PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911492

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911492

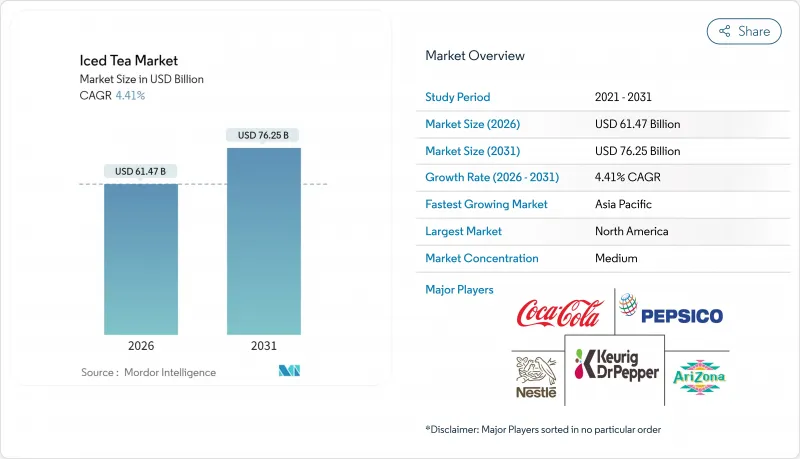

Iced Tea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The iced tea market was valued at USD 58.87 billion in 2025 and estimated to grow from USD 61.47 billion in 2026 to reach USD 76.25 billion by 2031, at a CAGR of 4.41% during the forecast period (2026-2031).

This growth is driven by increasing health awareness and a shift toward healthier drinks as people move away from carbonated soft drinks. North America leads the market, while Asia-Pacific is the fastest-growing region. Under the format options, ready-to-drink iced tea is the most popular, but powder/premix options are becoming more popular due to their convenience and customization. Flavored iced tea is the preferred choice, but unflavored options are gaining attention as consumer preferences change. By product type, black iced tea has the largest market share in 2024, while herbal iced tea is growing the fastest because of its health benefits. Similarly, PET bottles are the most commonly used packaging, but TetraPacks packs becoming more popular due to their eco-friendly and premium appeal. Most sales happen through off-trade channels, but on-trade sales are increasing. Drive-thru beverage concepts are also becoming a key trend, catering to consumers looking for convenience. The market is moderately competitive, with large multinational companies such as PepsiCo Inc., Nestle SA, AriZona Beverages USA, among others, competing alongside smaller regional players.

Global Iced Tea Market Trends and Insights

Rising preference for healthier alternatives to carbonated soft drinks

The iced tea market is expanding as more people prioritize healthier beverage options. Consumers are increasingly moving away from sugary sodas and choosing tea-based drinks that are refreshing, lower in calories, and often come with added health benefits. In 2024, a report by the International Bottled Water Association revealed that 69% of Americans prefer convenient and healthy packaged drinks over sodas. Similarly, a 2024 International Food Information Council (IFIC) survey found that 62% of consumers consider health a key factor when purchasing beverages. This growing focus on health has led to a rise in demand for low-sugar, functional, and clean-label iced teas. To meet this demand, many brands are introducing products enriched with vitamins, probiotics, and natural extracts like herbs and botanicals, which appeal to wellness-focused buyers. These innovations are making iced tea a popular and attractive choice in the market.

Convenience and on-the-go consumption

Busy lifestyles are driving the growing demand for convenient, ready-to-drink iced tea options, making packaging and accessibility crucial factors in the market's growth. With a global employment rate of 95.1% as of April 2025, as reported by the Organisation for Economic Co-operation and Development (OECD), many consumers are constantly on the move and prefer beverages that are quick and easy to carry. Single-serve bottles with resealable caps and drive-thru options are becoming increasingly popular to meet this need for convenience. For instance, in January 2025, Rosenberger's introduced its iced tea and lemonade and new energy iced teas in 12-oz cans. These products not only offer portability and classic flavors but also provide a caffeine boost of 120-180 mg per can, catering to consumers looking for both refreshment and energy. This focus on convenient packaging, functional benefits strategies is contributing to the steady growth of the global ready-to-drink iced tea market.

Sugar-reduction regulations raising reformulation costs

Sugar-reduction regulations are slowing the growth of the global iced tea market by increasing reformulation costs. In the United States, the Food and Drug Administration's (FDA's) proposed front-of-pack labeling rule, set to take effect in 2025, will require manufacturers to clearly label added sugars on their products. This change is pushing companies to accelerate reformulation efforts and invest heavily in research and development to comply with these new standards. Moreover, the 2024 International Food Information Council (IFIC) survey reveals that 66% of American consumers are actively trying to reduce their sugar intake this year, further pressuring producers to lower sugar content in their products. To address these challenges, companies are turning to alternative sweeteners and texture enhancers to maintain the taste and quality of their iced teas. However, this shift also requires renegotiating supply contracts due to reduced use of traditional white sugar.

Other drivers and restraints analyzed in the detailed report include:

- Continuous flavor innovation and line extensions

- Premiumization and clean-label positioning

- Intense competition from other healthy beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Black iced tea accounted for 38.10% of total sales in 2025, mainly due to its well-known health benefits, such as supporting immunity, and its status as a traditional and trusted beverage. Its familiar taste and versatility make it a go-to choice for a wide range of consumers. Black iced tea is often used as a base for flavored variants, which further boosts its popularity. The introduction of innovative blends, such as fruit-infused black teas, has also attracted younger consumers looking for refreshing and unique options. This balance between classic appeal and modern innovation has helped black iced tea maintain its strong position in the market.

Herbal iced teas are expected to grow at a CAGR of 6.04% from 2026 to 2031, driven by the increasing demand for beverages that offer functional health benefits. These teas often include ingredients like adaptogens (e.g., ashwagandha) and digestive aids (e.g., ginger), which appeal to health-conscious consumers seeking natural remedies. The growing focus on holistic wellness has positioned herbal iced teas as a premium product category, allowing brands to target niche markets and charge higher prices. Their association with relaxation and stress relief makes them particularly attractive in today's fast-paced lifestyle.

Ready-to-drink iced tea formats accounted for 78.60% of the market share in 2025, primarily due to their convenience and widespread availability. These products are pre-packaged and ready for immediate consumption, making them highly appealing to busy consumers. Strong brand recognition and extensive distribution networks have further solidified their dominance in the market. Concentrate syrups, on the other hand, continue to be popular in foodservice operations, especially in high-traffic areas like restaurants and cafes. These syrups offer efficiency and cost-effectiveness, allowing businesses to prepare large quantities of iced tea quickly while maintaining consistent quality.

Powder/Premix iced tea products are expected to grow at a CAGR of 5.38% through 2031, driven by their convenience and customization options. These products are particularly popular among consumers who prefer to adjust the strength and sweetness of their beverages. The lightweight nature of powder and premix formats also makes them cost-effective for transportation and storage, and their longer shelf life has encouraged manufacturers to expand their offerings, including single-serve sachets and multi-serve pouches. This trend is attracting both established brands and new entrants looking to cater to the growing demand for customizable and portable beverage solutions.

The Iced Tea Market Report is Segmented by Product Type (Black Iced Tea, Green Iced Tea, and More), Form (Ready-To-Drink, Powder/Premix, and More), Flavor Profile (Unflavored and Flavored), Packaging Type (PET Bottles, and More), Distribution Channel (On-Trade and Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated the iced tea market in 2025, accounting for 44.20% of the total value sales. This growth is attributed to the region's extensive retail network, strong consumer trust in ready-to-drink (RTD) brands, and a well-established cold chain distribution system. Regulatory measures, such as the standardized labeling deadline set for January 2028, provide clarity for businesses to plan ahead but may challenge smaller companies in adapting quickly. With most households already consuming iced tea, major brands are now focusing on premium offerings like organic and functional-enhanced products to sustain growth in this mature market.

Asia-Pacific is expected to grow at a 7.14% CAGR through 2031, fueled by a strong cultural connection to tea and the growing popularity of cafe culture. Younger consumers, particularly in China, prioritize factors like authenticity, social media appeal, and product traceability, which are accelerating the growth of premium iced tea segments. The region benefits from its proximity to major tea-producing countries like China and India, which provide cost advantages and ensure fresher products. These factors are helping local brands expand their presence in both domestic and export markets.

Europe, South America, and the Middle East and Africa are emerging as key regions for market expansion. In Europe, strict regulations on sustainability and sugar content are pushing brands to highlight eco-friendly practices and low-calorie options. South America is utilizing its favorable climate to produce high-quality black and herbal teas for export, while domestic consumption is gradually shifting from traditional beverages like mate and coffee to ready-to-drink iced teas, especially among younger, on-the-go consumers. Meanwhile, urbanization and improving cold-chain infrastructure in the Middle East and Africa are creating opportunities for multinational brands to enter the market, catering to the increasing demand for convenient and refreshing beverages.

- PepsiCo Inc.

- Unilever PLC

- The Coca-Cola Company

- AriZona Beverages USA

- Keurig Dr Pepper Inc.

- Nestle SA

- Tata Consumer Products Ltd.

- Milo's Tea Company

- Brew Dr. Tea Company

- Starbucks Corporation

- BOS Brands

- 4C Foods Corp.

- Jade Forest

- Hain Celestial Group

- Halfday Iced Tea

- Saint James Tea

- The Ryl Company

- Otsuka Holdings

- Weird Beverages

- Gujarat Tea Processors and Packers Ltd. (GTPPL)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising preference for healthier alternative to carbonated soft-drinks

- 4.2.2 Continuous flavor innovation and line extensions

- 4.2.3 Convenience and on-the-go consumption

- 4.2.4 Premiumisation and clean-label positioning

- 4.2.5 Indulgence of social media and collaboration

- 4.2.6 Increasing awareness of sustainability and ethical sourcing

- 4.3 Market Restraints

- 4.3.1 Intense competition from other healthy beverages

- 4.3.2 Sugar-reduction regulations raising reformulation costs

- 4.3.3 Regulatory and labelling compliance

- 4.3.4 Potential caffeine sensitivity concerns

- 4.4 Supply-Chain Analysis

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Black Iced Tea

- 5.1.2 Green Iced Tea

- 5.1.3 Herbal Iced Tea

- 5.1.4 Fruit Iced Tea

- 5.1.5 Other Product Types

- 5.2 By Form

- 5.2.1 Ready-to-Drink

- 5.2.2 Powder/Premix

- 5.2.3 Concentrate/Syrup

- 5.3 By Flavor Profile

- 5.3.1 Unflavored

- 5.3.2 Flavored

- 5.4 By Packaging Type

- 5.4.1 PET Bottles

- 5.4.2 Tetra Packs

- 5.4.3 Cans

- 5.4.4 Other Packaging Types

- 5.5 By Distribution Channel

- 5.5.1 On-Trade

- 5.5.2 Off-Trade

- 5.5.2.1 Supermarkets/Hypermarkets

- 5.5.2.2 Convenience Stores

- 5.5.2.3 Online Retail Stores

- 5.5.2.4 Food-service and HoReCa

- 5.5.2.5 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Colombia

- 5.6.2.3 Argentina

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Netherlands

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Indonesia

- 5.6.4.7 Vietnam

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PepsiCo Inc.

- 6.4.2 Unilever PLC

- 6.4.3 The Coca-Cola Company

- 6.4.4 AriZona Beverages USA

- 6.4.5 Keurig Dr Pepper Inc.

- 6.4.6 Nestle SA

- 6.4.7 Tata Consumer Products Ltd.

- 6.4.8 Milo's Tea Company

- 6.4.9 Brew Dr. Tea Company

- 6.4.10 Starbucks Corporation

- 6.4.11 BOS Brands

- 6.4.12 4C Foods Corp.

- 6.4.13 Jade Forest

- 6.4.14 Hain Celestial Group

- 6.4.15 Halfday Iced Tea

- 6.4.16 Saint James Tea

- 6.4.17 The Ryl Company

- 6.4.18 Otsuka Holdings

- 6.4.19 Weird Beverages

- 6.4.20 Gujarat Tea Processors and Packers Ltd. (GTPPL)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK