PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408335

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408335

India Taxi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

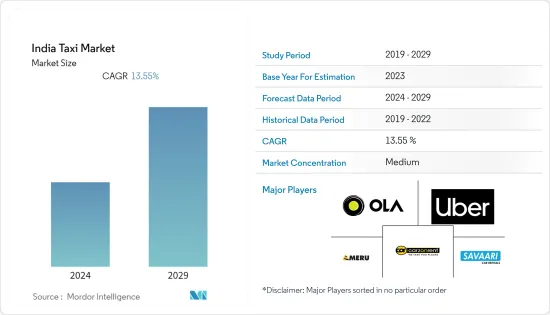

The India taxi market is valued at USD 20.61 billion and is expected to surpass the market value of USD 38.90 billion by the end of the forecast period by registering a CAGR of 13.55%.

Key Highlights

- The COVID-19 pandemic stands to be the most abrupt shock to the global economy in modern times. With transport being one of the COVID-19 transmission vectors, the pandemic has affected shared mobility at large, including ride-hailing and ride-sharing services. While the current COVID-19 pandemic may delay the achievement of turnover targets, the medium to long-term growth of taxis in India is very likely. This would qualify taxis as a significant and growing contributor to road transport air pollution in India. However, the taxi market is witnessing substantial growth owing to the swiftly escalating year-on-year adoption rate of electric vehicles.

- The rise of eco-friendly electric cab services will likely provide an attractive potential for market expansion. For instance, there was a dramatic rise in electric vehicle sales in the country, showing signs of active market growth in the Indian taxi market during the forecast period.

- Further, the expansion of taxi services provided by market leaders such as Uber, Ola Cabs, and Meru Cabs, as well as the ability to select convenient pick-up and drop-off locations, is encouraging consumers to choose them and positively impacts the target market growth in the upcoming period.

- Over the long term, the taxi industry is expected to grow due to increasing demand for ride-hailing and ride-sharing services, increasing demand from online taxi booking channels, and an increase in the cost of vehicle ownership. Compared to other modes of transportation, increasing traffic congestion and low taxi fares are the other major factors driving the taxi market in India.

India Taxi Market Trends

Adoption of Electric Vehicles will Possess a Positive Outlook for the Taxi Market

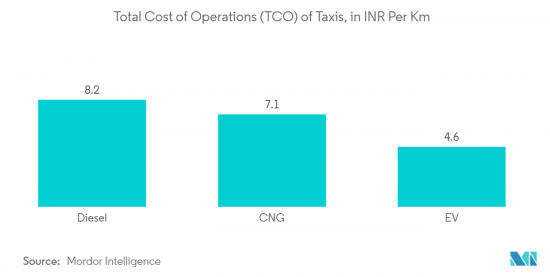

- One of the primary factors fuelling the market's growth is the increased adoption of electric vehicles in the country, mostly because of the stringent governmental regulations against pollution and environmental aspects. The Indian government has set a target of achieving 30% Electric vehicle sales by 2030. The electrification of ride-hailing vehicles, particularly a switch to battery electric vehicles (BEVs), would reduce CO2 emissions and improve air quality in cities. In addition, the adoption of BEVs could reduce maintenance and fuel costs for drivers and encourage a faster roll-out and higher utilization of charging infrastructure. Players in the Indian Taxi market are introducing various business strategies and expanding their market reach. They are partnering with car manufacturers to help Ride-Sharing companies negotiate reduced purchase or leasing prices for electric vehicles to be passed on to the drivers. At the same time, car manufacturers can benefit from further electric vehicle sales to meet their CO2 or zero emission standards. For Instance,

- In February 2023, Uber Technologies, India's leading Ride-sharing company, signed a Memorandum of understanding (MoU) with Tata Motors, India's leading automobile manufacturer and the pioneer of India's EV evolution, to bring 25,000 XPRES-T EVs into their premium category service. Aligned towards its goal of a clean and green environment, Tata Motors will be aiding Uber in electrifying its services across Indian cities Delhi NCR, Mumbai, Kolkata, Chennai, Hyderabad, Bengaluru, and Ahmedabad. The Company will begin the deliveries of the cars to Uber fleet partners in a phased manner.

- In March 2023, Ola Electric, India's leading mobility platform and one of the world's largest ride-hailing companies, was invented in StoreDot, an Israel battery tech company known for extremely fast charging (XFC) technology. This investment marks Ola Electric's initial step in global strategies investments, focusing on advanced battery technology for Ola Cabs and Two wheelers, including StoreDot's 5-minute 0-100% Extreme fast charging battery, with exclusive manufacturing rights for India.

- In September 2021, BluSmart Mobility, an Electric Ride-Hailing Mobility Service, signed a Memorandum of understanding (MoU) with Tata Motors, one of India's leading automobile manufacturers, to expand BluSmart's all-electric fleet multi-fold across Delhi NCR, and for the same, the Company has bagged a contract to supply 3,500 XPRES T EVs. This contract marks a key milestone in the electric fleet market. As more customers now prefer to travel in environment-friendly vehicles.

- As these factors continue to develop, it is likely to drive the growth trajectory over the coming years and will have a subsequent positive impact on the India Taxi market.

Online Bookings Driving the Market

- One of the primary factors fuelling the market's growth is the increased usage of online cab booking platforms; there are several factors, including the convenience they offer to passengers and the ease of online payment options. The flexibility of choosing pick-up and drop-off locations and the availability of information on the application, such as driver contact details and vehicle details, have also contributed to the increasing popularity of online type booking.

- The rise of smartphones and the internet has made it easier for customers to book rides online, and this trend is expected to continue in the future. In addition, major operators like Uber Technologies, Ola Cabs, and Meru Cabs offer ride-sharing options in certain cities, which have become increasingly popular due to their low-fare options. Players are also incorporating ride-sharing options into their application development to meet the growing demand for these services. Several key Taxi players are actively investing in the Indian region in order to expand their presence and cater to a wide range of customer base. For instance,

- In May 2023, inDrive, a California-based online ride-hailing platform, announced the launch of its services in Indian Metro cities Pune and Bengaluru. It has already launched its services in 2019. The platform follows a fair-price setting model under which passengers and drivers negotiate fares among themselves. It offers ride-hailing, intercity, freight, and delivery services in India.

- Further, the Indian government has encouraged the adoption of convenient technology in the taxi industry through various initiatives, for instance,

- In July 2023, Karnataka, India Transport Minister Ramalinga Reddy announced the development of an autorickshaw- and taxi-booking app akin to private cab aggregators like Ola and Uber. The app connects customers directly with auto and taxi drivers, targeting the market for affordable fares by eliminating intermediaries. It has gained popularity among commuters in the city. The fares are set based on the government's fixed price list, with a booking charge of INR 10. Drivers have the option to increase the booking charge up to INR 30.

- In August 2022, Kerala, India Chief Minister Pinarayi Vijayan launched Kerala Savari, a government-owned online taxi service in Thiruvananthapuram. The Kerala Savari has a fleet of around 500 autos and taxis enrolled, which will be charged 8% as a service charge against the 20-30% levied by private operators.

- These factors are likely to contribute to a positive outlook for India's taxi industry over the coming decade and which is likely to fuel the demand for the taxi market during the forecast period.

India Taxi Industry Overview

The India Taxi market is moderately fragmented. A few key players in the market are ANI Technologies Pvt. Ltd. (Ola Cabs), Uber Technologies Ltd., Meru Cabs, Mega Cabs, Spice Cabs, Carzonrent India Pvt. Ltd., Blu-Smart Mobility Pvt. Ltd., and Others. The majority of players in the Indian taxi market engage in fierce competition by employing a variety of technologies and strategies to capture market share and attract customers. For instance,

In May 2023, BluSmart Mobility, an Indian ride-hailing startup, aims to rival Uber and Ola's market dominance by emphasizing an all-electric taxi fleet and a proactive approach to attracting unhappy passengers and drivers from the established players. The company intends to increase its taxi fleets and drivers and benefit from the government's clean energy drives with environmentally friendly transportation.

In April 2022, Roppen Transportation (Rapido), an Indian bike taxi aggregator and logistics service provider based in Bangalore, India, and Swiggy, an online food ordering giant, took a strategic investment, Swiggy has led an investment of USD 180 Million in Bike and Auto-taxi aggregator Rapido. This vibrant, competitive environment drives innovation and contributes to India's position as a key player in the global taxi market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Accessibility and Utilization of Taxi Services

- 4.2 Market Restraints

- 4.2.1 Stringent Transportation Regulatory Hurdles to Restrict the Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Booking Type

- 5.1.1 Online Booking

- 5.1.2 Offline Booking

- 5.2 By Service Type

- 5.2.1 Ride-Hailing

- 5.2.2 Ride-Sharing

- 5.3 By Vehicle Type

- 5.3.1 Motorcycles

- 5.3.2 Cars

- 5.3.3 Other Vehicle Types (Vans)

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 ANI Technologies Pvt. Ltd (Ola Cabs)

- 6.2.2 Uber technologies Inc.

- 6.2.3 Meru Cabs

- 6.2.4 Spice Cabs

- 6.2.5 Carzonrent India Pvt. Ltd.

- 6.2.6 Mega Cabs

- 6.2.7 My Taxi India

- 6.2.8 NTL Taxi

- 6.2.9 inDrive

- 6.2.10 FastTrack Taxi

- 6.2.11 Savaari Car Rentals

- 6.2.12 BlaBlaCar

- 6.2.13 Roppen Transportation

- 6.2.14 Zoomcar India Pvt. Ltd.

- 6.2.15 Blu-Smart Mobility Pvt. Ltd.

- 6.2.16 *List Not Exhaustive

7 MARKET OPPORTUNITIES AND FUTURE TRENDS