PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693690

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693690

Food Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

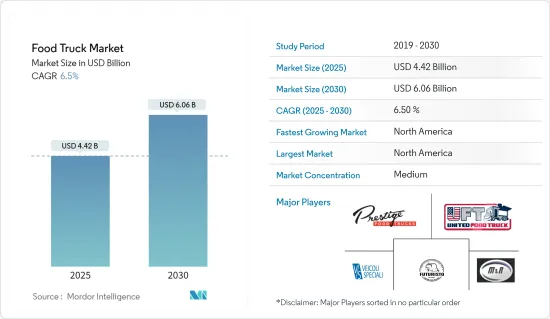

The Food Truck Market size is estimated at USD 4.42 billion in 2025, and is expected to reach USD 6.06 billion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

The food truck market has experienced substantial growth over the past decade, emerging as a dynamic and integral part of the broader foodservice industry. This industry, characterized by its mobility, flexibility, and unique culinary offerings, has evolved from a fringe novelty into a mainstream foodservice phenomenon. Technology plays a crucial role in the evolution and success of the food truck market. Modern food trucks are equipped with advanced kitchen equipment that enhances their ability to efficiently prepare a wide range of dishes. Moreover, the integration of point-of-sale (POS) systems and mobile payment solutions has streamlined the transaction process, making it easier for customers to order and pay for their meals.

Social media and digital marketing are also pivotal in promoting and growing food trucks. Platforms like Instagram, Facebook, and Twitter are extensively used by food truck operators to engage with customers, announce locations, promote menu items, and build a loyal following. This digital presence increases visibility and fosters a sense of community and direct interaction with customers.

While the food truck market offers numerous opportunities, it also faces regulatory challenges that vary significantly by region. Local governments impose regulations on food safety, health standards, parking permits, operating hours, and zoning laws. Compliance with these regulations is essential for food truck operators, but navigating the complex and often inconsistent regulatory landscape can be challenging.

The food truck market is highly competitive, with numerous operators vying for customer attention. Successful food truck businesses often differentiate themselves through unique branding, high-quality food, exceptional customer service, and strategic location choices. Collaboration with local businesses and participation in food truck festivals and community events can also enhance visibility and customer engagement.

The COVID-19 pandemic had a mixed impact on the food truck market. While some operators faced significant challenges due to lockdowns, reduced foot traffic, and event cancellations, others adapted by leveraging their mobility and outdoor service model to continue operating. The pandemic accelerated the adoption of contactless payment systems and online ordering, which have now become standard practices in the industry.

Food trucks also played a crucial role in supporting communities during the pandemic by providing accessible and convenient dining options when traditional restaurants were closed or limited in capacity. This resilience and adaptability reinforced the food truck market's position as a vital component of the foodservice industry.

The food truck market has evolved into a dynamic and integral segment of the foodservice industry, characterized by its flexibility, innovation, and adaptability. The combination of changing consumer preferences, technological advancements, and economic advantages continues to drive growth and diversification in the market.

Food Truck Market Trends

Fast Food is Driving Market Growth

The food truck market has grown impressively over the past decade, and a significant driver of this expansion has been the fast food segment. Fast food's inherent qualities, such as convenience, affordability, and speed, align perfectly with the food truck business model, creating a synergy that propels both industries forward.

The convenience factor is perhaps the most significant advantage of food trucks in the fast food industry. Consumers today lead busy lives, and the demand for quick, accessible meals is at an all-time high. By their very nature, food trucks offer mobility, allowing them to reach customers where they are, outside office buildings, at parks, or at popular events. This mobility is a key selling point for fast food offerings, which thrive on providing quick, on-the-go meals. Unlike traditional brick-and-mortar fast food restaurants, food trucks can relocate based on demand, ensuring a steady stream of customers.

The relatively low start-up and operational costs of food trucks compared to traditional restaurants make them an attractive venture for entrepreneurs. The fast food model, which typically requires less expensive ingredients and faster turnover, fits well within the food truck framework. Entrepreneurs can enter the market with a smaller investment, minimizing financial risk. This economic advantage has led to a proliferation of food trucks offering various fast food options, from burgers and tacos to sandwiches and pizza.

Moreover, consumer preferences are evolving, with a growing emphasis on unique and high-quality dining experiences. Food trucks have capitalized on this trend by offering gourmet fast food options that stand out from traditional fast food chains. These trucks often experiment with fusion cuisines, artisanal ingredients, and innovative recipes, attracting food enthusiasts looking for something different. This blend of quality and convenience has helped food trucks carve out a niche in the fast food segment.

The combination of changing consumer preferences, technological advancements, and economic advantages continues to drive the expansion of fast food trucks.

North America and Europe Witnessing Major Growth

The food truck market has been experiencing substantial growth globally, with North America and Europe emerging as significant regions driving this expansion. In North America and Europe, consumer preferences are shifting toward unique, high-quality, and convenient dining experiences. There is a growing demand for diverse culinary offerings in both regions that traditional restaurants may not provide. Food trucks cater to this demand by offering innovative and eclectic menus, often featuring gourmet, ethnic, and fusion cuisines.

Economic considerations also play a crucial role in the growth of the food truck market. The relatively low start-up and operational costs of food trucks compared to traditional brick-and-mortar restaurants make them an attractive venture for entrepreneurs. Initial investments for a food truck business are significantly lower, often ranging between USD 50,000 and USD 200,000. This affordability allows more entrepreneurs to enter the market, contributing to the proliferation of food trucks across cities in North America and Europe.

The regulatory environment in North America and Europe has become increasingly supportive of the food truck industry. Local governments in many cities have recognized the economic and cultural benefits of food trucks and are working to create more favorable regulatory frameworks. This includes streamlining the permit process, designating specific areas for food truck operations, and providing clear guidelines on health and safety standards.

In North America, cities like Los Angeles, New York, and Austin have established comprehensive regulations that support the growth of the food truck market. Similarly, in Europe, cities like London, Berlin, and Paris have seen an increase in food truck-friendly policies, which has contributed to the market's growth.

As the market continues to evolve, food truck operators in North America and Europe are likely to benefit from ongoing trends such as sustainability, technology integration, and health-conscious dining. The competitive landscape will drive continuous innovation, ensuring that consumers have access to a diverse and exciting array of food options. With their resilience and adaptability, food trucks are well-positioned to thrive in the dynamic and ever-changing foodservice industry, making North America and Europe key regions in the global food truck market.

Food Truck Industry Segmentation

The food truck market is dominated by several key players, such as Prestige Food Trucks, United Food Trucks United LLC, and M&R Specialty Trailers and Trucks. Major players in this industry are focusing on technological advancements. These companies focus on innovation and technological advancements to enhance the functionality and appeal of their food trucks. For example, they invest in state-of-the-art kitchen equipment, advanced POS systems, and eco-friendly technologies to meet evolving consumer demands and regulatory requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Consumption of Fast Food Expected to Drive the Market

- 4.2 Market Restraints

- 4.2.1 Increase in Online Food Deliveries May Hamper Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 Type

- 5.1.1 Vans

- 5.1.2 Trailers

- 5.1.3 Trucks

- 5.1.4 Other Types

- 5.2 Size

- 5.2.1 Up to 14 Feet

- 5.2.2 Above 14 Feet

- 5.3 By Application Type

- 5.3.1 Fast Food

- 5.3.2 Vegan and Meat Plant

- 5.3.3 Bakery

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States Of America

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 South Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Prestige Food Trucks

- 6.2.2 United Food Trucks United LLC

- 6.2.3 VS VEICOLI SPECIALI

- 6.2.4 Futuristo Trailers

- 6.2.5 M&R Specialty Trailers and Trucks

- 6.2.6 MSM Catering Manufacturing Inc.

- 6.2.7 The Fud Trailer Company

- 6.2.8 Food Truck Company BV

- 6.2.9 Foodtrucker Engineering LLP

7 MARKET OPPORTUNITIES AND FUTURE TRENDS