PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408368

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408368

China Home Loan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

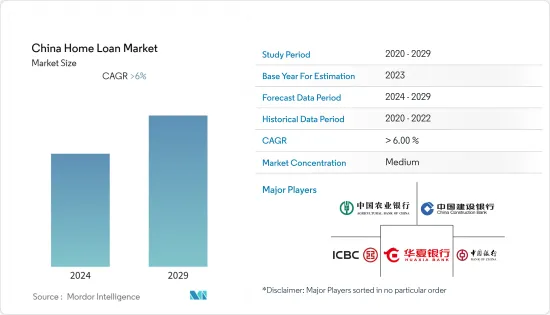

China's Home Loan Market has generated a revenue of USD 680 billion in the current year and is poised to achieve a CAGR of 6% for the forecast period. China has one of the largest home loan markets globally. The market has witnessed rapid expansion due to increased urbanization, rising income levels, and government initiatives to promote homeownership. According to data from the People's Bank of China, the outstanding balance of residential mortgage loans reached trillions of yuan.

In an attempt to stimulate China's flagging housing market, banks in some cities are extending the upper age limit on mortgages to between 80 and 95. Although not a national policy, banks in Beijing, Hangzhou, and other big cities have started offering relay loans to elderly customers, which pass on to their children if they cannot repay. The Chinese government has implemented various policies to support the housing market and facilitate access to home loans. These include measures such as down payment requirements, interest rate regulations, and targeted subsidies to certain groups of homebuyers.

Home loans in China are primarily provided by commercial banks, including large state-owned banks, joint-stock banks, and regional banks. Non-bank financial institutions, such as insurance companies and trust companies, also participate in the home loan market. The Chinese government has implemented policies to regulate down payment requirements for home loans. Different down payment percentages are applied based on factors such as property type, location, and the number of properties owned by the borrower.

The COVID-19 pandemic has had several impacts on the home loan market in China. During the initial phase of the pandemic, there were temporary disruptions in the home loan market due to lockdown measures, restricted movement, and the closure of some financial institutions. These disruptions led to delays in loan processing and approval. The pandemic and associated lockdowns resulted in a decline in housing transactions in certain areas. Reduced housing market activity had a direct impact on the demand for home loans as potential homebuyers delayed their purchase decisions.

China Home Loan Market Trends

Impact of Increasing Household Consumption on Home Loan Market in China

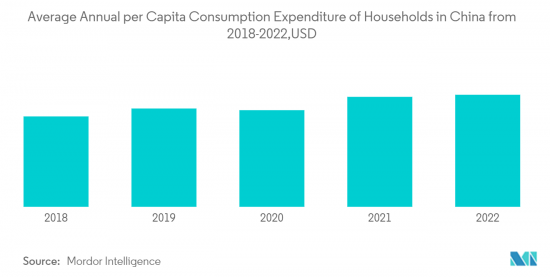

Household consumption expenditure is closely linked to housing demand. As households spend more on consumption, there is an increased desire for better living standards, including homeownership. Higher per capita consumption expenditure may drive demand for housing, thereby stimulating the demand for home loans to finance property purchases. The level of household consumption expenditure can also influence the ability to save for down payments on home purchases. If households have higher consumption expenditures, they may have less disposable income available for savings, which can affect their ability to accumulate the necessary down payment required for a home loan. This can impact the size of home loans individuals can qualify for and the overall demand for mortgage financing. The level of household consumption expenditure can be an indicator of economic confidence. When households have higher spending, it suggests a positive outlook on the economy and job stability. This can positively influence the home loan market as increased economic confidence encourages individuals to make long-term investments, such as purchasing a home and taking on a mortgage.

Impact of Construction cost in Home Loan Market

Construction costs directly impact the overall cost of building homes. When construction costs increase, developers may pass on these costs to homebuyers by raising property prices. Higher home prices can impact the affordability of housing and the loan amounts borrowers need to finance their purchases. It can also affect the loan-to-value ratios, down payment requirements, and borrowing capacity of homebuyers. Construction costs influence the loan amounts sought by homebuyers. As construction costs rise, borrowers may need larger loan amounts to cover the increased costs of purchasing or building a home. This can affect the demand for home loans and the overall loan portfolio of lenders. The impact of construction costs on the home loan market ultimately affects housing affordability. When construction costs increase, it can contribute to higher property prices and mortgage payments, potentially making homeownership less affordable for some individuals and impacting the demand for home loans.

China Home Loan Industry Overview

The competitive landscape of the home loan market in China is highly competitive and continues to evolve as new players enter the market and existing players adapt to changing consumer preferences and regulatory requirements. Factors such as interest rates, loan terms, customer service, digital capabilities, and reputation are key competitive differentiators in this market. The competitive landscape of the home loan market in China is dynamic and consists of various players, including banks, non-banking financial institutions, and online lenders. The following are the major Players in the market: ICBC Co.Ltd., Bank of China, China Construction Bank Corporation, Agricultural Bank of China Limited, and Hua Xia Bank Co., Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Real Estate Market Trends

- 4.2.2 Government Policies

- 4.3 Market Restraints

- 4.3.1 Interest rates on Home Loans

- 4.3.2 Market Volatility and Uncertainty

- 4.4 Insights on Various Regulatory Trends Shaping the Market

- 4.5 Insights on impact of technology in the Market

- 4.6 Industry Attractiveness - Porters' Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Purpose

- 5.1.1 Home Purchase

- 5.1.2 Refinance

- 5.1.3 Home Improvement

- 5.1.4 Construction

- 5.1.5 Other

- 5.2 By End User

- 5.2.1 Employed Individuals

- 5.2.2 Professionals

- 5.2.3 Students

- 5.2.4 Entrepreneur

- 5.2.5 Others (Homemaker, Unemployed, Retired, etc.)

- 5.3 By Tenure

- 5.3.1 Less Than 5 years

- 5.3.2 6-10 years

- 5.3.3 11-24 years

- 5.3.4 25-30 years

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 ICBC Co.Ltd.

- 6.2.2 Bank of China

- 6.2.3 China Construction Bank Corporation

- 6.2.4 Agricultural Bank of China Limited

- 6.2.5 Hua Xia Bank Co., Limited

- 6.2.6 Industrial Bank Co., Ltd.

- 6.2.7 China Everbright Bank Co., Ltd.

- 6.2.8 Postal Savings Bank Of China (PSBC)

- 6.2.9 China CITIC Bank International Limited

- 6.2.10 China Merchants Bank Co. Ltd.*

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US