PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408212

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408212

Russia Car Loan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

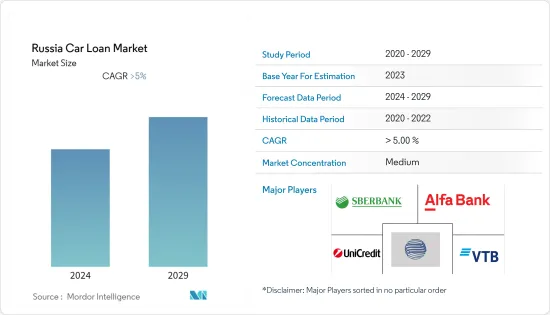

The Russia Car Loan Market generated a revenue of USD 34.8 billion in the current year and is expected to register a CAGR greater than 5% during the forecast period.

The car loan market in Russia experienced significant growth over the past decade, driven by several factors, including the increasing demand for cars, the availability of affordable car loan products, and the expansion of Russia's middle class. The average interest rate for car loans in Russia is relatively high compared to other countries but is trending downwards in recent years, driven by increased competition among lenders. The loan terms typically range from 1 to 7 years, with longer terms generally associated with higher interest rates.

The COVID-19 pandemic and the subsequent economic downturn in Russia harmed the car loan market, leading to declining loan volumes and revenue. However, the market is expected to recover in the coming years as the economy stabilizes and consumer demand for cars returns to pre-pandemic levels.

Russia Car Loan Market Trends

Low Interest Rates are Driving the Market

Low-interest rates are one of the key factors driving the growth of the car loan market in Russia. In recent years, the Central Bank of Russia lowered its key interest rate to stimulate economic growth and encourage borrowing. It made it cheaper for consumers to take out car loans.

When interest rates are low, banks and other lenders can offer car loans at more attractive rates, making them more appealing to consumers. Lower interest rates also mean that borrowers can take out larger loans without significantly increasing their monthly payments, making it easier to finance more expensive cars.

In addition, many lenders in Russia are offering longer loan terms for car loans, which can help reduce monthly payments even further. Longer loan terms can also make it easier for consumers to qualify for loans, as the monthly payments are spread out over a longer period.

Increased Consumer Demand for Cars

In recent years, increased consumer demand for cars in Russia drove the car loan market growth. As the economy improved and more people had disposable income, many Russians sought to purchase cars for personal or business use. However, buying a car outright can be a significant financial burden for many consumers, which is where car loans come in.

Car loans became increasingly popular in Russia as a way for consumers to finance their car purchases. The number of car loans issued in Russia increased by 7% in 2022 compared to the same period in 2021. Lower interest rates, longer loan terms, and increased competition among lenders drive this growth.

In addition, the Russian government introduced several measures to support the car industry, further boosting demand for cars and car loans. For example, the government provided subsidies for car purchases, reduced import duties on car components, and introduced tax breaks for car manufacturers.

Russia Car Loan Industry Overview

The market for Russian car loans is moderately concentrated, with several major banks and financial institutions offering car loans to consumers. Major players like Sberbank, VTB Bank, Gazprombank, Unicredit Group, and Alfa-Bank dominate the market. However, thanks to product innovation and technology developments, mid-sized and smaller businesses are growing their market share by winning new businesses and entering untapped sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Low Interest Rates are Driving the Market

- 4.2.2 Increased Consumer Demand for Cars

- 4.3 Market Restraints

- 4.3.1 Increase in Car Loan Interest Rates is Restraining the Market

- 4.3.2 Changing Mobility Trends is Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Collaborations Between Car Manufacturers and Lenders

- 4.4.2 Increasing Popularity of Electric Vehicles (EVs)

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights of Technology Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Used Cars (Consumer Use & Business Use)

- 5.1.2 New Cars (Consumer Use & Business Use)

- 5.2 By Provider Type

- 5.2.1 Banks

- 5.2.2 Non-Banking Financial Services

- 5.2.3 Original Equipment Manufacturers

- 5.2.4 Others (Fintech Companies)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Sberbank

- 6.2.2 VTB Bank

- 6.2.3 Alfa Bank

- 6.2.4 Unicredit Group

- 6.2.5 Gazprombank

- 6.2.6 Raiffeisenbank

- 6.2.7 Rosbank

- 6.2.8 Rosselkhozbank

- 6.2.9 Credit Bank of Moscow

- 6.2.10 Home Credit Bank*

7 FUTURE TRENDS

8 DISCLAIMER AND ABOUT US