las Toninas, Argentina, Praia Grande, Brazil, Myrtle Beach, SC, United States, Punta del Este, Uruguay.

Brazil Data Center Construction Market Trends

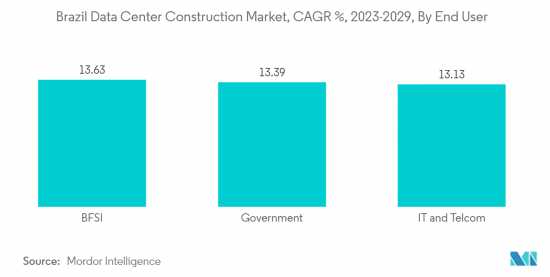

IT and Telecom to have significant market share

- The cloud segment reached an IT load capacity of 91.3 MW this year. It is expected to register a CAGR of 13.55%, surpassing 266.3 MW in six years. On the other hand, the BFSI segment is projected to register a CAGR of 13.63%, reaching a capacity of 139.9 MW in six years.

- Cloud and BFSI are expected to contribute the highest market share among end-user industries, while the manufacturing segment is expected to register the fastest growth over the forecast period. The Brazilian data center market is being driven by rising cloud use across most companies due to the development of technologies like artificial intelligence, big data, and blockchain among various end users.

- Big data and analytics solutions and services received a total investment of USD 2.9 billion in 2022, an increase of 10.8%. For artificial intelligence/machine learning (AI/ML), the expected spending in the same year was 28% Y-o-Y, reaching USD 504 million. In 2022, the Brazilian market for security services was valued at USD 1 billion, with an average growth rate of about 10% Y-o-Y since the pandemic.

- Sales of security products will surpass USD 860 million in the future, with cloud computing garnering significant interest. As the popularity of cloud computing services, security services, and applications increases, a more sizable colocation of cloud-based data centers is expected to be constructed in Brazil.

- In June 2022, Google Cloud announced an investment of BRL 1.6 billion (USD 312.65 million) in technological infrastructure. Google Cloud aims to assist its clients in expanding their digital capabilities, diversifying their service portfolios, and generating new business. This trend suggests the growing cloud demand in the country.

Sao Paulo is a major hotspot for data center construction market for the country

- The total IT load capacity in Sao Paulo reached 328.74 MW in the current year and is expected to register a CAGR of 14.33%, surpassing 1,007.54 MW in five years.

- On the other hand, Rio de Janeiro is estimated to register a CAGR of 11.36%, reaching a capacity of 89.36 MW. The Rest of Brazil is projected to register a CAGR of 2.02% to get 108.5 MW in five years.

- With a population of about 21.3 million, So Paulo is the largest and most populated city in Brazil, the Americas, and the southern and western hemispheres. In terms of economic status, the city is Latin America's powerhouse. Its economy is based on a strong technological basis.

- The state produces high-value goods in aviation, oil and gas, information and communications technology (ICT), and the green economy. Its GDP increased by 2.6% in 2020, twice the national average. Rio de Janeiro is Brazil's second-largest regional economy and financial hub. It is important at the national level because many of Brazil's most prominent companies, including mining, oil, and telecommunications companies, have headquarters in the city.

- These factors may further offer favorable conditions for the growth of the data center market in the region. The Rest of Brazil includes Brasilia, Ceara, Canoas, Curitiba, Porto Alegre, and Others. In April 2022, with the aid of a USD 31 million loan approved by the Inter-American Development Bank, the Brazilian state of Ceara accelerated the digital transformation of its government to boost citizen satisfaction and reduce the use of public services. This move may assist in enhancing digital transformation and connectivity in Ceara.

Brazil Data Center Construction Industry Overview

Brazil Data Center Construction Market is fairly consolidated, some significant players include AECOM, NetApp, Oracle, Pure Storage and Aceco TI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 MARKET INSIGHTS

5 Market Overview

6 Industry Attractiveness - Porter's Five Forces Analysis

- 6.1 Bargaining Power of Suppliers

- 6.2 Bargaining Power of Buyers

- 6.3 Threat of New Entrants

- 6.4 Threat of Substitutes

- 6.5 Degree of Competition

7 Key Industry Statistics

- 7.1 Planned/Under Construction IT Load Capacity

- 7.2 Planned/Under Construction Raised Floor Space

- 7.3 Planned/Under Construction Racks

- 7.4 Planned Submarine Cable

8 MARKET DYNAMICS

9 Market Drivers

- 9.1 Growth in Network Connectivity and Increased Adoption of Digital Transformation Related Technologies in the Region

- 9.2 Favorable tax Incentive Structure Introduced by Local Governments has Led to the Higher Participation from International Players

- 9.3 Ongoing Consolidation Efforts by Major Data Center Construction Companies to Aid their Expansion Activities

- 9.4 Growing Awareness on Modular Deployments and Increasing Rack Density

10 Market Restraints

- 10.1 Cost and Infrastructural Concerns Continue to be a Concern

- 10.2 Workforce-Related Challenges

11 MARKET SEGMENTATION

- 11.1 By Infrastructure

- 11.1.1 Electrical Infrastructure

- 11.1.1.1 UPS Systems

- 11.1.1.2 Other Electrical Infrastructures

- 11.1.2 Mechanical Infrastructure

- 11.1.2.1 Cooling Systems

- 11.1.2.2 Racks

- 11.1.2.3 Other Mechanical Infrastructures

- 11.1.3 Other Infrastructures

- 11.1.1 Electrical Infrastructure

- 11.2 By End User

- 11.2.1 IT & Telecommunication

- 11.2.2 BFSI

- 11.2.3 Government

- 11.2.4 Healthcare

- 11.2.5 Other End Users

12 COMPETITIVE LANDSCAPE

13 Company Profiles

- 13.1 Turner Construction Co.

- 13.2 DPR Construction Inc.

- 13.3 Fortis Construction

- 13.4 ZFB Group

- 13.5 Aceco TI

- 13.6 AECOM Limited

- 13.7 Constructora Sudamericana S.A

- 13.8 HostDime Brasil

- 13.9 CyrusOne Inc.

- 13.10 RITTAL Sistemas Eletromecanicos Ltda. (Rittal GmbH & Co. KG)

- 13.11 Nakano Corporation

- 13.12 Oracle

- 13.13 Delta Group

- 13.14 Ascenty Data Centers E Telecomunicacoes

- 13.15 Equnix Inc.

- 13.16 Aceco TI

- 13.17 Constructora Sudamericana

- 13.18 NetApp

- 13.19 Oracle

- 13.20 Pure Storage

14 INVESTMENT ANALYSIS

15 MARKET OPPORTUNITIES AND FUTURE TRENDS