PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644799

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644799

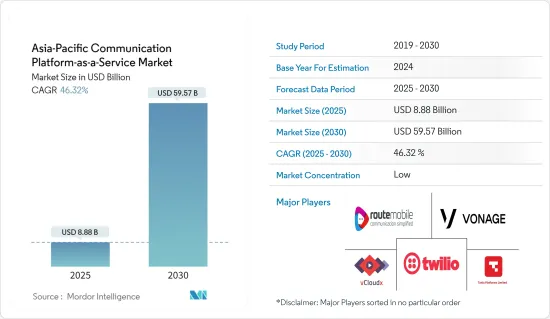

Asia-Pacific Communication Platform-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific Communication Platform-as-a-Service Market size is estimated at USD 8.88 billion in 2025, and is expected to reach USD 59.57 billion by 2030, at a CAGR of 46.32% during the forecast period (2025-2030).

The Asia-Pacific Communication Platform-as-a-Service Market Increased customer engagement, cloud encryption and digitisation are the main drivers of this trend. The communication platform as a service, also known as the cloud based delivery architecture which allows businesses to add realtime communications capabilities, is an PaaS. In particular, customer communication channels are improved through CPaaS cloud communications technology.

Key Highlights

- The most commonly used CPaaS cases are the WhatsApp Business API and chatbots. The same application may integrate text messaging, call support and video streaming services with CPaaS. Because everything's connected at the back end, this company knows about any problems that may come up.

- Authentication is one of the communication API solutions that is included in smartphone applications. This authentication provides a layer of protection to the client, ensuring the safety of the client's data. To reduce the likelihood of fraud, businesses can utilize CPaaS to authenticate user identification using OTP (one-time password). CPaaS allows for two-factor authentication for all mobile banking activity, password resets, and app authentication. By implementing robust security procedures, businesses can considerably boost their conversion rate from mobile payments.

- A CPaaS provides an all-in-one solution for developing your API infrastructure. This means that the cost of building an API is substantially lower than purchasing distinct components from several vendors or managing them via multiple software licenses and subscriptions.

- One of the elements causing the CPaaS market's sluggish growth is regulatory and security worries around user data. Due to the expanding stringent government restrictions around data usage and privacy-related issues, the widespread deployment of these communication systems created substantial challenges for many industries.

- With the COVID-19 pandemic, the market studied was expected to continue growing, owing to the rise in remote working. The companies were significantly adopting digital transformation in their strategy, shifting the focus on relying on CPaaS by integrating it into their existing process flow.

Asia-Pacific Communication Platform-as-a-Service Market Trends

IT and Telecom to Drive the Market Growth

- Over the years, companies in Asia-Pacific have made significant strides to transition the region, starting from a manufacturing center to a technology and innovation hub. The majority of regional Organizations have successfully illustrated the advanced benefits of integrating technology on the majority of levels of business and societies for more efficient, connected, and streamlined operations.

- Information and communication technologies, or ICTs, enable people to engage in a world that is changing quickly. Having access to various developing technologies is increasingly transforming work and other activities. One of the largest employment providers in India and a cornerstone of the national economy, the sector employs more than a million people directly or indirectly.

- IT and telecom companies may manage all of their communication through a single platform, which means that all of the consumer data is now centralized. CPaaS is a comprehensive data source. It gives agents a complete picture of each customer's information, including previous interactions, preferences, sales possibilities, open tickets, etc., making it simple for them to give each customer a unique experience.

- Looking at the increasing internet usage and its application in the IT and telecommunication industry, the demand for CPaaS may continue to thrive as the demand for data and internet increases in the market.

India to Witness the Growth

- Utilizing APIs and programmable communications, CPaaS is increasing its penetration in India. By quickly integrating with any brand's or company's current infrastructure, it has expanded its capabilities and given rise to hybrid communications.

- Companies are adopting innovation and the process of digital transformation faster than ever due to CPaaS. The CPaaS market is growing due to increasing partnerships and acquisitions in the ecosystem.

- SMEs, brands, and organizations must now regularly stay in touch with their customers, particularly online. The desire is for deeper consumer connection, and improved business solutions can readily meet this need. By sending their target audience, rich communication like photographs, videos, documents, etc., on their normal SMS function, RCS Business Messaging, WhatsApp Business Solution, and Viber Business Messages enable small and large organizations to interact and engaging with their target audiences.

- Marketers benefit from tracking marketing campaign KPIs in real time. Marketers may use a CPaaS platform to track impressions, discussions, and conversions from start to finish and observe them in real time, retrieve trend reports, and make changes in response to customer and prospect input. They can also connect other communication channels to their website to better determine which pages are converting and monitor the origins of client inquiries around the web.

Asia-Pacific Communication Platform-as-a-Service Industry Overview

The Asia-Pacific Communications Platform-as-a-Service (CPaaS) Market is fragemnted and characterized by intense competition, with numerous major and minor vendors operating in both regional and international markets. This market exhibits a fragmented nature, as key players employ various strategic approaches such as product innovation, mergers, and acquisitions to enhance their product offerings and maintain a competitive edge.

- In September 2023 : Twilio has been selected as a Leader in Gartner's first-ever Magic Quadrant for Communications Platform as a Service (CPaaS), Where Twilio's versatile CPaaS platform spans messaging, voice, video, AI/ML features, security, integrations, and more. With a commitment to global operations, compliance support, scalability, CustomerAI capabilities, and a far-reaching partner network, Twilio plays a pivotal role in helping businesses transcend borders, work efficiently, deliver trusted communications, and connect seamlessly.

- In March 2023, Qualtrics and Twilio announced an expansion of their partnership, introducing a new no-code connector that facilitates real-time data sharing and integration between Twilio's Segment customer data platform (CDP) and Qualtrics' Experience iD (XiD). This integration provides a comprehensive view of operational engagement data, including content engagement, purchases, user logins, and cart abandonments in the Twilio Segment, combined with qualitative data like customer satisfaction and effort scores in XiD. This synergy results in more robust customer profiles and actionable insights.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Exponential Increase in the Uptake of CPaaS- based Solutions over Other Adjacent Models (UCaaS and traditional deployments)

- 5.1.2 Growing Demand for Low-code Enablement to make Enterprise CPaaS highly Usable for Customer Operations, Service, and Marketing

- 5.2 Market Challenges

- 5.2.1 Legacy & Implementation Challenges

- 5.3 Market Opportunities

- 5.3.1 Technological Innovations, such as Integration with Payment Service, Lightweight Deployments to further Drive Adoption

6 MARKET SEGMENTATION

- 6.1 By Organization size

- 6.1.1 SME

- 6.1.2 Large-scale organization

- 6.2 By End-User

- 6.2.1 IT & Telecom

- 6.2.2 BFSI

- 6.2.3 Retail & Consumer goods

- 6.2.4 Consumer goods

- 6.2.5 Other end-user verticals

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 South East Asia

- 6.3.6 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Twilio

- 7.1.2 Vonage

- 7.1.3 Tanla

- 7.1.4 Route Mobile

- 7.1.5 VCloudX PTE Limited

- 7.1.6 8x8

- 7.1.7 MNF Group

- 7.1.8 Kaleyra Group

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS